“I early retired to come home to care for my sick parents. At the time of my retirement in 2017, I found out that CPOC was penalizing me 5 years, because I opted out of the NAF Retirement Plan. At the time, I had all my money going into the TSP, and was never told that I would take a hit for not contributing. Even at the group sessions, they never mentioned it. This is not fair. Now, I hear that they will stop paying my FERS Supplement in 1 year, when I turn 62. What can I do to get my full 35 years, without the penalty? Please Help…” – Anthony

When I come across questions like this, Anthony, I cannot help but hear my father’s calm and stoic voice saying, “It is not a matter of what you know, it is a matter of what you know that just aint so.”

You are 100% right Anthony; the nuances of contributing to your Federal Employee Retirement System (FERS) are not always clearly addressed in group benefits training courses. The reason is that the classes are often speaking to the general public and not to specific, Federal Employees with unique circumstances like yours.

One of the reasons that we are so passionate about educating Federal Employees about their benefits is because circumstances like yours are real. They really happen; where you are trying to do the right thing, you are trying to navigate a complex system and make informed financial decisions but weren’t able to either get the information that you needed or understand how the benefit system works when it comes to the Office of Personnel Management (OPM) calculating what qualifies as your credible service.

Creditable services are not always straight forward. Throughout your working career, you may have part-time employment, temporary time or a break in service all of which could change how OPM calculates your retirement when it comes to determining your FERS pension.

We are going to dive into Anthony’s situation specifically and then address how other Federal Employees could avoid making this mistake when it comes to calculating their Federal Service.

Correcting Credible Service on FERS Pension After Retirement

When you retire from Federal Service, having your Official Personnel File (OPF) correct in order to accurately reflect your creditable service time is incredibly difficult to achieve.

When you submit your retirement application to your Human Resource department within your agency, they prepare your application and your OPF. Your OPF is sent to OPM so they can adjudicate the information within and finalize your pension calculations based on your creditable service.

When OPM is reviewing Creditable Service they are defining it as:

- Service in which the Employee’s pay is subjected to FERS retirement deductions,

As a Federal Employee under FERS, you can also use your unused sick leave towards your total creditable service for annuity computation purposes.

There are also a host of other exceptions when it comes to calculating your credible service too like:

- Part-time, Intermittent, Temporary “PIT” service performed abroad after December 31, 1988, and before May 24, 1998, under a temporary part-time or intermittent appointment pursuant to sections 309 and 311 of the Foreign Service Act of 1980.

- Service performed under the Foreign Service Pension System

- Service as a Senate Employee Child Care Center worker

- Service as a volunteer or volunteer leader in the Peace Corps

- Service as a VISTA volunteer

- Service before 12/31/1990 with either the Democratic or Republican Senatorial Campaign or National Congressional Committees

- Service before 12/21/2000 with the Library of Congress Child Development Center

- Service as a Senior Official

- Congressional Employees that do no elect program coverage and are subject to the Social Security Amendments of 1983

- Service performed under a Federal Reserve Bank Plan

- Non-appropriated fund instrumentality (NAF) service under P.L. 107-107 that can be used for a title to an annuity under the FERS, but not in the computation

- CSRS refund service that flips to FERS

After OPM certifies your retirement, you begin to receive your FERS Pension. If you notice a discrepancy between what you think your credible service is and what OPM thinks it is, you have a VERY short window to get it fixed.

There is no specific time according to OPM but in our experience, it is less than 3 to 6 months.

Because, Anthony, you were not paying into the Federal Employee Retirement System (FERS) during your working years, OPM will not allow you to go back and make a contribution for that time to be eligible for credible service.

For your time to count as credible service, you must have been paying into the FERS.

Retirement Service Computation Date

Many Feds think that their creditable service for retirement benefits starts with their Service Computation Date – but this is not correct.

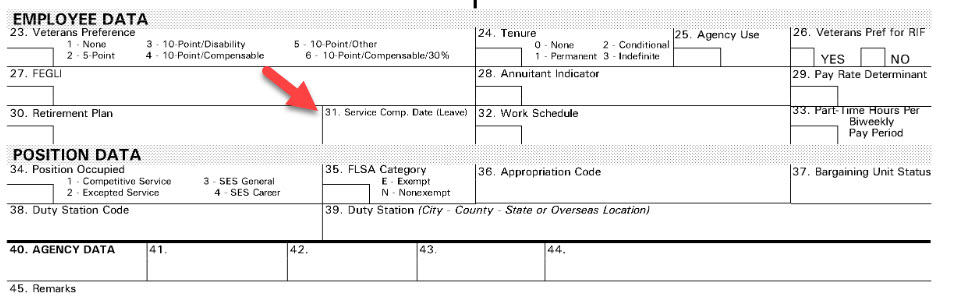

Your SCD will most often be seen on your Standard Form-50 (SF-50).

Your SCD is only for calculating leave. It is not the date always chosen to calculate your Retirement Benefits.

Your creditable service is based on your retirement service computation date (RSCD).

OPM uses your RSCD to determine the beginning of your Years in Service for the pension calculation. Your credible years of service are 100% tied to your RSCD.

You can find your *Estimated* RSCD on your Personal Statement of Benefits. But, this is just an estimate. OPM does not calculate your official RSCD until AFTER you have retired.

You can determine your RSCD by a thorough review of every SF-50 that you have received since you began Federal Service.

When OPM calculates your creditable service, they only look at years and months. If you are trying to determine your years of credible service you can begin by counting the number of whole years, months and days of creditable service from your RSCD to your planned retirement date. Any days (less than 30) are simply dropped from the calculation. They don’t round up, they only round down.

When adding military time (that you bought back) to your civilian time, you don’t drop the days until you’ve added everything up.

To convert years, months (and days) into years use the Time Factor Table.

If you had temporary time, took leave without pay, or had a break in service, be extra careful when calculating your RSCD. You should also pay extra attention if you are planning on retiring very close to your required years in service. Federal Employees have been called back to work 6 months after they retired (or thought they retired) because when OPM calculated their RSCD – they didn’t have enough years in service to be eligible for retirement. Don’t let this happen to you.

Standard Form 3107

Before you retire from FERS, you should request from your HR a Certified Summary of Federal Service.

To request a Certified Summary of Federal Service, which audits your OPF and provides you with your credible service time, you complete SF-3107.

When you open the SF-3107 packet, it begins with an immediate retirement application but as you scroll down you will discover the Certified Summary of Federal Service form.

Have agency complete this form. You know what your credible service should be – the point of this form is to have your agency complete it so that you can ensure that what you think you have and what they show that you have matches.

This form can be laborious for your agency to complete so allow a good 3 to a 6-month window for them to get everything back to you.

Checking on your Credible Service

Anthony, your situation is lousy and we wish that we had that magical answer to give you on how to get this corrected but the cold hard truth is that it is not fair.

OPM is generally very easy to work with and they are not trying to “cheat” you out of your credible service. They can only work within the framework of what they have in front of them. When they received your OPF from your HR, they went through all of the years of credible service and if you were not paying into FERS, they did not count.

For Feds still working, we cannot stress enough that Anthony’s situation is all too common. Your benefits are complex and understanding credible service is often something that many Feds struggle withe especially after long careers.

You must regularly be checking with your HR and ensuring that your OPF reflects accurate information and that you ARE paying into FERS each pay period.

If you are not paying into FERS each pay period your time will not count towards your years of creditable service and we will not be able to go back and have this corrected once you retire.

Anthony, we are so sorry that we cannot provide more guidance on ways that you could have this fixed.

If you know someone that could benefit from the information that we provide here, on Federal Employee benefits, please share this article with them below.

-JC Shilanski

Federal Employees Make Mistakes

But YOU Don't Have To

- Forgetting to Check Your Beneficiary Designations

- Expecting Pension Check to Arrive in 30 Days After Retiring

- Not Knowing the Difference Between SCD vs. RSCD

- Completing Retirement Paperwork Incorrectly

- Failing to Prepare Financially for Retirement

- Failing to Understand Tax Consequences

- Getting Bad Advice

Click below and learn how to avoid making them yourself