If my spouse retired from Federal Service under CSRS and waived the spousal benefits but I am under his FEHB insurance is there any way for me to keep FEHB insurance if he passes away before me or we get divorced? I have listened to several of your podcasts and have heard stated that all benefits will be canceled if he passes first or there is a divorce. I am a federal employee (FERS) that would like to retire within the next 1-2 yrs (currently 32 yrs of service) but don’t know if I will have to stay five years with health insurance just for me to be sure I’ll be eligible to keep it after retirement. Is it possible for me to get insurance now for myself and show proof of continuous FEHB insurance while under my spouse’s plan to qualify? I currently carry our Vision and Dental.

Rules to Keep in FEHB Retirement

Melissa, this is such a great question. Before we dive into the answers you’re seeking, let’s lay some groundwork on how FEHB works in retirement.

There are two rules that you as a Federal Employee must keep in mind in order to keep your Federal Employee Health Benefits (FEHB) in retirement.

You must retire with the eligibility for an immediate pension and have been enrolled in FEHB for 5 years or, when first eligible.

In order for your spouse to maintain FEHB in retirement after you are deceased, the spouse must have been enrolled in FEHB prior to your death and be eligible to receive a survivor benefit.

Your FERS benefits have several components, one of them is the survivor benefits you leave to a legally married spouse and your dependents upon your passing. Your spouse is eligible to keep FEHB after you pass as long as they were enrolled in FEHB before you passed and were/are receiving a survivor benefit.

Now that the groundwork has been laid, let’s start pulling apart the questions so that we can provide answers.

If you, Melissa, were not a Federal Employee and your spouse waived spousal benefits the answer would be “No, you could not keep your Federal Employee Health Benefits after his passing.” In order to maintain FEHB after a spouse passes, you must receive a survivor benefit AND have been enrolled in FEHB.

However, Melissa, in your specific case you are what we call a “Dual-Fed” meaning that your spouse is/was a Federal Employee and so are you.

Because you are a Federal Employee, while you could not carry FEHB under his employee benefits if he were to pass – you can under yours.

Upon your husband’s passing, you can enroll in FEHB outside of open season, as death is a qualifying life event. Your 5 years of coverage under FEHB does NOT need to specifically be in your name only. Your enrollment while under his plan counts towards your 5 years of coverage.

Divorce is also a qualified life event to make changes outside of an open enrollment time.

When you go to complete your Application for an Immediate Retirement from Federal Service SF-3107, you will want to ensure that you pay special attention to the question, “Are you eligible to continue Federal Health Benefits coverage as a retiree?” You must indicate a “Yes” answer here.

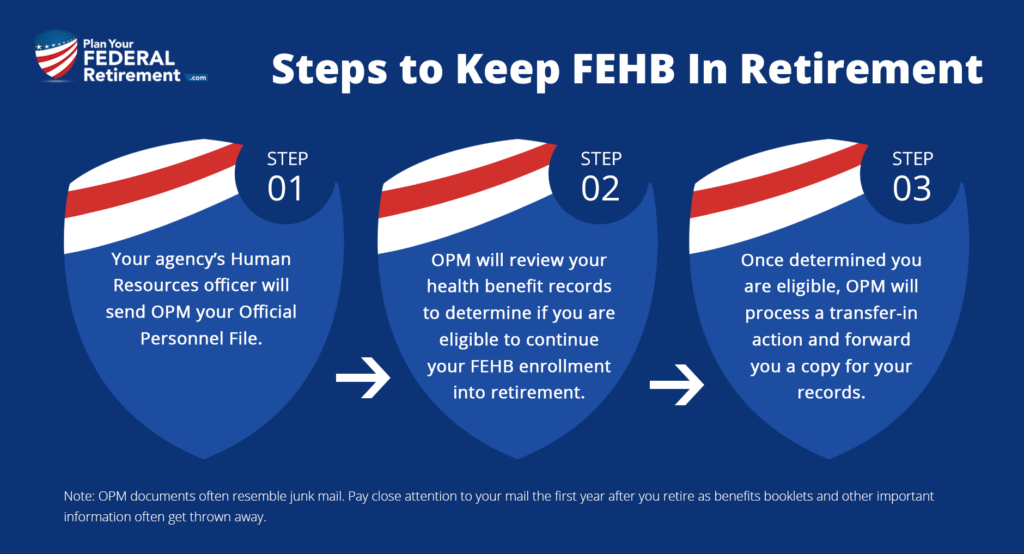

In order for the Office of Personnel Management to know that as a Federal employee you are eligible for health insurance into retirement, your agency’s Human Resources officer will send OPM your Official Personnel File. OPM will review your health benefit records to determine if you are eligible to continue your FEHB enrollment into retirement. Once determined you are eligible, OPM will process a transfer-in action and forward you a copy for your records. OPM documents, when they come in from the postal service, often resemble junk mail. You will want to pay attention to your mail the first year you retire as often benefits booklets and other important information gets thrown away.

In the event that you and your spouse divorce when one or both of you are retired, you can still enroll in FEHB PROVIDING that you indicated that you were eligible to continue health insurance into retirement and received your certification from OPM.

Melissa, as you have 32 years of Government Service, you will be eligible in retirement (providing of course you reached your MRA) to keep health insurance. In the event that your spouse divorce or your husband predeceases you, you will be able to enroll in FEHB as you have met the eligibility requirements. Just make sure of course, that you indicate “yes” to being able to maintain health insurance in retirement on your application for retirement.

This was a GREAT question and you know from listening to our podcast for Federal Employees that we love to get ones like these. Our passion is educating Federal employees on their benefits. The best way that we can grow is by listeners like you reaching out, sharing information, and tuning in.