Social Security: What YOU Need to Know

https://youtu.be/9Msn-e86wL8 Social Security is one of the most talked about and misunderstood parts of retirement planning. For many federal employees nearing retirement, online discussions, headlines,

https://youtu.be/9Msn-e86wL8 Social Security is one of the most talked about and misunderstood parts of retirement planning. For many federal employees nearing retirement, online discussions, headlines,

Listen to the Full Episode: As the year closes, federal employees can’t afford to miss critical planning opportunities that protect their retirement and avoid

https://youtu.be/9rU64rw2cbU When you hear the word “bridge,” you probably picture the Golden Gate or Brooklyn Bridge, not your retirement income. For federal employees, though, a

Listen to the Full Episode: A year-end retirement review can be a valuable step for federal employees who want to better understand their benefits

https://youtu.be/aXGJ0TL-QC4 From Magazines To TikTok Financial “trends” are nothing new; only the platforms have changed. Decades ago, investors chased the latest ideas from glossy money

Listen to the Full Episode: Year-end is one of the most strategic times for Federal Employees to review their financial picture, retirement timeline, and

https://youtu.be/xIjeO–32Lc Most federal employees are surprised to learn that up to 85% of their Social Security benefits may be taxable in retirement. In this episode,

https://youtu.be/M_e4Sfc8vvk We’re all feeling the impact of inflation. Groceries, gas, utilities… everything costs more. Unfortunately, federal retirees may soon feel it even more directly. For

Listen to the Full Episode: In this episode of Plan Your Federal Retirement, Jamie C. Shilanski, RFC®, talks about one of the most stressful

https://youtu.be/eMUJ7_5dMU0 Are Federal Employees Being Auto-Enrolled in Medicare Part D? If you’re enrolled in a Federal Employee Health Benefits (FEHB) plan that now offers Medicare

Listen to the Full Episode: Ever wonder what questions other federal employees are asking as they plan for retirement? In this special episode, we’re taking

Real Question from a Federal Employee I am a widow and own an inherited TSP from my husband. Currently, I listed our Living Trust as

Federal Employment has perhaps never been more uncertain. The Cross Roads When we visit with Federal Employees, we usually run into two groups of people.

Feds are facing yet another extended furlough in 2025. A furlough is when an employer, in this case the federal government, places employees on an

Real Question from a Federal Employee As I approach retirement, what are the safest and best TSP investment and allocation strategies, any suggestions? – Andrew

Listen to the Full Episode: When it comes to money, the emotional impact is often overlooked, but it can ‘make or break’ a family’s financial

Real Question from a Federal Employee What is the maximum amount of unused annual leave that I may be paid for when I retire? – Wayne

Listen to the Full Episode: Healthcare is one of the most important, and often most confusing, parts of retirement. For federal employees, the combination of

Real Question from a Federal Employee Hey, I am retired Air Force 22 years a combat injury related 100 % disabled veteran. I am working

Listen to the Full Episode: Social Security is one of the most misunderstood parts of retirement planning. For federal employees and their families, it’s not

Real Question from a Federal Employee Do I need Medicare Part B if I have FEHB? I find it hard to believe Medicare Part B

Listen to the Full Episode: Are you a year away from retirement? The final 12 months before you retire from federal service are some of

Real Question from a Federal Employee What age can I start collecting Social Security retirement benefits? What is my full retirement age, and how does

Listen to the Full Episode: What does real retirement readiness look like? In this episode, Micah is joined by his father and mentor, Floyd, to

Real Question from a Federal Employee Hello, I have a question. I’m a few years out from retiremen, how can I be sure I’m financially

Listen to the Full Episode: Facing the New Challenges of Federal Retirement: What 2025 Means for You Federal retirement in 2025 requires thoughtful consideration of

Listen to the Full Episode: Are today’s market swings making you nervous about your retirement? You’re not alone but the good news is, there are

I have 2 years state retirement contributions, 10 years military (7 years federal 3 years guard). Can I combine state and federal retirement contributions? Do

Listen to the Full Episode: In this episode of the Plan Your Federal Retirement podcast, Micah Shilanski and Christian Sakamoto dive deep into the relationship

Question about TSP matching Contributions.If I retire at the end of a month, which happens to be the middle of a pay period, do I

Listen to the Full Episode: Is your financial plan ready for unexpected changes? In this episode, Micah and Jamie highlight the importance of taking charge

Can I suspend FEHB in retirement then start it again later if my new (private sector) employer offers health coverage benefits that I’d like to

I have 15 years of federal service and am 55 years old. I have only been in the FEHB for my most recent 3 years

https://youtu.be/AH8GKsjrlSQ The more confident you are that you won’t be scammed, the more vulnerable you are. Scammed, Phished, Hacked, or Conned… isn’t just for the

Is it possible to request a waiver to access the FERS Supplement two years early? My wife has 32/33 years but only turns 55 in

Listen to the Full Episode: Is “buy and hold” really the best strategy for retirement investing? In this podcast episode, Micah and Christian explore why

Thank you for your wonderful and helpful videos on postponed retirement. The one question I have remaining is – I understand that if I retire

Listen to the Full Episode: Think you know how your FERS pension, Social Security, or military retirement will be taxed? Think again. In this episode,

First, I have listened to your podcast for year,s and it has been a wealth of information. Thank you. Now for my question…I am a

Listen to the Full Episode: What does retirement really look like beyond the financials? In this podcast episode, Micah and Floyd discuss what life is

I’m 65 now, still working usps, when I retire in 1 to 2 years, I’m interested in keeping monthly health insurance down. Is it more

https://youtu.be/RGaefOcEvEw Every Investor should have their “Rules on Investing” in place for times of “market volatility and turmoil.” Times like this, I am often reminded

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Yes, good morning. Jeff here, wondering about having a postponed retirement. When the paperwork needs to be filled out, if I want to start that

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Good morning, my name is Alberto. I am a Mail Handler for the Postal Service with 40 years of service. Currently, I can carry over

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

https://youtu.be/-lxMYExTiGQ The Road Not Taken: What Happens When Federal Employees Make (or Avoid) Big Decisions. Understanding Federal Retirement Options: Deferred Resignation, VERA, Postponed Retirement, and

https://youtu.be/VQ0Z9PhhxEQ How prepared are you if you no longer work for the Federal Government? Maybe you accepted the Trump Administration’s “deferred resignation” package; maybe your

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Hello, at age 57 years and two months, I separated from federal service for a civilian job after serving 5.3 years and buying back 17.2

My wife is a federal employee and will retire next year. She is going to be 50 years old. I am going to be 58

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

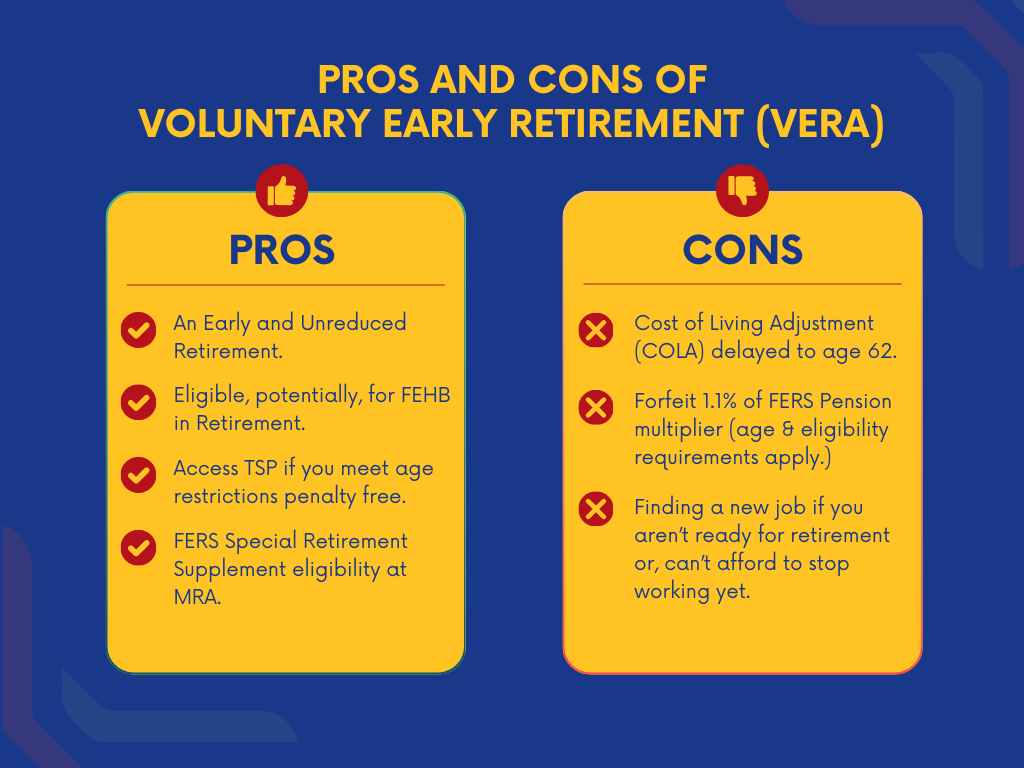

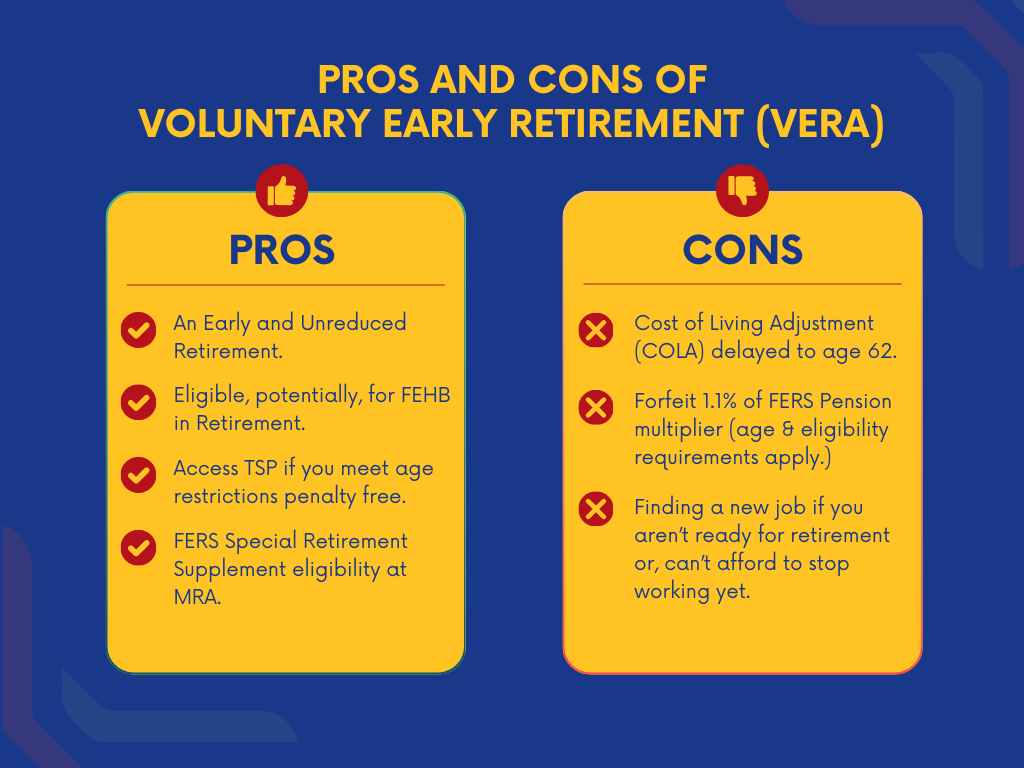

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits professional, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Need help with federal employee survival benefits. I looking for specific help with my wife’s survivor FERS and Death Benefits. My wife worked for the

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Hi, my name is Eric. I am calling because I have a question about buying back my military time. I am retired from the from

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Hello. My name is Joyce and I am trying to determine the best date to retire either december 31st or january 11th 2025 at the

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

I’m 60 years old with 36 years of service. I called the TSP help line and asked if I could roll over money from the

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Hello, I just started federal employment this July. I served Active Duty in the Army for 9 years from 2009 to 2018. In 2018 I

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Yes, my name is Bobby and I have a question on the life insurance coverage. I read here that it said that the basic life

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

“Yes, my name is Marty. I like to know about FERS, if there is a maximum amount of years that I can work and then

Listen to the Full Episode: Understanding how to navigate taxes in retirement is crucial for preserving your hard-earned income. From Roth conversions to Qualified Charitable

Yes, my name is Martha, and I tune into as many of your podcasts as I can, for your valuable information, I have a question

Listen to the Full Episode: Planning for your retirement requires a solid understanding of your options. Discover the best strategies for managing your Thrift Savings

If you have a birth month of Jan ro April, and the year you obtain age 61, you exceed the earnings limit, how is that

Listen to the Full Episode: Are you ready to turn your retirement savings into a reliable income stream? Understanding your spending goals and determining your

FERS supplement annuity. I retired from SSA under the 25 years of service at any age in 2014. I was told I would be eligible

Hi. I have congressional experience and a break in service and I have just retired to the executive branch and I was wondering how the

Listen to the Full Episode: Are you ready to turn your retirement savings into a reliable income stream? Understanding your spending goals and determining your

I can retire in october 2019 with 30 years under first, I will be 56 and I mean 10 months old and I do not

Listen to the Full Episode: Join Tammy and Micah, as they share their insights on navigating retirement preparation, avoiding common mistakes with OPM, and ensuring

Hello PYFR team! I love the podcast and appreciate it and all the resources you offer. My question is about taxes on the pay-out of

Listen to the Full Episode: Have you considered what happens to your assets and who will take care of your financial matters when you’re gone?

I read the $1,000.00 example that you write and 50% of 1K is 500.00 a month for my wife. That makes sense and I understand.

Listen to the Full Episode: Federal employees can use various calculators to estimate their FERS benefits, but accurate documentation and proper completion of estate planning

I am eligible to retire from fed service at 57 1/2. I will have 36 years of service. I plan on using my TSP to

Listen to the Full Episode: Are you seeking clarity on TSP strategies? Join us on our latest podcast episode, where Christian and JT decode the

I am 8 years from retirement and currently invested 100% in the C fund. When should I start moving money to the G fund and

Listen to the Full Episode: Are you ready to take control of your retirement finances? Your current spending habits could shape your future retirement lifestyle

If I retire age 59 under Postponed Retirement can I collect the SRS – Kenneth https://youtu.be/KAGt4Mu4OpM Federal workers have three main parts to their retirement: a

Listen to the Full Episode: It is time to discuss retirement planning, cash flow management, and potential retirement expenses! In this special episode, Micah leads

Listen to the Full Episode: Are you ready to embark on a journey towards a secureretirement? Join Micah and Tammy, as they analyze advanced retirement

How do I calculate my high three? I was a FERS employee from 1991-2000 then returned to FERS in 2022. I am 58 with a

Listen to the Full Episode: Are you ready to retire? Have you considered the emotional part of this journey? Are you and your spouse on

I worked for the federal government from 1995 to 2000. I turn 62 in 2024. I spent my entire federal career at Nevada. I live

Listen to the Full Episode: Federal retirees face unique challenges, from income replacement to tax considerations. But what about life insurance needs and survivor benefits?

Questions about social Security and COLA (cost of living adjustment) are among the most common. Let’s go through the basics with Floyd Shilanski, RCF, Managing

“In mid 2025, I will turn 62, therefore my FERS supplement will stop. I currently work PT not to exceed 2013 earnings limit. However, in

Listen to the Full Episode: There are a lot of complexities in federal retirement benefits and retirement planning. Let’s unravel the key aspects and pitfalls

Listen to the Full Episode: What are the essential steps to a successful federal retirement? Join, Micah and Tammy, in today’s episode as they go

“Can I take out a loan towards my FERS contributions? I’m a federal employee and no where close to retirement. Would it work like the

Listen to the Full Episode: Ever wondered why your retirement is losing money despite investment diversification? Join Micah and Christian in our latest episode, where

My husband was retired in May of 2020 at age 65 after 20 years of service with the FBI. We kept our health, vision and

Listen to the Full Episode: As the holiday season ends, it is important to take action about our retirement plans and talk about the changes

”If I receive 26k in annual leave payout does that count against the earnings limit of my supplement? Also what about the money I made

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn about estate planning documents for federal employees and the

Listen to the Full Episode: You already know how important estate planning is for your retirement, but do you know the crucial must-do’s? In this

”Hi, I’m 61 years old and my FERS supplement is ending soon. What should I do when that income goes away? And how am I

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn about the importance of retirement planning and the use

Listen to the Full Episode: It’s time to get invaluable insights from cash flow considerations to navigating the intricate rules of the Federal Employees Retirement

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn everything you need to know about Medicare and Federal

Listen to the Full Episode: What coverage do you have, and what coverage do you actually need?Join Micah and Tammy in this episode, where they

I absolutely loved the episode on what you cannot do in the TSP. Naturally, it brought up other questions in my mind. Before I got

“should I delay my social security and let my wife draw it until my FRA? I planned on drawing at 62 anyways. I am retired navy and

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and make sure you know how to manage your Year-End Tax

Listen to the Full Episode: As the year winds down, it’s time to get proactive about your finances and tax planning! Join us as we

“What happens to a surviving spouse if an employee dies while working, but that employee was also in the process of buying back military time?

Listen to the Full Episode: Learn how to avoid making irreversable mistakes after death and empower yourself with the knowledge you need to plan for

Listen to the Full Episode: Don’t let irreversible mistakes catch you off guard. Empower yourself with the knowledge you need to plan for a secure

“If I retire after age 62, and supplement my monthly FERS pension by making small withdrawals from my Traditional TSP (assume $2,000/ month), would IRS

Listen to the Full Episode: Learn to make informed retirement decisions and secure your financial future with valuable information in regard to your TSP, covered

Listen to the Full Episode: Whether you’re just starting your career, planning for retirement, or already in retirement, or someone looking to understand TSP better,

Listen to the Full Episode: Learn why the TSP is such a phenomenal tool for your retirement and find out what you should know about

Listen to the Full Episode: In this episode, host Micah Shilanski and a special guest – JT Ferrin, delve into explaining the meaning of TSP

Listen to the Full Episode: Learn about your options for living abroad in retirement and find out everything you need to keep your benefits, covered

Listen to the Full Episode: Do you wonder about your options for living abroad in retirement? Are you ready for change but need to know

“I am currently age 32 (a bit away from retirement) and I have been with USPS for 6.5 years now. It says you are fully

Listen to the Full Episode: Learn why the Federal Employee Health Benefits (FEHB) is such an excellent benefit for federal employees, allowing them to keep

Listen to the Full Episode: In this episode of Plan Your Federal Retirement Podcast, Micah and Jamie discuss the Federal Employee Health Benefits (FEHB) and

“I’m about 10 years out from retirement. I’m wanting to stop putting money into the traditional tsp and start a Roth. Is that doable?” –

Listen to the Full Episode: Learn what the importance is of understanding the rules and regulations for federal employee retirement, covered by Sierra Steele. Enjoy

Listen to the Full Episode: Are you a federal employee planning for retirement? Do you know that negative outcomes can be prevented if only you

Listen to the Full Episode: How do you know what to have in savings? Learn all about great tips on how to organize your savings

Listen to the Full Episode: How many months’ worth of living expenses do you need to have saved up and why? Do you have emergency

“Micah, I have a question about the earnings test for FERS Supplement. I’m a title 38 physician, planning to retire with age 60 + 20

Listen to the Full Episode: Does everybody have the right to a FERS Supplement? Learn all about who will receive it and what you need

Listen to the Full Episode: The FERS supplement is a great benefit of your FERS retirement package. This supplement is available to federal employees who

“Love your podcast! I am a Federal retiree and fine with Thrift Savings Plan (TSP) and Federal Employees Group Life Insurance (FEGLI) standard order of

Listen to the Full Episode: Learn what’s possible and what’s not when it comes to your TSP in retirement. Here are the 7 things you

Listen to the Full Episode: Retirement can be challenging, especially when it comes to managing your finances. One of the biggest mistakes you can make

“I am turning 62 and I am drawing disability FERS. Can I draw social security and FERS together? And will my FERS change when I

Listen to the Full Episode: The importance of knowing what lies ahead, what to expect and what steps to take when transitioning to retirement, covered

Listen to the Full Episode: You are getting closer to retirement, but specific tasks must be completed to enjoy it thoroughly. You’ll need to take

“I watched the very helpful video on ROTH IRA conversions. I will be retiring by the end of 2022 and I do not have any

Listen to the Full Episode: You’ve been working and saving and planning for your retirement. And when you retire, you go through a psychological shift

“I retired from PHMSA/USDOT January 2021 and I just received my first W2 form from the Department of Interior and It says that I paid

Listen to the Full Episode: The importance of knowing the different streams of income and how to use them, covered by Victoria Kellerman. Enjoy the

Listen to the Full Episode: Cashflow is the heartbeat of retirement, so you have to know the details of your income streams, the theory, and

Listen to the Full Episode: The importance of making a financial plan for a great retirement, covered by Victoria Kellerman. Enjoy the show? Use the

Listen to the Full Episode: Setting goals and mapping a strategy – these are the ground rules for taking the action in your hands! No,

Listen to the Full Episode: One of the most essential and fundamental questions is choosing the right federal retirement plan! Do you know how much

“August 2023 I will turn 62 and stop receiving the OPM Social security . After August for the remainder of 2023 will I still be

Listen to the Full Episode: What if you erroneously select an annuity from the TSP instead of a withdrawal from it, can you reverse that

Listen to the Full Episode: Net vs. Gross income. Which one hits the door of your bank account? Changes regarding insurance? Life insurance, health insurance…

Listen to the Full Episode: Accidents happen, but some come with severe consequences. For example, when covering someone with your HSA that you shouldn’t cover,

“Hello , I worked for 11 years as a federal employee until age 57, now I am 62 , can I still get fehb, ie

Listen to the Full Episode: Changes the Secure 2.0 brings and what do they mean for the retirees and federal employees, covered by Victoria Kellerman.

Listen to the Full Episode: Changes are happening, and questions have been raised! That is why we have a special guest in today’s episode –

“When should I retire to take advantage of the planned big 2023 COLA increase? If I retire in December, will my pension benefits be increased

Listen to the Full Episode: The benefits in retirement that Federal Employees have are based on three things: Pension Social Security TSP To avoid misconceptions

“I plan to retire at age 57 with an MRA + 10 option. I don’t plan on taking my FERS retirement out until later age

Listen to the Full Episode: Whether you are 30, 50, or 70, a subject that has a hold on you is how to improve

“I have been working in the federal system for 3 years and will retire within the next 5 years. I am 62. I have a

“If I started in the NAF system in 1996 and then converted to GS in 2008 we were told it would count towards retirement. From

Listen to the Full Episode: Christian Sakamoto joins the show again today to discuss cash flow and the money you spend in retirement. This is

Listen to the Full Episode: There are a couple of times a year when it’s really important to have clients come in and review things.

“I am in the process of divorcing (prior to my federal retirement). I am considering agreeing to providing my soon to be ex-spouse partial survivor

Listen to the Full Episode: The effects of inaccurate information can be devastating, and there’s a lot of questionable information out there. So, in this

“I’m just about 65 and make about 125K a year working for the federal government. I plan to retire in five years when I’m 70.

Listen to the Full Episode: Today Micah and Tammy tackle estate planning, a topic that impacts a lot of people, but that we don’t tend

“Can I withdraw my FERS to use as a down payment for purchase of Real Estate?” – Tracey. https://www.youtube.com/watch?v=CPm4DDHl0-c&feature=youtu.be When Federal Employees use their retirement

“Planning on retiring at my MRA, is the FERS supplement subject to the social security earnings test? Thank you for your time!” – Craig. https://www.youtube.com/watch?v=87LW2zw_7Lg

Listen to the Full Episode: Christian Sakamoto joins the show again today to help answer some of the top questions we get from people who

Listen to the Full Episode: Have you noticed that the markets are down? Did you know there are some key opportunities to look into when

Listen to the Full Episode: Sometimes there are misconceptions we have that lead to big mistakes before retirement—and they all stem from one main problem.

“Hi Tammy and Micah, Thanks for the information. I separated from the government at age 54 1/2 years and 20.5 years of service. I like

Listen to the Full Episode: Pros and cons to moving investments around. Enjoy the show? Use the Links Below to Subscribe:

Listen to the Full Episode: Many people want to move investments into or out of their TSP, and there are a lot of questions surrounding

“Hi! I LOVE your podcasts! I am a Federal employee, have met my MRA and will meet my 30-years of service on Nov 2, 2021.

Micah and Tammy have been seeing lots of mistakes and missteps happening lately, with more people reaching out to see whether they were wrong or

“Thank you very much for the great information. Question: Do I need to list my ex-spouse on my FERS retirement application if we were married

Micah is flying solo in today’s podcast to answer this indirect question that he gets when meeting with clients. He discusses how to decide what

“The question is the following: My wife and I are both federal employees. I will retire before her. Upon my death, she will receive a

“From my understanding, those military retirees who are getting a military retirement aren’t eligible for the FERS Supplement. If I’m incorrect someone please let me

“I worked from 2010 to 2013 at VA Hospital. I quit/and then I work back in 2018 until now. My question is are those 3

“I can’t find any info on deductions for the Federal Long Term Care insurance and it is not on my retirement estimate from my HR

“If my TSP beneficiary is currently my Trust, then upon my death, will that transfer be made by a one time full payment -20% for

“If I erroneously select an annuity from the TSP instead of a withdrawal from it, can I reverse that option? Thanks.” – Orlando. https://www.youtube.com/watch?v=8T69Yxmht-k Listen,

“I am a retired FERS federal employee (age 65). I just watched your episode about a “like kind direct transfer” of tsp funds to an

Answering your tax questions. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

In this episode, Micah is joined by a special guest who will shed light on some myths and misconceptions that you may be dealing with

Answering listener questions following Monday’s episode. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

When it’s time for that little blue book to arrive, it’s important not to just file it away. Today, Micah and Tammy share what this

Answering listener questions to help you better understand long-term care. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

As people get ready to retire, questions about long-term care often start coming up. Although it may not be the most fun subject, it’s a

“How do I know when it’s worth it to withdraw (refund) my FERS contribution when I leave the Fed workforce? if I have less than

How to plan TOGETHER for a successful retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Now that we’re in February, we’re going to call this episode “the love episode”—and there’s no love like survivor benefits. So today, Micah and Tammy

“First off, great content on your site! A plethora of information for Federal employees that is extremely invaluable for retirement planning. Regarding the FERS Supplement

Answering your questions about TSP, Roth conversions, and more. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Sometimes we get so caught up on end-of-the-year stuff that things can easily be missed or slip by us if we’re not careful. Tammy and

What you need to be thinking about getting done in the new year. Listen to the Full Episode: Enjoy the show? Use the Links Below

It’s a new year, and Tammy and Micah are here to talk about some of the things that have changed, some of the things that

“Hey! I love the podcast, and I’m hoping you might be able to tell me if my Lifecycle fund-based investment strategy overlooks any important factors.

In this episode, Tammy and Micah continue with the insights into TSP series and answer some great questions from active TSP participants. Whether you are

In this mini-series, Micah and Tammy have been talking about your TSP during a time of volatility and the strategies you can implement to encourage

Today, Tammy and Micah continue to address questions they’ve been receiving regarding your TSP and market volatility. In this second part of the series, they

“Hello, I am a vested former federal employee with the Naval Shipyard. I left federal employment in 2007 with 7+ years of service and am

How are things going to unfold when it comes to your Thrift Savings Plan (TSP) account? Tammy and Micah have been getting a flood of

“I am a widow of a retired service member and receive military survivor annuity and VA pension based on my husband’s service connected death. I

Answering listener questions about our “controversial” podcast. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Right now, the entire world revolves around COVID—even more so with executive orders and rules that are requiring employees to get the vaccine by the

As a Federal Employee, your High-3 average salary refers to the average of the highest three consecutive years of base pay earned. This is calculated

Answering listener questions about Medicare Advantage and retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

At 65, something happens to all of us where we have this forced decision that we have to deal with when it comes to Medicare—and

https://youtu.be/A-QWGEgHvqc Nealy asks a question that we see every now and then from federal employees: “Should you collect unemployment while you’re waiting on your Federal

Answering additional questions about Social Security, COLA, and TSP benefits. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Today, Micah and Tammy are picking up where they left off in the last episode and discussing Social Security COLA and your TSP COLA. They’ll

https://youtu.be/uFdTV3a4-XA “Hi, I have a question regarding Roth TSP which I have not gotten a clear answer on. I will be 54 this year. I

https://youtu.be/sTR9M-po3jghttps://vimeo.com/590901980 Hello, first off, I wanted to say I really enjoy your podcasts. I have really learned a lot from you both over the past

“I stumbled on your podcast and the information is GOLD – thank you! I am 45 and 15 years away from retirement. This year I

Learn more about the things that can sabotage your retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

“Hello, I am a retired 58 yr old federal employee that retired after 34 years of service. My wife and I are looking at buying

How is my benefit calculated? In order to calculate your FERS pension, you will need to know your creditable years of service as well as

When it comes to retirement, there is an overwhelming amount of incomplete or incorrect information on the internet purported as fact. The truth is, you

Learn the important differences between retiring at 60 and retiring at 62. Listen to the Full Episode: Enjoy the show? Use the Links Below to

“Mr. Shilanski, Social Security Survivors Benefit question. I am under the FERS program and I plan to retire late this calendar year. I am 65

There is so much misinformation out there, and sometimes, it is important to simply get back to basics and ensure your information is correct. So

I worked for the federal govt for 11 years. I was born in 1960 January. I was 56 at the time of separation. Need to

At age 59 1/2, I would like to use a TSP one time withdrawal to pay off a mortgage then eventually transfer the balance to

What you need to know about how a divorce can impact your retirement planning. Listen to the Full Episode: Enjoy the show? Use the Links

Are you still allowed to contribute the maximum of $26,000 to the TSP even if you only work half of the year? Is there any

Divorce is generally not a fun topic, but when you are considering retirement, it is a necessary discussion to have. For many people, the terms

Questions to ask yourself to ensure you’re properly balancing your social security and TSP so you get the most benefit. Listen to the Full Episode:

I am not sure this question is easy to answer but here goes. I retired in 2019 (LEO RET/Special Provisions) and immediately took a job

Are you wondering what to do about your social security or how to go about taking money from your TSP? If so, this episode is

What you need to know about your TSP benefits so you can avoid risk and maximize your retirement funds. Listen to the Full Episode: Enjoy

I researched the cost of life insurance and purchased a 20 year fixed plan that costs less than half what FEGLI will for me starting

You’ve worked your whole life, now you’re ready to retire. But do you know how to maximize your benefits and set yourself up for retirement

How to protect and prepare your loved ones for unexpected life events. Listen to the Full Episode: Enjoy the show? Use the Links Below to

It’s the little details that can really trip you up, so Tammy and Micah share specific areas and situations they’ve noticed clients having trouble with

The importance of looking over your policies, reevaluating your beneficiaries and everything you need to know about FEGLI. Listen to the Full Episode: Enjoy the

“I am 59 and planning to retire a year from now. My wife will retire at the same time (but at age 61, not a

With so many misconceptions around life insurance, it can be hard to determine the appropriate plan or amount for your needs. Unfortunately, there are some

How to properly plan for the day of your retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

With more retirement planning and with every year that retirement gets closer, the question is often asked, “What day is best to retire?” Tammy and

Do you have a plan put in place for who will inherit your assets after your demise? Many people are solely focused on increasing their

If my spouse retired from Federal Service under CSRS and waived the spousal benefits but I am under his FEHB insurance is there any way

Ensuring you have met your savings goals during your retirement planning is incredibly important, but it is just one of many things to consider. Unfortunately,

“What happens to your sick leave if you are 63 years and have 28 years of federal service. Thanks for taking this question.” FERS Sick

When it comes to your retirement, it can be a very stressful time—or it can be a very smooth transition. It really comes down to

“As a FERS retiree, am I required to sign up for Medicare at age 65; or can I opt out of Medicare Part B? Also,

What is a Creditable Service? Simply put, the Creditable Service is the amount of time a federal employee has worked for the federal government that

What is the Voluntary Contribution Program? The Voluntary Contribution Program was developed for employees who are part of the Civil Service Retirement System (CSRS). It

What is the Military Buyback Program? The Military Buyback Program is a program for veterans to retroactively “buy back” their time spent in the military

Once your FERS Supplement ends, should you take Social Security benefits? This really comes down to a case by case basis. As you probably know

What is my FERS contribution? Depending on your start date, your contribution will be either be 0.8%, 3.1%, or 4.4% to FERS. The chart below

How is my benefit calculated? In order to calculate your FERS pension, you will need to know your creditable years of service as well as

What is the FERS Basic Benefit Plan? As a Federal Employee, your retirement consists of three components: your Basic Benefit (also called your annuity or

When we consider retirement, most of us think about this chapter in our lives as a positive time—and it can be, as long as we

When you are planning for your retirement, there are a lot of different areas you need to be aware of financially, and it can be

Tax season is upon us, and for many, it is a scary time. With so many opinions floating around, it is hard to decipher between

“I will be 65 years old next July and plan on retiring in Dec. 2022. I am covered under my husband’s health plan and also

“I am 65, born in (November) 1955. I’ve only been a Federal Civilian Employee for 5yrs this November. I’ve also withdrawn $7,000.00 last year for

There is so much that we can’t control, and it’s easy to focus on those things and feel helpless to stop them. But in this

“Micah, love your videos. I’m retired (58 years old) from USPS. Very aggressive in TSP. 40% C, 40% S, and 20% I- I’m down close

Mary Beth Franklin is our go-to professional for all things Social Security benefits. With over 40 years as a financial journalist and a CFP® designation,

“Is there a reason why you did not include the MRA+10 in the group below when speaking about qualifying for FEHB? I thought that this

What kind of protection does the spouse of a federal employee have? Does everyone need insurance—and how is it beneficial? In this episode, Tammy and

“Next May I can retire with 35 years at the age of 62. I was considering working 10 more months to retire at 63 and

Today Micah’s sister, Jamie Shilanski, joins the show to talk about financial planning and the inconsistent advice that many people are hearing regarding their finances.

“I retired on Dec 31 2019. Don’t you think I should pull all my money out of the TSP and put it in a high

“I am considering transferring/$10,000 from my TSP to my Roth account in Fidelity. Your presentation mentioned TSP to IRA to Roth. What’s the correct

We’re on the brink of another open season, so today Micah and Tammy are sharing the information you need to know about this upcoming season.

Today Micah and Tammy are setting the record straight and dispelling some myths about what you actually need to retire with. There’s a lot of

“If I start contributing to Roth tsp this year. I am 56 that would mean I cannot take any contributions from the Roth’s for 5

We hear a lot of people say they want to turn on their social security as soon as possible in order to capitalize on the

Everyone looks forward to retirement and the freedom that comes along with no longer being locked down to a job, but what if it isn’t

Answering Retirement Questions If you have questions about your retirement from Federal Service, we can help! Our FERS Federal Fact Check for Federal Employees who

Micah and Tammy have shared their thoughts and experiences with credible services, agency estimates, and other incomes, but what about risk management? In this episode,

“I was looking at my LES I noticed the FERS Retirement on deductions section is a different “year to date” amount from the FERS Retirement

“I am retiring on 12/31 at the age of 56 – will my FERS Supplement calculation include 2019 earnings – after they get reported to

TSP Contribution. My spouse recently changed her TSP contribution because her friend told her to. She currently has: L2030 80%, C-Fund 10% and S-Fund 10%.

To have a comfortable and enjoyable retirement, you need a financial safety net to fund it all. So when you are planning for the rest

Welcome to the Plan Your Federal Retirement Podcast, where Certified Financial Planner Micah Shilanski and Principal Retirement Specialist Tammy Flanagan come together to ensure you

We have been receiving questions from Federal Employees across the United States this week, wondering if they should make changes in their TSP due to

“My strategy is to leave my TSP untouched and “will” it to my spouse” – Mike As Financial Advisors who work with Federal Employees, we

“I early retired to come home to care for my sick parents. At the time of my retirement in 2017, I found out that

“I have a tsp question for you concerning the new TSP withdraw options. I retired in 2015 from air traffic control at age 50. Will

Help Avoid Losing Out On Your FERS Benefits “I recently separated as an attorney from a federal agency at age 61 and ten months. Because

“Thank you for the great videos, they are very informative. I do have a question for you. I am 59 years old and a retired

“Hi, I am approaching retirement age am starting to gather data. I worked for the VAMC from 1982-1996. I think I have both FERS and

“Hello. Thank you for providing such informative information. I am a widow benefit; at age 60 if I retire and can later switch to my

“Just wondering if you ever give advice to widows/widowers. I believe we are in a unique situation that I seldom find addressed anywhere.” – Valerie

“I am 66 and currently a full time federal employee. I have a two children under the age of 26. I would like to continue

“Your TSP is an asset that can be given to future generations and your social security income is not. As the condition of social security

“If I choose to contribute to the ROTH Component of the TSP, how much can I contribute? Will ROTH TSP Contributions effect my Traditional TSP

Question “Is the money that I withdrawal from my TSP in retirement all taxed as ordinary income or are the contributions that I made taxed

“I plan to retire in the next few months from USPS and take my health insurance with me. I am debating signing up for Medicare

The Thrift Savings Plan (TSP) was created under the Federal Employee’s Retirement System Act of 1986 for federal employees and members of the uniformed services.

“Always” Generally, an estimate from your Human Resources (HR) Department on your Federal Employee Retirement System (FERS) benefits is a good source of information for

“Is there a 10% penalty for signing up for $1,250 monthly straight withdrawal (not an annuity) from the TSP if I retire at my MRA

Traditional vs Roth TSP Understanding the difference between contributions to the Traditional vs Roth TSP is critical to long term financial planning. Before we dive

Without a doubt since its inception in 1997, the ROTH retirement account has gained tremendous popularity. Named after the Delaware Senator, William Roth, under

One of the great questions that we get from people over age 50 is whether or not it is too late to really take advantage

One of the questions that Federal Employees frequently ask us is how they can convert some of their Thrift Savings Plan (TSP) dollars into the

If you were eligible to retire from the Federal Government as a FERS Employee and receive a FERS Supplement, then you are probably aware that

FERS Federal Fact Check! We love answering questions from Federal Employees about their benefits. Our passion for financial planning with Federal Employees has provided

FERS Federal Fact Check! We love answering questions from Federal Employees about their benefits. Our passion for financial planning with Federal Employees has provided us

Is your spouse eligible for FEHB into your retirement from Federal Service? The Federal Employee Health Benefit (FEHB), is one of the best benefits that

Are Postponed and Deferred Retirement the same? Recently, when we met with a group of Federal Employees under the FERS system, they used the words

As a Federal Employee, how will the passing of the Tax Cuts and Job Act impact you? This is a great time of year in

Hi. I’m Micah Shilanski from Plan Your Federal Retirement. Welcome to our video. We just finished teaching two days of federal benefits classes. They were

The Best Kept Secret in CSRS eBook Only $7.97 Available for Instant Download CSRS and CSRS Offset Federal Employees have a unique benefit called the

CSRS Voluntary Contributions Transfer to a Roth IRA While the CSRS VCP program was originally designed to allow CSRS to put more money in and

Micah Shilanski, CFP® Micah Shilanski is a CERTIFIED FINANCIAL PLANNER™ professional who specializes in helping federal employees get the most out of their federal retirement

You need to know your FERS MRA to find out if you are eligible for different types of FERS retirement. Your Minimum Retirement Age will range

When you are ready to retire, you have several TSP retirement choices. You can… Leave your money in the TSP Take monthly TSP withdrawals Annuitize

When we talk about CSRS Survivor benefits – most people think of the survivor annuity. But Civil Service Retirement System employees have several choices when

How Will Your Federal Retirement Benefits Be Taxed?Many people simply forget – or perhaps just don’t understand the taxation of federal retirement benefits. Taxes will

You may have heard of FERS deferred retirement – where you separate from service now, but start your FERS pension later. But you might also

Looking for in-person FERS Retirement Seminars in Alaska? Shilanski & Associates, Inc. offers live, in-person FERS retirement classes in Anchorage, Alaska. At our full-day workshop,

When you take a FERS Retirement – you’ll receive a monthly pension for the rest of your life. How do you calculate this amount? First

Your High 3 Salary is an important part of your pension calculation for federal retirement. Your High 3 Salary is the highest average basic pay

Video Transcription: Hi, I’m Micah Shilanski from Plan Your Federal Retirement. We just wrapped up a wonderful two days of teaching an eight-hour

Your Retirement Savings: Questions about Your ‘Cash Bucket’ A portion of your retirement savings needs to be in a ‘Cash Bucket’. A well-funded Cash Bucket

What it Means for Federal Employees in Alaska, Hawaii & US Territories The COLA Locality Pay transition is in progress. It started in 2010, and

New legislation means that Alaska COLA is being phased out, and the New Alaska Locality Pay Rate is being phased in. Federal Employees in Non-Foreign

Take Home Pay Concerns & Hidden Tax Increases The transition from COLA to Locality Pay for Federal Employees in Alaska, Hawaii and U.S. Territories brings

The Non-Foreign AREA Act of 2009: COLA to Locality Pay The Non-Foreign AREA Act of 2009 spells out the transition from COLA to Locality Pay

New legislation means that Hawaii COLA is being phased out, and Locality Pay is being phased in. Federal Employees in Non-Foreign Areas are now being

Retirement Planning for Federal Employees is Different Retirement planning for federal employees is unique. As a Federal Employee, you know you have one of the

Planning your federal retirement? You need to know that Federal Employees have unique financial planning needs that most generic financial planning doesn’t address. One of

*The Best Kept Secret in CSRS* The CSRS Voluntary Contributions Program (VCP) is a special component of the Civil Service Retirement System. eBook Only $7.97

Some federal retirement benefits give Federal Employees a head start on retiring earlier than most. As a Federal Employee, you know that you have one

Learn about ‘Buckets of Money’ When you’re investing for retirement, it’s easy to get caught up in all of the details. Most federal employees

How Much Money Should be in Your ‘Cash Bucket’? Thinking about your retirement savings and investing for retirement? You should consider putting some of your

The amount of retirement savings you need in your ‘Cash Bucket’ will change as your fixed income changes in retirement. If you’re not familiar with

Military Buyback for Federal Retirement Getting ready for federal retirement? Could a military buyback towards your federal creditable service make sense for you? Lots of

Be prepared! Your Federal Pension check is usually delayed. Even if you have turned in all of your paperwork on time – in does not

TSP – “I can take my money out, however I want to in retirement!” Hi, I’m Micah Shilanski from Plan Your Federal Retirement. Welcome to

https://youtu.be/9Msn-e86wL8 Social Security is one of the most talked about and misunderstood parts of retirement planning. For many federal employees nearing retirement, online discussions, headlines,

Listen to the Full Episode: As the year closes, federal employees can’t afford to miss critical planning opportunities that protect their retirement and avoid

https://youtu.be/9rU64rw2cbU When you hear the word “bridge,” you probably picture the Golden Gate or Brooklyn Bridge, not your retirement income. For federal employees, though, a

Listen to the Full Episode: A year-end retirement review can be a valuable step for federal employees who want to better understand their benefits

https://youtu.be/aXGJ0TL-QC4 From Magazines To TikTok Financial “trends” are nothing new; only the platforms have changed. Decades ago, investors chased the latest ideas from glossy money

Listen to the Full Episode: Year-end is one of the most strategic times for Federal Employees to review their financial picture, retirement timeline, and

https://youtu.be/xIjeO–32Lc Most federal employees are surprised to learn that up to 85% of their Social Security benefits may be taxable in retirement. In this episode,

https://youtu.be/M_e4Sfc8vvk We’re all feeling the impact of inflation. Groceries, gas, utilities… everything costs more. Unfortunately, federal retirees may soon feel it even more directly. For

Listen to the Full Episode: In this episode of Plan Your Federal Retirement, Jamie C. Shilanski, RFC®, talks about one of the most stressful

https://youtu.be/eMUJ7_5dMU0 Are Federal Employees Being Auto-Enrolled in Medicare Part D? If you’re enrolled in a Federal Employee Health Benefits (FEHB) plan that now offers Medicare

Listen to the Full Episode: Ever wonder what questions other federal employees are asking as they plan for retirement? In this special episode, we’re taking

Real Question from a Federal Employee I am a widow and own an inherited TSP from my husband. Currently, I listed our Living Trust as

Federal Employment has perhaps never been more uncertain. The Cross Roads When we visit with Federal Employees, we usually run into two groups of people.

Feds are facing yet another extended furlough in 2025. A furlough is when an employer, in this case the federal government, places employees on an

Real Question from a Federal Employee As I approach retirement, what are the safest and best TSP investment and allocation strategies, any suggestions? – Andrew

Listen to the Full Episode: When it comes to money, the emotional impact is often overlooked, but it can ‘make or break’ a family’s financial

Real Question from a Federal Employee What is the maximum amount of unused annual leave that I may be paid for when I retire? – Wayne

Listen to the Full Episode: Healthcare is one of the most important, and often most confusing, parts of retirement. For federal employees, the combination of

Real Question from a Federal Employee Hey, I am retired Air Force 22 years a combat injury related 100 % disabled veteran. I am working

Listen to the Full Episode: Social Security is one of the most misunderstood parts of retirement planning. For federal employees and their families, it’s not

Real Question from a Federal Employee Do I need Medicare Part B if I have FEHB? I find it hard to believe Medicare Part B

Listen to the Full Episode: Are you a year away from retirement? The final 12 months before you retire from federal service are some of

Real Question from a Federal Employee What age can I start collecting Social Security retirement benefits? What is my full retirement age, and how does

Listen to the Full Episode: What does real retirement readiness look like? In this episode, Micah is joined by his father and mentor, Floyd, to

Real Question from a Federal Employee Hello, I have a question. I’m a few years out from retiremen, how can I be sure I’m financially

Listen to the Full Episode: Facing the New Challenges of Federal Retirement: What 2025 Means for You Federal retirement in 2025 requires thoughtful consideration of

Listen to the Full Episode: Are today’s market swings making you nervous about your retirement? You’re not alone but the good news is, there are

I have 2 years state retirement contributions, 10 years military (7 years federal 3 years guard). Can I combine state and federal retirement contributions? Do

Listen to the Full Episode: In this episode of the Plan Your Federal Retirement podcast, Micah Shilanski and Christian Sakamoto dive deep into the relationship

Question about TSP matching Contributions.If I retire at the end of a month, which happens to be the middle of a pay period, do I

Listen to the Full Episode: Is your financial plan ready for unexpected changes? In this episode, Micah and Jamie highlight the importance of taking charge

Can I suspend FEHB in retirement then start it again later if my new (private sector) employer offers health coverage benefits that I’d like to

I have 15 years of federal service and am 55 years old. I have only been in the FEHB for my most recent 3 years

https://youtu.be/AH8GKsjrlSQ The more confident you are that you won’t be scammed, the more vulnerable you are. Scammed, Phished, Hacked, or Conned… isn’t just for the

Is it possible to request a waiver to access the FERS Supplement two years early? My wife has 32/33 years but only turns 55 in

Listen to the Full Episode: Is “buy and hold” really the best strategy for retirement investing? In this podcast episode, Micah and Christian explore why

Thank you for your wonderful and helpful videos on postponed retirement. The one question I have remaining is – I understand that if I retire

Listen to the Full Episode: Think you know how your FERS pension, Social Security, or military retirement will be taxed? Think again. In this episode,

First, I have listened to your podcast for year,s and it has been a wealth of information. Thank you. Now for my question…I am a

Listen to the Full Episode: What does retirement really look like beyond the financials? In this podcast episode, Micah and Floyd discuss what life is

I’m 65 now, still working usps, when I retire in 1 to 2 years, I’m interested in keeping monthly health insurance down. Is it more

https://youtu.be/RGaefOcEvEw Every Investor should have their “Rules on Investing” in place for times of “market volatility and turmoil.” Times like this, I am often reminded

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Yes, good morning. Jeff here, wondering about having a postponed retirement. When the paperwork needs to be filled out, if I want to start that

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Good morning, my name is Alberto. I am a Mail Handler for the Postal Service with 40 years of service. Currently, I can carry over

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

https://youtu.be/-lxMYExTiGQ The Road Not Taken: What Happens When Federal Employees Make (or Avoid) Big Decisions. Understanding Federal Retirement Options: Deferred Resignation, VERA, Postponed Retirement, and

https://youtu.be/VQ0Z9PhhxEQ How prepared are you if you no longer work for the Federal Government? Maybe you accepted the Trump Administration’s “deferred resignation” package; maybe your

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Hello, at age 57 years and two months, I separated from federal service for a civilian job after serving 5.3 years and buying back 17.2

My wife is a federal employee and will retire next year. She is going to be 50 years old. I am going to be 58

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits professional, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Need help with federal employee survival benefits. I looking for specific help with my wife’s survivor FERS and Death Benefits. My wife worked for the

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

Hi, my name is Eric. I am calling because I have a question about buying back my military time. I am retired from the from

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John

Hello. My name is Joyce and I am trying to determine the best date to retire either december 31st or january 11th 2025 at the

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and

I’m 60 years old with 36 years of service. I called the TSP help line and asked if I could roll over money from the

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and

Hello, I just started federal employment this July. I served Active Duty in the Army for 9 years from 2009 to 2018. In 2018 I

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal

Yes, my name is Bobby and I have a question on the life insurance coverage. I read here that it said that the basic life

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension

“Yes, my name is Marty. I like to know about FERS, if there is a maximum amount of years that I can work and then

Listen to the Full Episode: Understanding how to navigate taxes in retirement is crucial for preserving your hard-earned income. From Roth conversions to Qualified Charitable

Yes, my name is Martha, and I tune into as many of your podcasts as I can, for your valuable information, I have a question

Listen to the Full Episode: Planning for your retirement requires a solid understanding of your options. Discover the best strategies for managing your Thrift Savings

If you have a birth month of Jan ro April, and the year you obtain age 61, you exceed the earnings limit, how is that

Listen to the Full Episode: Are you ready to turn your retirement savings into a reliable income stream? Understanding your spending goals and determining your

FERS supplement annuity. I retired from SSA under the 25 years of service at any age in 2014. I was told I would be eligible

Hi. I have congressional experience and a break in service and I have just retired to the executive branch and I was wondering how the

Listen to the Full Episode: Are you ready to turn your retirement savings into a reliable income stream? Understanding your spending goals and determining your

I can retire in october 2019 with 30 years under first, I will be 56 and I mean 10 months old and I do not

Listen to the Full Episode: Join Tammy and Micah, as they share their insights on navigating retirement preparation, avoiding common mistakes with OPM, and ensuring

Hello PYFR team! I love the podcast and appreciate it and all the resources you offer. My question is about taxes on the pay-out of

Listen to the Full Episode: Have you considered what happens to your assets and who will take care of your financial matters when you’re gone?

I read the $1,000.00 example that you write and 50% of 1K is 500.00 a month for my wife. That makes sense and I understand.

Listen to the Full Episode: Federal employees can use various calculators to estimate their FERS benefits, but accurate documentation and proper completion of estate planning

I am eligible to retire from fed service at 57 1/2. I will have 36 years of service. I plan on using my TSP to

Listen to the Full Episode: Are you seeking clarity on TSP strategies? Join us on our latest podcast episode, where Christian and JT decode the

I am 8 years from retirement and currently invested 100% in the C fund. When should I start moving money to the G fund and

Listen to the Full Episode: Are you ready to take control of your retirement finances? Your current spending habits could shape your future retirement lifestyle

If I retire age 59 under Postponed Retirement can I collect the SRS – Kenneth https://youtu.be/KAGt4Mu4OpM Federal workers have three main parts to their retirement: a

Listen to the Full Episode: It is time to discuss retirement planning, cash flow management, and potential retirement expenses! In this special episode, Micah leads

Listen to the Full Episode: Are you ready to embark on a journey towards a secureretirement? Join Micah and Tammy, as they analyze advanced retirement

How do I calculate my high three? I was a FERS employee from 1991-2000 then returned to FERS in 2022. I am 58 with a

Listen to the Full Episode: Are you ready to retire? Have you considered the emotional part of this journey? Are you and your spouse on

I worked for the federal government from 1995 to 2000. I turn 62 in 2024. I spent my entire federal career at Nevada. I live

Listen to the Full Episode: Federal retirees face unique challenges, from income replacement to tax considerations. But what about life insurance needs and survivor benefits?

Questions about social Security and COLA (cost of living adjustment) are among the most common. Let’s go through the basics with Floyd Shilanski, RCF, Managing

“In mid 2025, I will turn 62, therefore my FERS supplement will stop. I currently work PT not to exceed 2013 earnings limit. However, in

Listen to the Full Episode: There are a lot of complexities in federal retirement benefits and retirement planning. Let’s unravel the key aspects and pitfalls

Listen to the Full Episode: What are the essential steps to a successful federal retirement? Join, Micah and Tammy, in today’s episode as they go

“Can I take out a loan towards my FERS contributions? I’m a federal employee and no where close to retirement. Would it work like the

Listen to the Full Episode: Ever wondered why your retirement is losing money despite investment diversification? Join Micah and Christian in our latest episode, where

My husband was retired in May of 2020 at age 65 after 20 years of service with the FBI. We kept our health, vision and

Listen to the Full Episode: As the holiday season ends, it is important to take action about our retirement plans and talk about the changes

”If I receive 26k in annual leave payout does that count against the earnings limit of my supplement? Also what about the money I made

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn about estate planning documents for federal employees and the

Listen to the Full Episode: You already know how important estate planning is for your retirement, but do you know the crucial must-do’s? In this

”Hi, I’m 61 years old and my FERS supplement is ending soon. What should I do when that income goes away? And how am I

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn about the importance of retirement planning and the use

Listen to the Full Episode: It’s time to get invaluable insights from cash flow considerations to navigating the intricate rules of the Federal Employees Retirement

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and learn everything you need to know about Medicare and Federal

Listen to the Full Episode: What coverage do you have, and what coverage do you actually need?Join Micah and Tammy in this episode, where they

I absolutely loved the episode on what you cannot do in the TSP. Naturally, it brought up other questions in my mind. Before I got

“should I delay my social security and let my wife draw it until my FRA? I planned on drawing at 62 anyways. I am retired navy and

Listen to the Full Episode: Listen to this week’s recap episode with Sierra Steele and make sure you know how to manage your Year-End Tax

Listen to the Full Episode: As the year winds down, it’s time to get proactive about your finances and tax planning! Join us as we

“What happens to a surviving spouse if an employee dies while working, but that employee was also in the process of buying back military time?

Listen to the Full Episode: Learn how to avoid making irreversable mistakes after death and empower yourself with the knowledge you need to plan for

Listen to the Full Episode: Don’t let irreversible mistakes catch you off guard. Empower yourself with the knowledge you need to plan for a secure

“If I retire after age 62, and supplement my monthly FERS pension by making small withdrawals from my Traditional TSP (assume $2,000/ month), would IRS

Listen to the Full Episode: Learn to make informed retirement decisions and secure your financial future with valuable information in regard to your TSP, covered

Listen to the Full Episode: Whether you’re just starting your career, planning for retirement, or already in retirement, or someone looking to understand TSP better,

Listen to the Full Episode: Learn why the TSP is such a phenomenal tool for your retirement and find out what you should know about

Listen to the Full Episode: In this episode, host Micah Shilanski and a special guest – JT Ferrin, delve into explaining the meaning of TSP

Listen to the Full Episode: Learn about your options for living abroad in retirement and find out everything you need to keep your benefits, covered

Listen to the Full Episode: Do you wonder about your options for living abroad in retirement? Are you ready for change but need to know

“I am currently age 32 (a bit away from retirement) and I have been with USPS for 6.5 years now. It says you are fully

Listen to the Full Episode: Learn why the Federal Employee Health Benefits (FEHB) is such an excellent benefit for federal employees, allowing them to keep

Listen to the Full Episode: In this episode of Plan Your Federal Retirement Podcast, Micah and Jamie discuss the Federal Employee Health Benefits (FEHB) and

“I’m about 10 years out from retirement. I’m wanting to stop putting money into the traditional tsp and start a Roth. Is that doable?” –

Listen to the Full Episode: Learn what the importance is of understanding the rules and regulations for federal employee retirement, covered by Sierra Steele. Enjoy

Listen to the Full Episode: Are you a federal employee planning for retirement? Do you know that negative outcomes can be prevented if only you

Listen to the Full Episode: How do you know what to have in savings? Learn all about great tips on how to organize your savings

Listen to the Full Episode: How many months’ worth of living expenses do you need to have saved up and why? Do you have emergency

“Micah, I have a question about the earnings test for FERS Supplement. I’m a title 38 physician, planning to retire with age 60 + 20

Listen to the Full Episode: Does everybody have the right to a FERS Supplement? Learn all about who will receive it and what you need

Listen to the Full Episode: The FERS supplement is a great benefit of your FERS retirement package. This supplement is available to federal employees who

“Love your podcast! I am a Federal retiree and fine with Thrift Savings Plan (TSP) and Federal Employees Group Life Insurance (FEGLI) standard order of

Listen to the Full Episode: Learn what’s possible and what’s not when it comes to your TSP in retirement. Here are the 7 things you

Listen to the Full Episode: Retirement can be challenging, especially when it comes to managing your finances. One of the biggest mistakes you can make

“I am turning 62 and I am drawing disability FERS. Can I draw social security and FERS together? And will my FERS change when I

Listen to the Full Episode: The importance of knowing what lies ahead, what to expect and what steps to take when transitioning to retirement, covered

Listen to the Full Episode: You are getting closer to retirement, but specific tasks must be completed to enjoy it thoroughly. You’ll need to take

“I watched the very helpful video on ROTH IRA conversions. I will be retiring by the end of 2022 and I do not have any

Listen to the Full Episode: You’ve been working and saving and planning for your retirement. And when you retire, you go through a psychological shift

“I retired from PHMSA/USDOT January 2021 and I just received my first W2 form from the Department of Interior and It says that I paid

Listen to the Full Episode: The importance of knowing the different streams of income and how to use them, covered by Victoria Kellerman. Enjoy the

Listen to the Full Episode: Cashflow is the heartbeat of retirement, so you have to know the details of your income streams, the theory, and

Listen to the Full Episode: The importance of making a financial plan for a great retirement, covered by Victoria Kellerman. Enjoy the show? Use the

Listen to the Full Episode: Setting goals and mapping a strategy – these are the ground rules for taking the action in your hands! No,

Listen to the Full Episode: One of the most essential and fundamental questions is choosing the right federal retirement plan! Do you know how much

“August 2023 I will turn 62 and stop receiving the OPM Social security . After August for the remainder of 2023 will I still be

Listen to the Full Episode: What if you erroneously select an annuity from the TSP instead of a withdrawal from it, can you reverse that

Listen to the Full Episode: Net vs. Gross income. Which one hits the door of your bank account? Changes regarding insurance? Life insurance, health insurance…

Listen to the Full Episode: Accidents happen, but some come with severe consequences. For example, when covering someone with your HSA that you shouldn’t cover,

“Hello , I worked for 11 years as a federal employee until age 57, now I am 62 , can I still get fehb, ie

Listen to the Full Episode: Changes the Secure 2.0 brings and what do they mean for the retirees and federal employees, covered by Victoria Kellerman.

Listen to the Full Episode: Changes are happening, and questions have been raised! That is why we have a special guest in today’s episode –

“When should I retire to take advantage of the planned big 2023 COLA increase? If I retire in December, will my pension benefits be increased

Listen to the Full Episode: The benefits in retirement that Federal Employees have are based on three things: Pension Social Security TSP To avoid misconceptions

“I plan to retire at age 57 with an MRA + 10 option. I don’t plan on taking my FERS retirement out until later age

Listen to the Full Episode: Whether you are 30, 50, or 70, a subject that has a hold on you is how to improve

“I have been working in the federal system for 3 years and will retire within the next 5 years. I am 62. I have a

“If I started in the NAF system in 1996 and then converted to GS in 2008 we were told it would count towards retirement. From

Listen to the Full Episode: Christian Sakamoto joins the show again today to discuss cash flow and the money you spend in retirement. This is

Listen to the Full Episode: There are a couple of times a year when it’s really important to have clients come in and review things.

“I am in the process of divorcing (prior to my federal retirement). I am considering agreeing to providing my soon to be ex-spouse partial survivor

Listen to the Full Episode: The effects of inaccurate information can be devastating, and there’s a lot of questionable information out there. So, in this

“I’m just about 65 and make about 125K a year working for the federal government. I plan to retire in five years when I’m 70.

Listen to the Full Episode: Today Micah and Tammy tackle estate planning, a topic that impacts a lot of people, but that we don’t tend

“Can I withdraw my FERS to use as a down payment for purchase of Real Estate?” – Tracey. https://www.youtube.com/watch?v=CPm4DDHl0-c&feature=youtu.be When Federal Employees use their retirement

“Planning on retiring at my MRA, is the FERS supplement subject to the social security earnings test? Thank you for your time!” – Craig. https://www.youtube.com/watch?v=87LW2zw_7Lg

Listen to the Full Episode: Christian Sakamoto joins the show again today to help answer some of the top questions we get from people who

Listen to the Full Episode: Have you noticed that the markets are down? Did you know there are some key opportunities to look into when

Listen to the Full Episode: Sometimes there are misconceptions we have that lead to big mistakes before retirement—and they all stem from one main problem.

“Hi Tammy and Micah, Thanks for the information. I separated from the government at age 54 1/2 years and 20.5 years of service. I like

Listen to the Full Episode: Pros and cons to moving investments around. Enjoy the show? Use the Links Below to Subscribe:

Listen to the Full Episode: Many people want to move investments into or out of their TSP, and there are a lot of questions surrounding

“Hi! I LOVE your podcasts! I am a Federal employee, have met my MRA and will meet my 30-years of service on Nov 2, 2021.

Micah and Tammy have been seeing lots of mistakes and missteps happening lately, with more people reaching out to see whether they were wrong or

“Thank you very much for the great information. Question: Do I need to list my ex-spouse on my FERS retirement application if we were married

Micah is flying solo in today’s podcast to answer this indirect question that he gets when meeting with clients. He discusses how to decide what