The Thrift Savings Plan (TSP) was created under the Federal Employee’s Retirement System Act of 1986 for federal employees and members of the uniformed services. This is an Employer-sponsored retirement account that allows participants, Federal Employees, to participate in a low-cost investment and receive an employer match on some of their contributions.

Federal Employees enrolled in the TSP have two “buckets” within their TSP account.

Pre-Tax Account: The first “bucket” is the Traditional element. This allows you to make contributions on a tax-deferred basis. When we defer taxes, that means that we are putting them off until later.

The money that you put into the Traditional TSP is done so on a pre-tax basis. When you withdrawal those funds later at a qualifying age, they are considered taxable income.

After-Tax Account: The after-tax account is called the “ROTH” TSP. This account was named after Senator Roth who helped pass the legislation allowing monies invested to be made on an after-tax basis to this account.

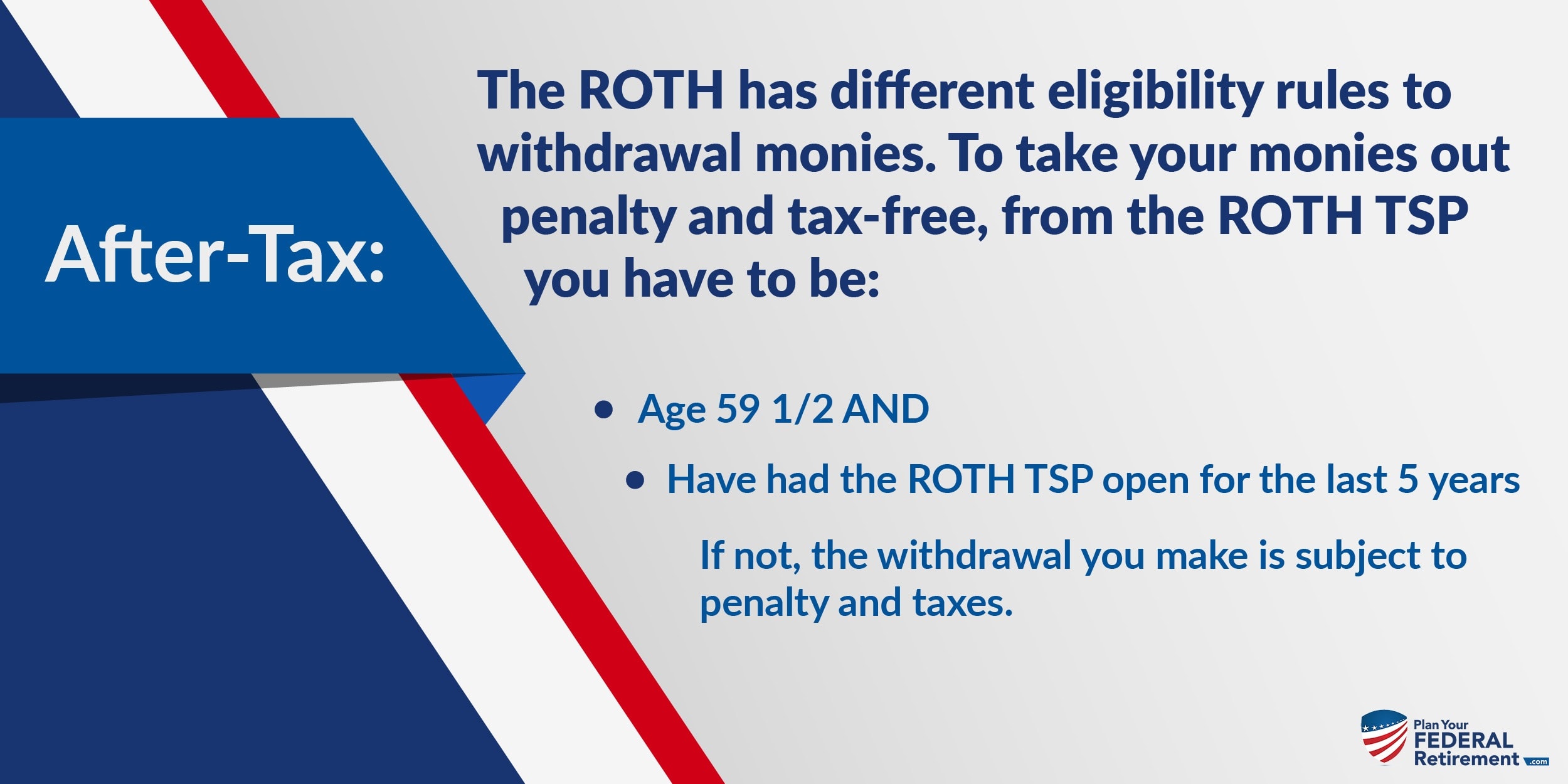

When you make a contribution to the After-Tax account of your TSP, the ROTH, your funds grow tax-free. You already paid taxes when you made the contribution so when you go to withdraw those funds, once you meet eligibility requirements, they are tax-free.

Accessing Pre and Post Tax Contributions to the TSP

The Pre-Tax and After-Tax accounts have different rules as to when you can access those funds.

In the private sector, people participate in Individual Retirement Accounts (IRA’s) which have an age requirement that you reach 59 1/2 before you can withdrawal your monies from an IRA without penalty.

The TSP, for Federal Employees, is different. Here is how:

However, any monies you take out of this account are subject to income taxes. This account was made on a pre-tax basis so when you withdraw those funds, taxes are owed at your ordinary income tax rate.

Employer Contributions

Employer contributions to the TSP are always made to the Pre-Tax Account.

Even if 100% of your contributions are made to the ROTH TSP, your Employer’s contributions will be made to the Pre-Tax TSP account.

How Much Can You Contribute to the ROTH TSP?

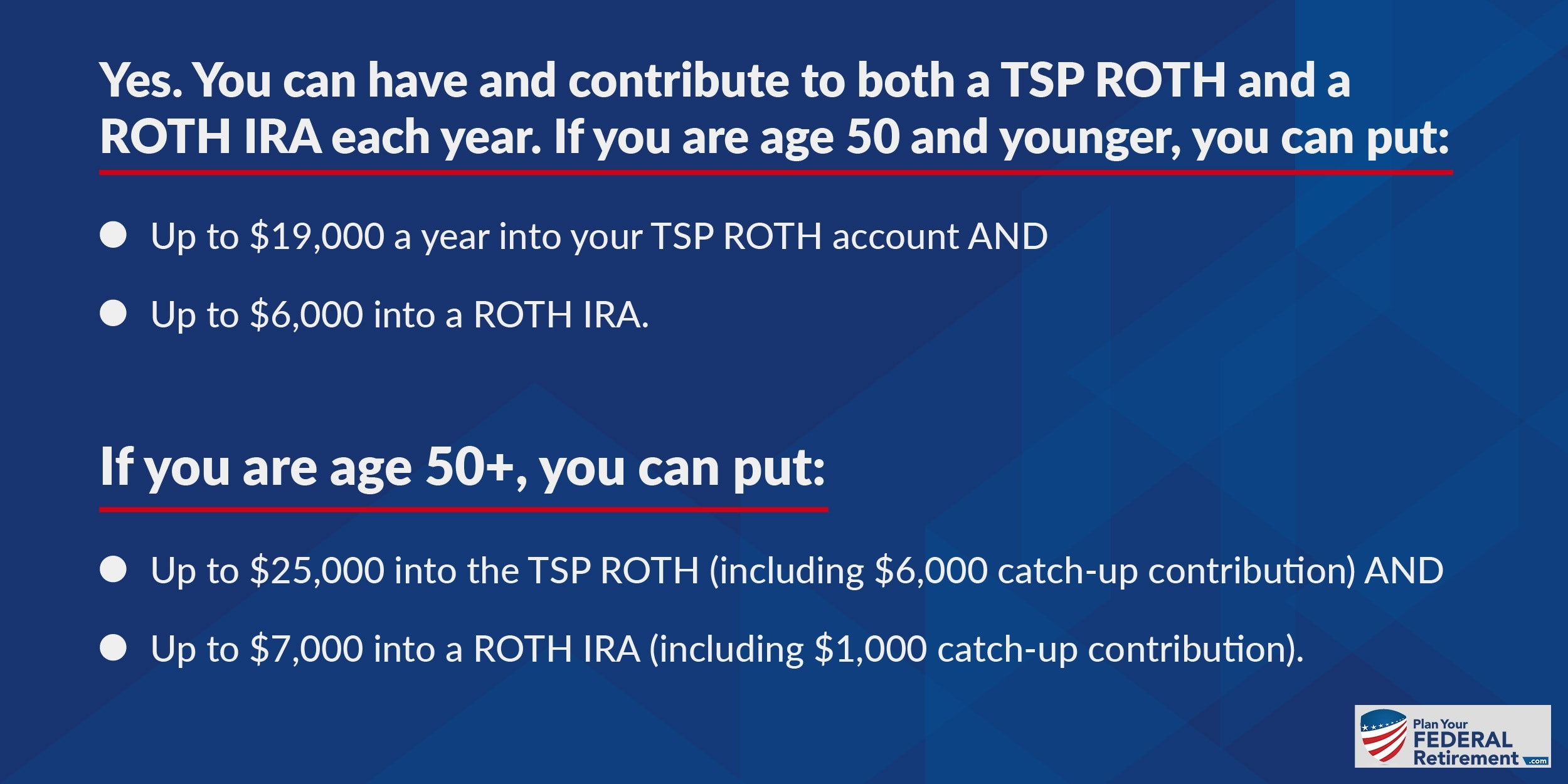

Every year the Internal Revenue Services establishes the maximum contribution levels that Employees can contribute to their employer plans.

In 2019, the maximum contribution that a Federal Employee can make to their TSP account is $19,000 if they are younger than age 50.

If they are older than age 50, they can make a $19,000 contribution and elect to make a “catch-up” contribution of $6,000 additionally. This is a total of $25,000 that can be contributed to the TSP if you are age 50+.

Each year the IRS reassess this amount and publishes new guidelines as to what the annual contribution limits are. Changes, from year to year, are generally around $500.00.

Can I Have a ROTH TSP and a ROTH IRA?

Remember, with an IRA, ROTH IRA, and TSP ROTH you have to get to age 59 1/2 before you can withdraw those funds without penalty. Also, with the ROTH IRA and TSP ROTH, you have to have had the account open for longer than 5 years.

Are there income limits to the ROTH?

The TSP ROTH is not subjected to income limitations for participants. You can contribute to the TSP ROTH even if you are a high-income earner without a phase out qualifications.

However, the ROTH IRA is subject to income limitations. If the adjusted gross income for your household exceeds $180,000 a year, you may want to talk with a financial professional. They can see if a “back door ROTH IRA” potentially makes financial sense for you.