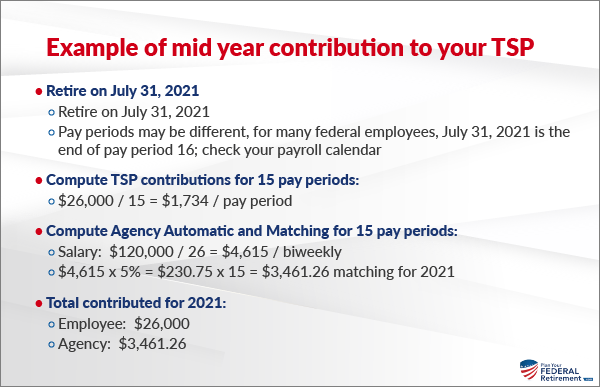

Are you still allowed to contribute the maximum of $26,000 to the TSP even if you only work half of the year? Is there any advantage to maxing out your contribution to the TSP fund for 2021 if you’re retiring in 2021 and plan to withdraw money in 2021 is an amount greater than the contributions for the year?

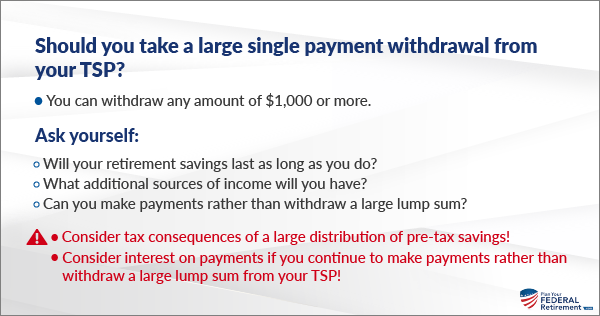

Should you take a large single payment withdrawal from your TSP?

- You can withdraw any amount of $1,000 or more.

- Ask yourself:

- Will your retirement savings last as long as you do?

- What additional sources of income will you have?

- Can you make payments rather than withdraw a large lump sum?

- Consider tax consequences of a large distribution of pre-tax savings!

- Consider interest on payments if you continue to make payments rather than withdraw a large lump sum from your TSP!