Hello, first off, I wanted to say I really enjoy your podcasts. I have really learned a lot from you both over the past year or two. I am a recent retiree, and I just switched over to an HSA (GEHA HDHP). I am new to the whole HSA thing as I had Blue Cross and APWU insurance for the previous 30 years, and I’m not sure I quite understand the benefits of it. Can you discuss the benefits of maximizing the amount of contributions to the HSA to maximize my benefit in retirement? Thanks!

Shawn’s question is one of my favorite topics to explain to federal employees at almost any stage of their career and even those who retired earlier than age 65. Shawn is enrolled in a high deductible health plan (HDHP) which is a health plan that has a high deductible… But it also offers a very interesting tax advantaged savings plan called a Health Savings Account or HSA. Here are some of the key features of an HSA:

- It is an “IRA” for healthcare

- Partners with a High Deductible Health Plan (HDHP)

- Tax-free contributions, tax-free growth and tax-free withdrawals

- Must withdraw for qualified expenses, otherwise withdrawals are taxable and subject to early withdrawal penalty under age 65 (non-qualified withdrawals)

- Money in the HSA is yours

- Use funds for medical expenses or save and invest for future expenses

- Earns interest and can be invested

- Keep funds even if you change health plans or leave federal service

- FDIC insured bank account

- May contribute in retirement as long as no other health plan besides the HDHP

In order to contribute to an HSA, you must be enrolled in a HDHP or high deductible health plan. These are health plans that have a deductible (the amount you must pay before the insurance steps in) of at least $1,400 / year (self only) or $2,800 / year (self plus one or family). These also have limits on the most you will pay out of pocket when using network providers which is $7,000 for self only and $14,000 for self plus one or family enrollments. All of the numbers used are 2021 dollar amounts. These may change from year to year.

FEHB HDHP plans may credit a portion of your premium to your HSA (think of this as a reduction in your deductible)

If you are not qualified to have an HSA, then you will receive a credit to an “HRA” (Health Reimbursement Arrangement)

GEHA 2021 deductible (this is the plan that Shawn is enrolled):

$1,500 self only

$3,000 self plus one or family

What are the contribution limits for an HSA?

Self only: $3,600 (2021)

Self Plus One or Self and Family: $7,200 (2021)

Catch-Up Contributions (age 55 and above): $1,000 (2021)

Deduct the reimbursement from FEHB plan from the contribution limit to determine maximum contribution to HSA each year

Shawn is enrolled in the GEHA HDHP plan that has the following reimbursement and out of pocket maximum:

GEHA provides a $75 / month ($900 / year) premium reimbursement for Self Only

GEHA provides a $150 / month ($1,800 / year) premium reimbursement for Self Plus One and Family

GEHA: Out-of-pocket maximum is $5,000 (self); $10,000 (self + one or family) in network;

out of network is $7,000 (self); $14,000 (self + 1 or family).

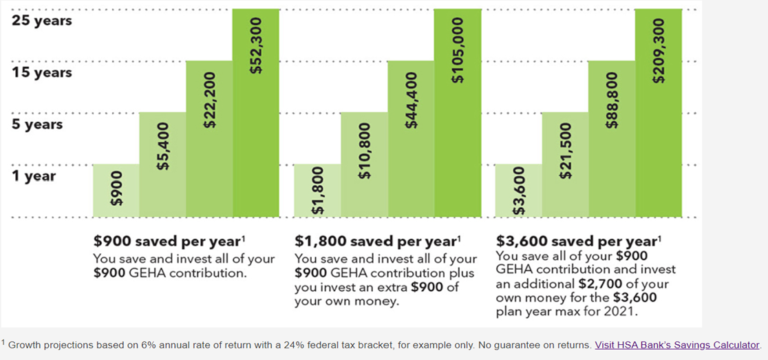

Here is an example that shows how your money can grow inside of an HSA:*

What else do I need to know?

-

FEHB plan may establish an HSA or HRA for you

-

GEHA uses HSA Bank (hsabank.com)

-

Receive your first HSA deposit by February 15 of new plan year

-

Additional plan contributions every month

-

Use debit card and online banking option to make payments

-

Pay using credit card and reimburse yourself from account

-

See IRS Publication 502 and IRS Publication 969 for more information regarding qualified medical expenses, health savings accounts and health reimbursement arrangements.

There are some other FEHB HDHP plans:

GEHA (plan codes 341 – 343)

Aetna (plan codes 224 – 226)

MHBP (Plan Codes 481 – 483)

United Healthcare (Plan codes LS1 – LS3; LU1 – LU3, plan codes vary by state)

There are few other regional HDHP plans, check opm.gov/healthcare/plan-information