“Thank you for the great videos, they are very informative. I do have a question for you. I am 59 years old and a retired postal worker, I would like to keep my money in the TSP, and would like to average 6% growth per year. What percentages do you recommend I put in each fund to accomplish this? Thank you again for the videos.” Larry.

Thrift Savings Plan (TSP) Allocations

Without fail, when our Financial Planners tell people that we specialize in Federal Employee benefits, a FERS Employee will often muster up the courage to ask how they should have their Thrift Savings Plan (TSP) allocated.

We love giving advice to Federal Employees! but we can only give specific investment advice privately when we work with you one on one. So as we dive into TSP allocations, we are going to speak very broadly. This should not be considered individual investment advice. For that, you will need to meet with your Financial Planner and talk to them directly.

Oh, you aren’t working with a Financial Planner who understands your Federal Employee Benefits?

Hmmm…. did we mention that we do that? As a profession.

Just saying. 🙂

Now that our shameless plug is out of the way… oh wait, did we mention that we also teach a Critical Concepts class which we go through conversations like investment allocations in greater detail for Federal Employees?

Ok, that’s all. No more plugs and down to the details of your TSP allocation question, Larry. You were a good sport.

What changes occurred with the TSP Modernization Act

We L.O.V.E. the TSP for its accumulation power. It is a great tool for FERS Employees to really take more control of their retirement planning and allocate some of their pay into this retirement plan. There was a downside of the TSP; for years the options on withdrawals for retirees were limited and ill-fitting.

For example, let’s say that Bob recently retired from Federal Service at age 61. He has been enjoying retirement but has decided that his monthly FERS Pension and FERS Supplement are not quite enough to cover his monthly expenses. Bob determines that he is short about $1,000 a month in his retirement cash flow.

Bob talks with his wife, Sue, and they decide that since Bob is over age 59 1/2 that they could take $1,000 a month from his TSP to make up this shortfall. Sue asks if there was a penalty but Bob tells her that since he is over age 59 1/2 the penalty won’t apply. They decide that it is the right move for their family.

Bob calls up TSP and asks how he can go about getting a monthly withdrawal of $1,000 and the TSP office assists him in setting up the monthly distribution from his account. One-month into the process, Bob checks his bank account and sees that $800.00 was deposited by the TSP office and not the $1,000 that he requested.

Bob calls the TSP office and they inform him at the time that Bob had requested a gross distribution of $1,000 from his TSP and they withheld 20% for taxes and sent those funds to the IRS. Bob explains that it wasn’t his intention, that he needed $1,000 net deposited into his account. The TSP says no problem and changes his distribution to $1,200 so that he nets $1,000 in his bank account – those changes would have taken place the following year.

The following year, under the old rules. The ability to make changes to your retirement distribution under the old TSP rules just didn’t make sense for retirees. There were a host of other changes that needed to take place as well.

As Financial Planners who work with Federal Employees, we were rather opinionated about the changes that needed to take place in order to modernize the TSP.

Under the TSP Modernization Act, participants can now change their withdrawals with more frequency. Now they can change the amount and frequency (monthly, quarterly, annual) of their installment payments and change from life-expectancy payments to a fixed dollar amount at any time throughout the year.

Here is a look at some of the top changes that the TSP Modernization Act made for the benefit of FERS Employees and FERS retirees alike:

- After you separate from service, you can take multiple post-separation partial withdrawals.

- If you’re 59½ or older and still working in federal civilian or uniformed service, you can take up to four in-service withdrawals each year.

- Are able choose whether your withdrawal should come from your Roth balance, your traditional balance, or a proportional mix of both.

- After you are 70½ and separated from federal service, you no longer need to make a full withdrawal election. (You will still need to receive IRS required minimum distributions (RMDs).)

- If you’re a separated participant, you can take monthly, quarterly, or annual payments.

- You can stop, start, or make changes to your installment payments at any time.

- You now have enhanced online tools to help you make withdrawals in the My Account section of tsp.gov. (TSPSF10)

One area that the TSP Modernization Act failed to address though is proportionate distributions from your TSP allocations.

TSP Allocations Between the Funds

We often think of the TSP as one big investment vehicle but we forget that the account is broken down into sub-categories of investment allocations. These allocations are known as “investment funds”.

The TSP has five individual investment funds:

“The Government Securities Investment (G) Fund – The G Fund has investments in short-term U.S. Treasury securities. It gives you the opportunity to earn rates of interest similar to those of long-term Government securities with no risk of loss of principal. The U.S. Government guarantees the payment of principal and interest. The interest rate paid by the G Fund securities is calculated monthly, based on the market yields of all U.S. Treasury securities with 4 or more years to maturity.

The Fixed Income Index Investment (F) Fund – The F Fund has investments in a bond index fund that tracks the Bloomberg Barclays U.S. Aggregate Bond Index. This is a broad index representing the U.S. Government, mortgage-backed, corporate, and foreign government sectors of the U.S. bond market. This fund offers you the opportunity to earn rates of return that exceed money market fund rates over the long term (particularly during periods of declining interest rates).

The Common Stock Index Investment (C) Fund – The C Fund has investments in a stock index fund that tracks the Standard & Poor’s 500 (S&P 500) Index. This is a broad market index that is made up of the stocks of 500 large to medium-sized U.S. companies. It offers you the potential to earn the higher investment returns associated with equity investments.

The Small Capitalization Stock Index (S) Fund – The S Fund has investments in a stock index fund that tracks the Dow Jones U.S. Completion Total Stock Market (TSM) Index. This is a market index of small and medium-sized U.S. companies that are not included in the S&P 500 Index. This offers an opportunity to earn potentially higher investment returns that are associated with “small cap” investments. The S Fund has greater volatility than the C Fund.

International Stock Index Investment (I) Fund – The I Fund has investments in a stock index fund that tracks the MCSI EAFE (Europe, Australasia, Far East) Index. This is a broad international market index, made up of primarily large companies in 22 developed countries. It gives you the opportunity to invest in international stock markets and to gain a global equity exposure in your portfolio.” (tsp.gov)

When you want to withdraw monies from your TSP, the TSP office is going to take that distribution proportionally across your TSP funds. When the stock market is going up, we don’t mind this strategy so much.

What about when the stock market is going down?

Let’s return to our trusted hypothetical retiree, Bob. Inside of Bob’s TSP account, he has invested in 70% equities (stocks) and 30% fixed income.

When Bob makes his withdrawal request from the TSP, they are going to withdraw 70% from equities and 30% from fixed income. If the stock market is in a decline, he is still making these withdrawals as the account values are declining. If this is a short term market correction probably not that big of a deal but what if it were the long correction? What if the markets experienced a longer-term pullback?

Emotionally we are probably thinking that Bob should just stop his withdrawals until the market recovers but is that realistic? If you are in retirement and find yourself in need of additional cash flow from your investments what is the reality of stopping the withdrawal needs for 3, 5 or even 7 years?

What if in Bob’s personal situation, he cannot afford to stop the TSP withdrawals in his retirement?

The TSP is still one of our favorite investment vehicles for FERS Employees and the Modernization Act went a tremendous way into well, modernizing the plans’ abilities to keep up with a growing sector of retirees who will live in retirement for 20, 30 or even 40 years but it still has some ways to go.

That is why we like to work with FERS Employees to embrace what we call our Buckets of Money strategy – sound interesting right? Who doesn’t love buckets of money?

Buckets of Money

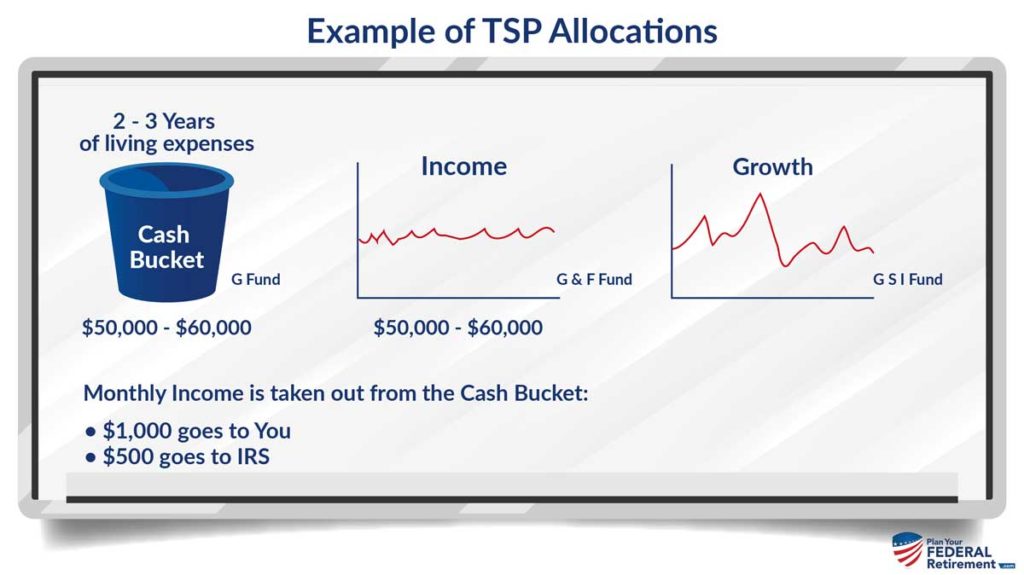

We believe in a multi-faceted approach to managing your retirement assets. Here we are going to speak broadly about all of your investable assets. This are your TSP funds, Retirement Accounts and other invested assets that you have. When we look holistically at all of your investments, we then break them down into various “buckets of money”.

Cash Bucket

The first bucket is going to be your cash bucket. This bucket will contain 2 to 3 years of your monthly net living expenses. Any monies you will need in the next couple of years should be in this cash bucket.

Do not forget about income taxes when thinking about how much monies should be in your cash bucket. Even when you are retired, Uncle Sam is still going to want to stop by and visit. As a FERS employee, most of your retirement is tax-deferred; this is often missed by retirees when planning their retirement cash flow.

Whey do we want 2 to 3 years? Because on average in the United States our recessions last about two to three years. In 2008, the “Great Recession” lasted 5 years. Monies that you are going to need in the next couple of years don’t belong in long term investments.

What we do not want to have happen is the economy goes through a period of recession and you need to sell or withdraw living expenses from your investments because you did not have enough in cash. Income planning in retirement is critical. Especially as a retiree when you have spent your entire life in an “accumulation” stage.

Income Bucket

The next bucket of money is your fixed income bucket. This bucket has investments in which you may earn a little more than you are able to in a cash account but is not exposed to tremendous market volatility.

In this account, we want to see around 2-3 years of monies that you will need. This is in addition to the cash bucket.

That is a total of 5 to 6 years of monies not subjected to the market volatility associated with long term investments.

If you create your cash bucket and your income bucket, you have just allocated 5 to 6 years of living expenses that should not experience the same volatility that long term investments do.

Why is this so important? We can talk to the mathematics reasons that this strategy makes sense all day long but more importantly it speaks to our emotions that we face in retirement.

During your working years with the Federal Government you have been deferring your salary and watching your investments, hopefully, grow. This is the accumulation stage.

When you retire, you exit the accumulation stage and enter the distribution and capital preservation stage. These are financial terms that pretty much mean: you’re going to start spending those retirement savings but be careful because they have to last your entire life.

We have had Federal Employees that through their working life never pay attention to market volatility go into retirement and feel the compulsory need to check their account balances daily. They start watching sensationalized news programs and reading articles about how to invest their monies based on the latest, greatest trend. When it becomes most important for them as retirees to be long term focused, they are short term.

When the market begins to decline, they panic and want to make emotional financial decisions.

Really intelligent people can make very poor decisions when they are emotional.

As a Federal Retiree, you have to have a long term financial plan for retirement. This cash bucket approach allows you to make long term decisions and not short term ones based on market volatility or, at least it is a good start.

The most powerful tool you have as an investor.

Time. Time is the most powerful tool that you have as an investor. The more time that you allow your investments to recover from short term losses the better.

We believe in long term financial planning and making disciplined financial decisions based on you and your family’s goals and risk tolerance levels.

So Larry, while we cannot specifically tell you exactly how you should have your TSP Allocated we hope that the “buckets of money” strategy gives some insight into our preferred TSP Allocation strategies.

Questions?

We love talking with Federal Employees and answering your questions. If you have a question about your Federal Employee benefits, let us know! Contact us and we would love to discuss the question and potentially feature your question on FERS Federal Fact Check.

JC Shilanski

We seen the mistakes that people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

7 CRITICAL MISTAKES

Federal Employees make

✗ Forgetting to check your beneficiary designations

✗ Expecting pension check to arrive in 30 days after retiring

✗ Not knowing the difference between SCD vs. RSCD

✗ Completing retirement paperwork incorrectly

✗ Failing to prepare financially for retirement

✗ Failing to understand tax consequences

✗ Getting bad advice

Click the button below and learn how to avoid these mistakes while planning YOUR retirement