Traditional vs Roth TSP

Understanding the difference between contributions to the Traditional vs Roth TSP is critical to long term financial planning. Before we dive into answering whether or not it makes financial sense to change your contributions from the Traditional TSP to the ROTH TSP, let’s start by understanding the difference between the two.

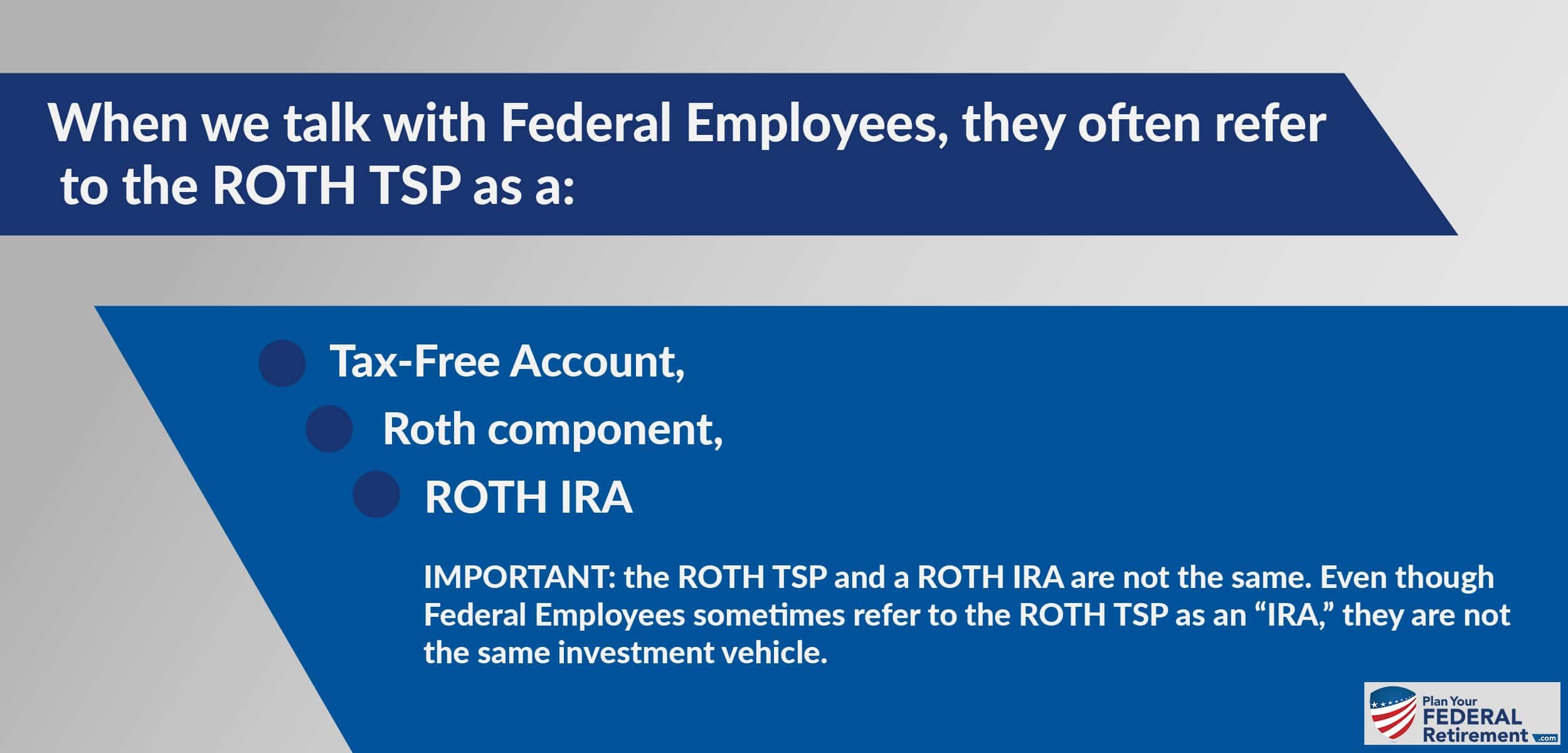

As Financial Planners who work with Federal Employees regularly, we hear a lot of “Fed Speak” or, common language or terms used by Federal Employees. Sometimes they are accurate and sometimes they are not. That is why we always like to start at the beginning. As you know, the beginning is always a great place to begin.

Financial topics can be complex and the greater clarity that you have on each, allows you to be better informed about what may or may not be appropriate for your particular situation.

Traditional vs Roth TSP: A few differences and terms explained

Traditional TSP

This is the tax-deferred component of the TSP. 100% of your Employer Contributions are deposited into this account when made — regardless of what selection you, as a participant, make.

The money that you contribute to the Traditional TSP has not yet been taxed. Those taxes instead, are deferred until later when you withdraw the funds.

What is really important to understand about the Traditional TSP is its tax-deferred status. 100% of your employer contributions are made on a tax-deferred basis. During your working years, when your taxes are generally high (especially as you inch closer to your High-3) this can provide some tax relief as the funds are contributed on a pre-tax basis.

Just keep in mind though that when you pull money out of your TSP, making a distribution from the Traditional TSP, you pay taxes at that time at that rate. It is often a misconception that taxes will be lower when you retire. That is entirely contingent on your personal situation and tax law. Retiring does not necessarily guarantee you are in a lower tax bracket. Keep that in mind when you conduct your planning.

ROTH TSP

This is the component of the TSP in which your contributions have been made on an after-tax basis. The monies you earmark for the ROTH TSP have been taxed at your current rate at the time that you made the contribution. These contributions are post-tax.

Remember, your employer contributions are never made post-tax. Your employer contributions, regardless of what selection you personally make with your own monies, are made on a pre-tax basis.

Meaning, if you have 100% of your TSP Contributions going into the ROTH TSP, your Employer Contributions will still be made in the Traditional TSP.

You will not receive a tax deduction for contributing funds to the ROTH TSP. You make contributions to your ROTH TSP on a post-tax basis. When you pull money out, making a distribution, you do so on a tax-free basis providing you have done so within the guidelines of the investments rules.

Which should you contribute to: TSP Traditional or ROTH TSP?

This is not a black and white question because every person’s tax situation is different. Even if you are 5 years away from retirement, that does not mean changing gears and contributing to the ROTH TSP is the best decision for you to make.

We love ROTH’s because of the tax-free planning these investments make possible. However, they are not always our default answer, because you have to understand a person’s particular income tax situation both now and in the future.

Federal Income tax planning is a really important concept in your financial planning process.

Deciding if you should contribute to the Traditional vs ROTH TSP is a tax planning question. Contributing to the Traditional TSP means that you are going to do so on a tax-deferred basis. Contributing to the ROTH TSP means that you are going to pay taxes today and plan to withdraw the funds tax-free later, providing that you meet the qualifications of having the account open more than 5 years AND have reached the age of 59 1/2.

When you plan to contribute after-tax monies, you need to ensure that doing so makes the most financial sense from a tax planning perspective.

By addressing what your tax liabilities are today, you can better assess if it makes more long term financial sense to make pre or post-tax contributions to the TSP.

The ROTH TSP is a great tool, but make sure that it is the right tool for the job you’re doing when you are evaluating the Traditional vs ROTH TSP.

Happy Planning

We seen the mistakes that people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

7 CRITICAL MISTAKES

Federal Employees make

✗ Forgetting to check your beneficiary designations

✗ Expecting pension check to arrive in 30 days after retiring

✗ Not knowing the difference between SCD vs. RSCD

✗ Completing retirement paperwork incorrectly

✗ Failing to prepare financially for retirement

✗ Failing to understand tax consequences

✗ Getting bad advice

Click the button below and learn how to avoid these mistakes while planning YOUR retirement