Special Benefit for Some FERS Who Retire Before Age 62

Have you heard about the FERS Supplement?

It’s an important benefit for FERS planning to retire before age 62 – but it’s so unknown, it’s practically a secret.

The FERS Supplement is also called the Special Retirement Supplement or SRS. It is designed to help bridge the money gap for certain FERS who retire before age 62. It will supplement your missing Social Security income until you reach age 62.

But not all FERS are eligible to receive the Supplement.

Rules of Eligibility for FERS Supplement

The first rule might sound obvious – but people really do ask… Yes, you must be in the FERS Retirement system to get the FERS Supplement.

And the Supplement is unique to FERS – there is no counterpart to the Supplement in the Civil Service Retirement System (CSRS).

The second requirement is that you must have a normal immediate retirement, not an early retirement (MRA+10). This means you must have 30 years of creditable service and meet your MRA. Or you can have 20 years of creditable service and be age 60.

And while you can seek a normal immediate retirement at age 62 with 5 years in service – the Supplement is only paid until age 62. So if you retired at 62 with 5 years of service, you would not get this benefit.

Special Rules for Special Provisions

I want to note here that Special Provisions FERS (ATC, LEO or FF) have some different rules for the Supplement. Click here if you are Special Provisions.

Estimating the FERS Supplement

The calculation for the FERS Supplement is extremely complex and time-consuming. If you’re interested in an exact calculation, check out the OPM CSRS/FERS Handbook, Chapter 51, Retiree Annuity Supplement

Most people are fine with an estimate for initial planning purposes. The easiest way to get a ballpark on your Supplement involves your Age 62 Social Security benefit.

In order to estimate your Supplement amount, you’ll want to have your annual Social Security statement handy. You’ll also need to know how many years of creditable service you would have at your estimated retirement.

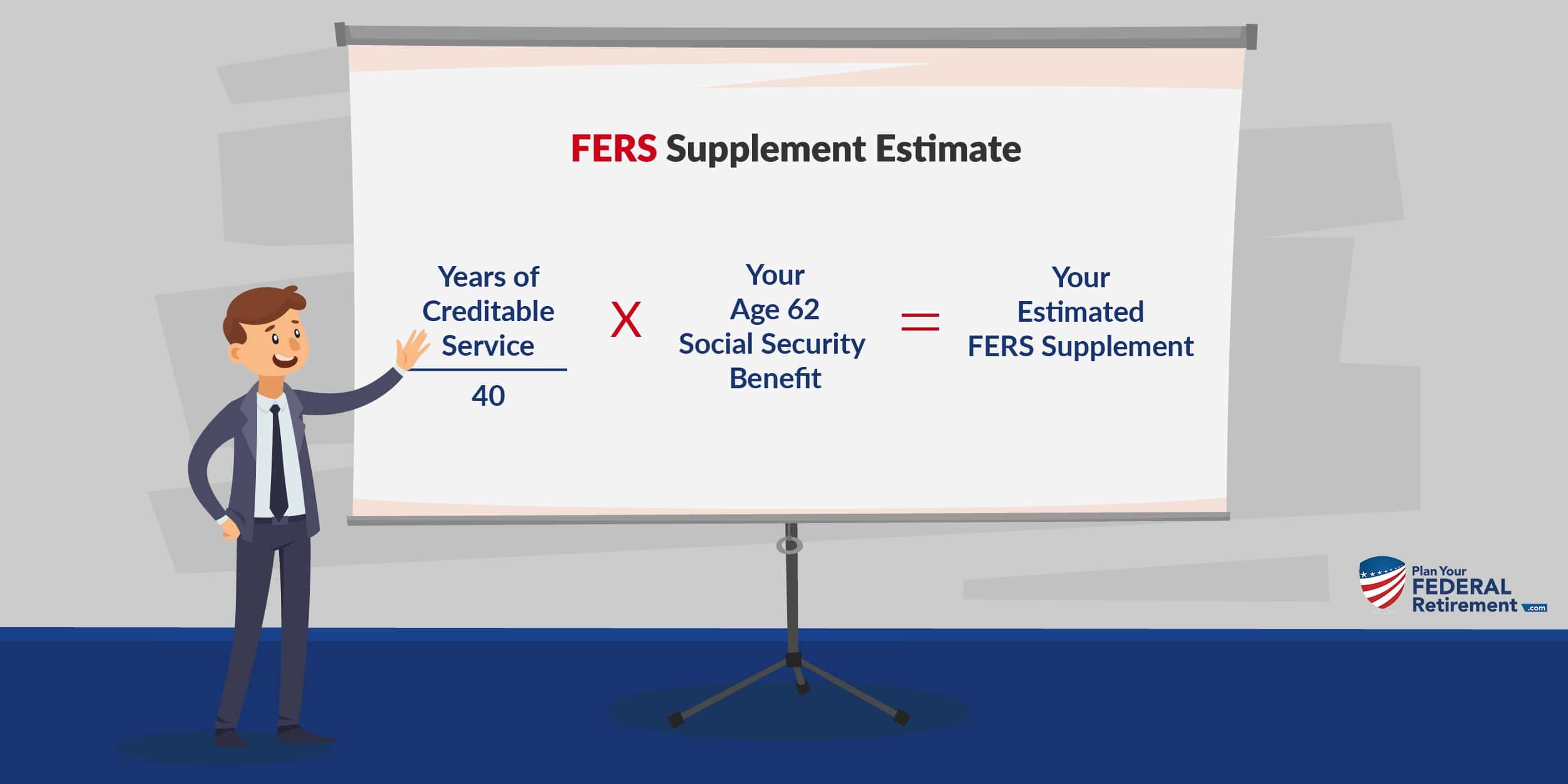

The estimate formula is…

Years of Creditable Service: this is the number of years that count towards your retirement, and possibly some military time. (Time in military service counts here *only* if it was performed during a period covered by military leave with pay or leave without pay from civilian service. See Section 51A2.1-3 of the CSRS / FERS Handbook)

40: this is a fixed number and does not change

Your Age 62 SS Benefit: You’ll find this number on page 2 of your Social Security statement. And it doesn’t matter what age you plan to start receiving Social Security – for this formula, you must use the age 62 Social Security benefit amount.

You can see that almost by design, the Supplement will be less than your Age 62 Social Security benefit. Unless, of course, you have 40 years of service.

Let’s walk through an example together…

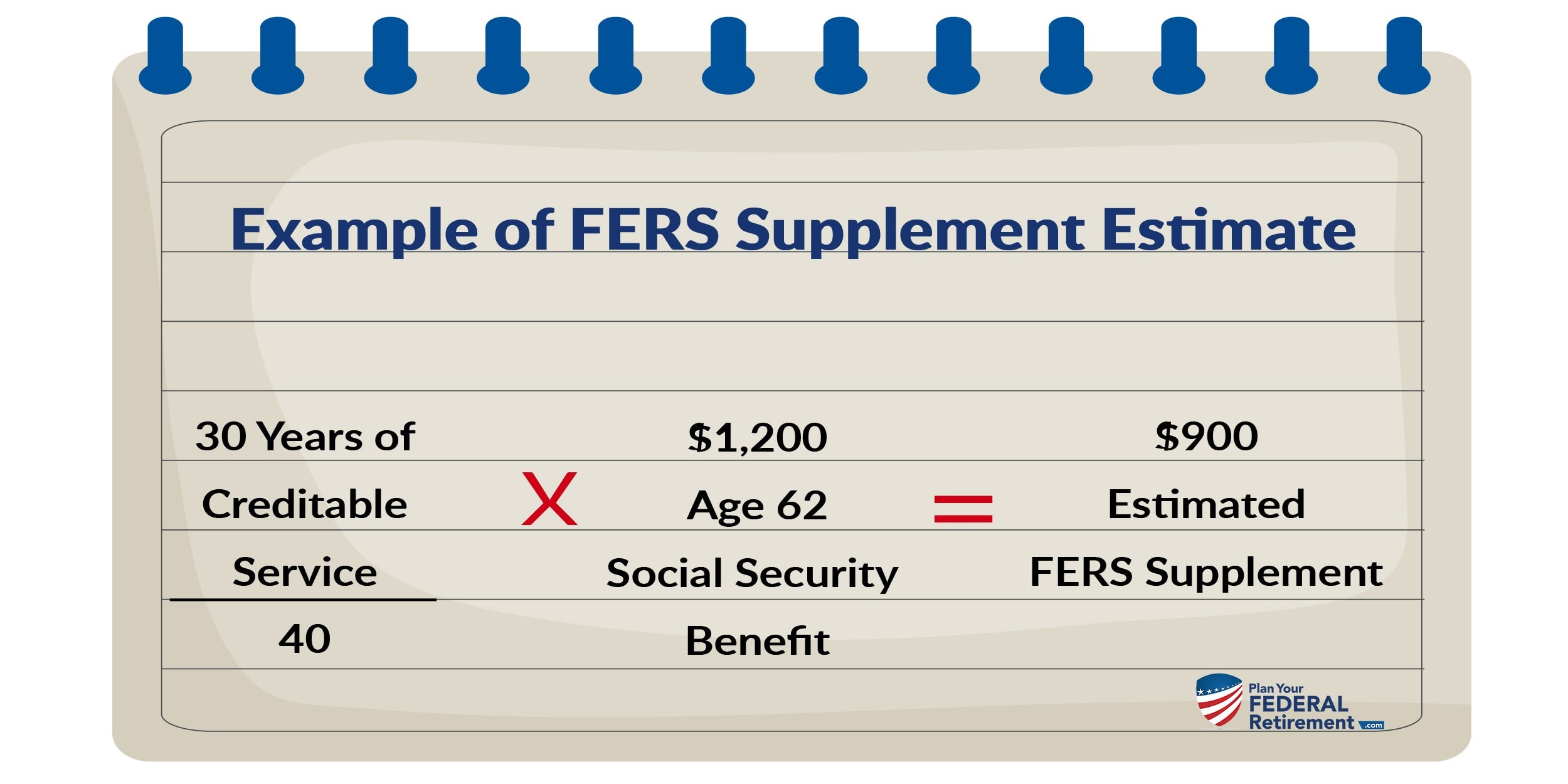

Say Jane is a FERS, and she will retire with 30 years of creditable service. She has reached her MRA, which is 57. And her age 62 Social Security benefit will be $1,200 a month.

Approximately how much will her FERS Supplement be?

Well, we take 30 years of service divided by 40 (30/40) = .75 Now take .75 times $1,200 (her age 62 SS benefit) = $900.

So Jane’s Supplement will be approximately $900 a month. And she’ll receive this supplement once she retires and up until the month she turns 62.

But we’re not done quite yet.

That is an estimate of the gross amount, but what is the approximate net amount Jane will receive?

Will Jane’s Supplement be subject to any reductions? And will it be subject to taxes?<

Very likely. The government giveth, and the government taketh away.

Reduction in FERS Supplement

The Supplement is treated much like Social Security Income.

And if you take any Social Security income before your Full Social Security Retirement Age (Your FRA varies from 65 to 67 depending on the year you were born) your Supplement is subject to a reduction and possibly taxes.

If you will have earned income (ex: a part-time job) after you retire from Federal service, your Supplement may be reduced.

The reduction is significant and because the income threshold is so low, it will impact many FERS retirees. Especially FERS who plan to get another job, even a part-time job, after they retire from Federal service.

Back in the 1990’s, there were some big changes to the way Social Security was taxed. The government decided that they would reduce the amount of Social Security (and FERS Supplement) someone could receive before they reached their Full Retirement Age (for Social Security) and if they earned more than a certain amount. These changes continue to impact the FERS Supplement today.

In 2019 the earnings limit is $17,640

What counts toward that limit? Earned income – which is essentially any income you receive as a W-2 wage. So if you earn more than $17,640, your FERS Supplement will be reduced. For every $2 you earn above the limit, your FERS Supplement will be reduced by $1.

Here’s How the Reduction Works –

Let’s go back to our example with Jane. Say Jane gets a part-time job after her federal retirement. That job pays her $30,000 a year, which is $12,360 over the income limit.

Half of $12,360 is $6,180, which is her annual reduction. Divide that by 12, and we get a reduction $515 a month.

Earlier, we estimated Jane’s Supplement to be $900 a month. Once we factor in her reduction, we see that Jane’s Supplement will really be closer to $385 a month.

But we have one more hurdle before we really know what Jane’s net amount will be. Taxes…

Taxes and the FERS Supplement

When we discuss the Supplement in the FERS Pre-Retirement classes I teach, some people think, “If the government already reduced my FERS Supplement – surely they won’t tax it too.”

Well – they can – and they do.

While the reduction in the FERS Supplement is calculated by the Social Security reduction rules; the way the FERS Supplement and Social Security are taxed is different. While the majority (but not all) of your Social Security income will likely be subject to tax; ALL of your FERS Supplement will be subject to ordinary income tax.

Looking at Our Example…

Going back to our example with Jane – she has a part time job that pays her $30,000 a year. In our example, her Reduced FERS Supplement was approximately $385 a month. Taxes are complex, but for the sake of easy numbers let’s say she pays taxes at a rate of 15%. 15% of $385 would be $58, leaving Jane with a FERS Supplement of $327 a month.

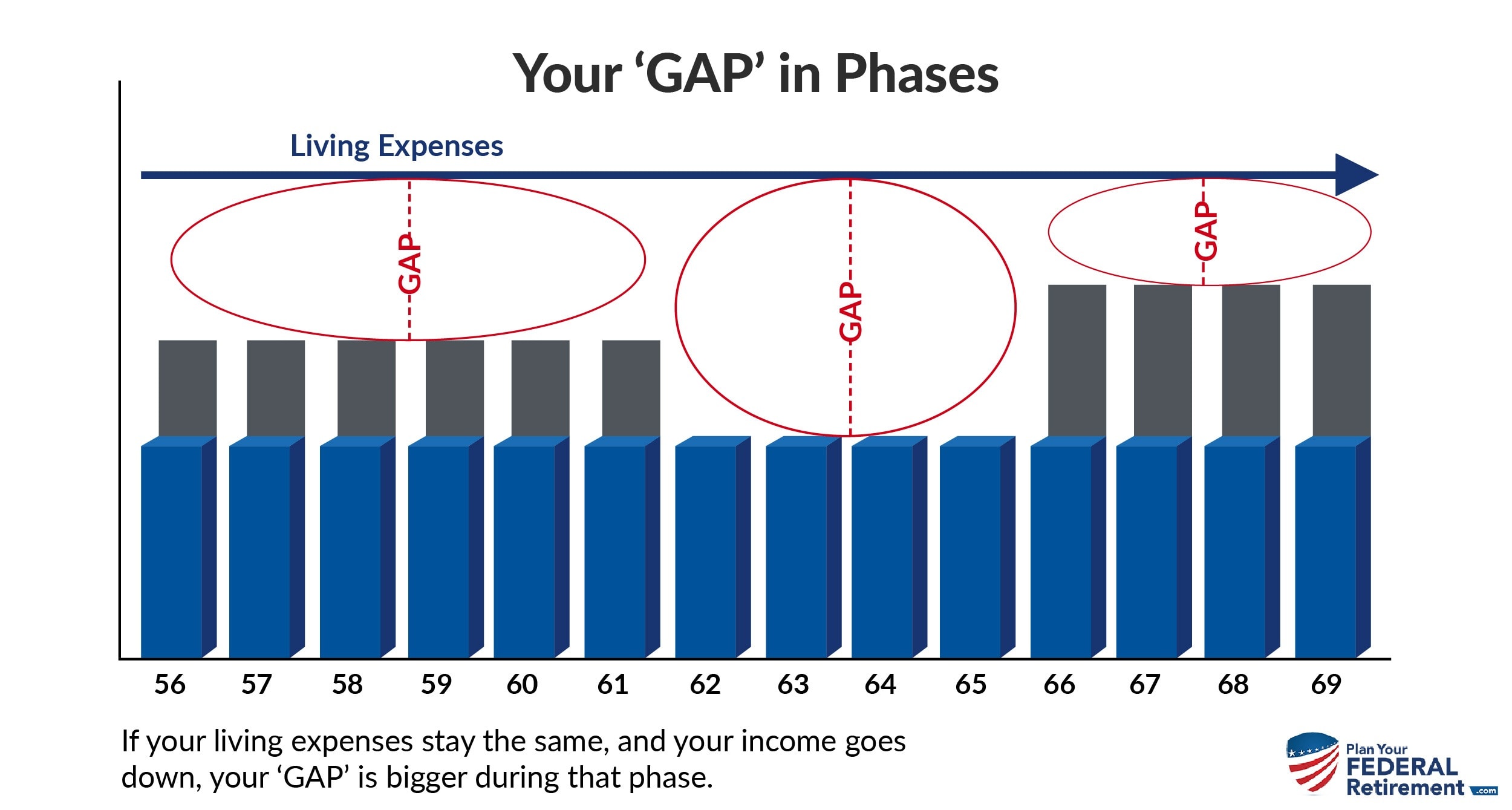

Mind the Gap: FERS Supplement to Regular Social Security

The FERS Supplement will stop the month you turn age 62. And it stops whether or not you have started drawing Social Security at age 62.

Some people may choose to start drawing Social Security at age 62 – but others will want to delay until later.

Why delay? The longer you wait, the higher your benefit will be. That is, up until age 70. The amount will not increase if you wait any longer than age 70 to draw Social Security.

But if you delay drawing Social Security to get a larger benefit – it means you have to go that many more years without the monthly benefit.

This can create a money gap – and it’s important to plan ahead for it.

Everyone’s personal financial situation is unique – so you’ll want to carefully weigh your financial plans to see when it makes the most sense for you to start drawing Social Security.

This is just one of the things I help my clients with. You can click here to find out more about how I help my federal employee clients.

Are You Retiring Before Age 62?

If you’re thinking about retiring soon, you need to make sure you’re getting the most out of your federal benefits. Sometimes people retiring early miss out on important benefits because they didn’t understand all their options. Make sure you understand your benefits *before* you retire.