“Can I be on the safe side to estimate my retirement deductions for FEHB, and Life Insurance by using the amount that is being deducted now?” – Paul

Preparing for Retirement

A few years before you are ready to retire under the Federal Employee Retirement System (FERS) a lot of time is spent preparing. When we meet with clients that have finally reached a point in their career where retirement is no longer a “thought” but reality, they are eager to ensure they have everything in order.

For most people, you only retire one time. You want to ensure that when you are really ready to be done working that you have thoroughly strategized how you will continue to maintain your lifestyle in retirement.

When we visit with Federal Employees, more times than we care to admit we have to break the news that in all of their planning they forgot about some really important key factors.

Most federal employees that we have met overestimate their FERS Pension.

As a working Federal Employee you receive your pay bi-weekly. But in retirement, your pension will arrive on a monthly basis. This is important to remember. Any deductions or withholdings you were making on a bi-weekly basis will have to be adjusted for monthly.

We are going to address Paul’s question in this article and some key components that we do not want you to forget about when estimating your FERS Pension.

Calculating your FERS Pension

The Office of Personnel Management (OPM) refers to your pension as an “annuity”. For clarity, when we talk about your monthly retirement income we will always call it a pension because – that is what it is. Annuities can have different meanings in the world of finance and we want to always provide you with absolute clarity so that there is no confusion whenever we can.

Throughout your working career, you have most likely had a vague idea that your pension is calculated by your years of service and some multiplication of your “high three”.

To estimate what your FERS Pension may be in retirement, you will want to know:

- Your Retirement Service Computation Date,

- Your Hi-Three,

- Your multiplication factor.

The Retirement Service Computation Date (RSCD) is NOT the same as the Service Computation Date (SCD). Your SCD is used to estimate the amount of sick leave you are eligible for. Your RSCD is used to estimate your retirement eligibility. You will want to contact your HR for your RSCD. This is typically done when you request a FERS Benefits Estimate. You will use this number to determine the number of creditable years of service that you have. Take the date that you want to retire in and subtract it from the date of your RSCD. This will show you how many years, months and days of creditable service that you may have under FERS.

The next factor to look at is known as your “Hi-Three”. This is the three consecutive years over your working career in which your base salary was the highest. For most Feds retiring under FERS, this is the last three years of their career; but it could be different for you.

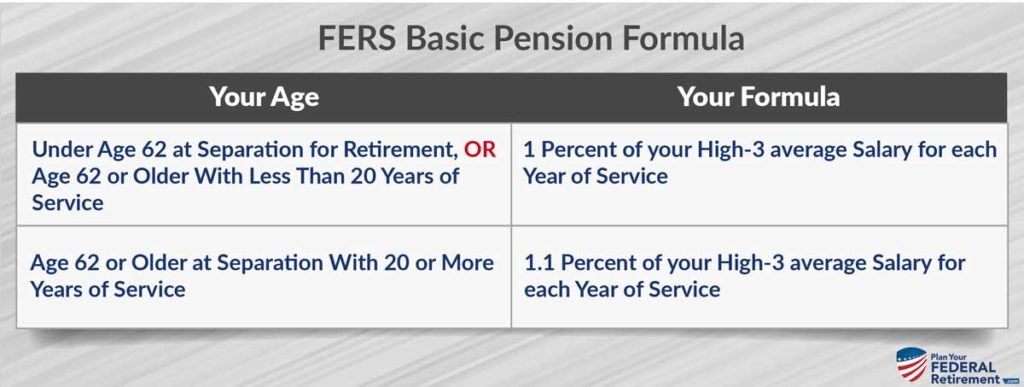

Using your age at retirement, your RSCD and your Hi-Three you are now ready to compute your FERS Basic Pension using this formula:

Special Provisions FERS Pension

Special Provision for Air Traffic Controllers, Firefighters, Law Enforcement Officers, Capitol Police, Supreme Court Police or Nuclear Materials Couriers are all considered special provisions and therefore, their formula and retirement eligibility dates will be different:

- 1.7% of your high-3 average salary multiplied by your years of service which do not exceed 20, PLUS

- 1% of your high-3 average salary multiplied by your service exceeding 20 years

FERS Pension: Gross v. Net

Once you have computed your FERS Pension using the above formula do not get too excited.

The number that you computed is going to be your gross number. That is before any deductions have taken place. If you are basing your retirement off of your FERS Benefits Estimate, make sure that you are taking into consideration that you will receive the net – not the gross.

Your FERS Pension will have several deductions taken out of it before you receive the Net.

- Survivor Benefits,

- Federal Employee Health Benefits,

- Tax Withholdings,

- Federal Employee Group Life Insurance (FEGLI)

- Dental Insurance.

Survivor Benefits – 10% of Your Pension

If you are married, your FERS Pension benefit will be reduced for a survivor benefit.

If you do not plan to leave a survivor annuity you must deliberately request that your pension not be reduced AND your spouse has to consent to your election of less than a full survivor annuity. This applies to all legally married couples regardless of separation or not.

If the total of the survivor benefit(s) you elect equals 50% of your benefit, there is a 10% reduction in your annuity. If the total equals 25%, the reduction is 5%.

For your spouse to continue to receive FEHB in retirement, if you pass, they must receive a survivor pension.

Federal Employee Health Benefits Deducted from your FERS Pension

When you retire from the Federal Government and have met the eligibility requirements to maintain FEHB in retirement, the premium that you pay will be deducted from your FERS Pension.

“To continue your health benefits enrollment into retirement, you must: (1) have retired on an immediate annuity (that is, an annuity which begins to accrue no later than one month after the date of your final separation); and (2) have been continuously enrolled (or covered as a family member) in any FEHB Program plan (not necessarily the same plan) for the five years of service immediately preceding retirement, or if less than five years, for all service since your first opportunity to enroll.” (opm.gov)

If you are wondering how the Office of Personnel Management (OPM) will know that you are eligible for the continuation of FEHB in retirement – your Human Resources department will inform them.

When your HR audits your Official Personnel File, they will complete the necessary paperwork to notify OPM that you met the eligibility requirements. This is transferred with your Retirement Application to OPM.

Your premium payments for FEHB will be deducted from your pension check.

Your FEHB Premiums that you paid while you were working, were made on a pre-tax basis. When you retire, your FEHB Premiums are on a post-tax basis. Tax planning is critical and this is another key factor in planning your retirement that you need to calculate.

Tax Withholdings on your FERS Pension

When you are planning for retirement all members of your family should be involved – or think they should be – like your dear Aunt IRS.

But do not worry, she at least wants to keep things simple when it comes to your retirement so she uses a “simple” formula to calculate the taxable portion of your pension.

While working, you put a little money in for what would, at retirement, become your pension and your employer put a little in too. These contributions were all put into whichever retirement system that you as an employee fell into FERS, CSRS-Offset or CSRS.

When you start to receive your pension income under FERS, you are allowed to exclude the portion of the monthly benefit that is attributable to your after-tax contributions.

To know which portion of your FERS pension is tax-free, the IRS takes the entire amount that you contributed over your working years on a post-tax basis and this is called your “total investment”. OPM provides the IRS with this number while processing your retirement.

Next, the IRS will take the number of monthly payments that you are expected to receive; you will see this as the “total months”. This is based on your age at retirement and what survivor elections that you made when you submitted your retirement application to receive your FERS pension.

The formula that the IRS uses to calculate the non-taxable portion of your FERS pension is to take the total investment and divide by your total months. This formula provides the tax-free portion of your FERS pension in retirement.

Paying for FEGLI and other benefits in retirement, deducted from your FERS Pension

While you are employed, the benefits that you enrolled in like the Federal Employee Group Life Insurance (FEGLI) were deducted from your paycheck every two weeks.

This salary deduction to pay for insurance premiums continues when you receive your FERS pension if you have elected to continue coverage in retirement.

Keep in mind though that your FERS pension check will only be deposited once a month; not twice. Instead of the premiums being deducted twice, in smaller amounts, you will have one deduction.

Soap Box Alert: We work with a lot of Federal Employees who are retiring under FERS. So does your HR. The difference is that when we work with our clients we are developing a comprehensive financial plan that takes into consideration the entire scope of their families, carefully evaluating their specific needs. Your HR processes a lot of retirement applications and can tell you a tremendous amount of information on HOW to process your application but they cannot and should not provide you with financial advice on which elections to make.

One of my clients, Bob, had filled out his retirement application with our office – we always like to help our clients complete the form to ensure it has a second set of eyes on it before being processed – and had made the elections for FEGLI as it was appropriate for Bob and his family. We had been trying to get life insurance on Bob for years but it was cost-prohibitive and in some cases, he had even been denied coverage. If he predeceased his wife, Susan, the family would have to make some rather significant life decisions on how they would be reducing their lifestyle to live off of 50% of Bob’s pension. Not the position that we want any widow to be in.

We maintained Bob’s FEGLI to provide coverage with a 25% reduction only while he was in retirement. Bob’s HR person saw this election on his retirement application and decided not to process it and instead call Bob and say,

“Hey this isn’t what I see most applications choose. Most FERS take a 75% reduction on FEGLI when they retire. If you change your application, your FERS Pension will increase by $200 a month.”

By all accounts, the HR person was trying to help Bob. The problem is that the HR person did not understand Bob’s personal financial situation and was providing advice that would have a detrimental permanent impact on Bob’s family.

You are responsible for your retirement, not your HR.

Oh, and yes – if we were able to place private insurance on Bob we could later go back and reduce his FEGLI coverage in retirement and his pension would increase. Strong emphasis: IF. FEGLI increases significantly over time as you age but if it is the only life insurance coverage that you can get, and you need the coverage, then do not be too hasty to terminate it for a little extra income in your FERS Pension.

FERS Pension Deductions

Paul, I hope that you found this article on what deductions you need to consider on your FERS Pension to be of help.

When determining your FERS Pension amount keep in mind that the gross benefit is the calculation often seen but your retirement spending is based on your net calculation.

Deductions from your FERS Pension can include:

- Survivor Benefits,

- Federal Employee Health Benefits,

- Tax Withholdings,

- Federal Employee Group Life Insurance (FEGLI)

- Dental Insurance.

Congratulations on your future retirement, Paul, and if you know someone that can benefit from reading this article – SHARE!

We are passionate about helping Federal Employees navigate the complexity of their retirement. That’s why you might want to check our 7 Retirement Mistakes.

Federal Employees Make Mistakes

But YOU Don't Have To

- Forgetting to Check Your Beneficiary Designations

- Expecting Pension Check to Arrive in 30 Days After Retiring

- Not Knowing the Difference Between SCD vs. RSCD

- Completing Retirement Paperwork Incorrectly

- Failing to Prepare Financially for Retirement

- Failing to Understand Tax Consequences

- Getting Bad Advice

Click below and learn how to avoid making them yourself