Retirement tax planning is hands down one of our favorite topics to discuss at Plan Your Federal Retirement! Not only does talking about tax planning in retirement make us the most sought-after dinner party guests but it also allows us to debunk a lot of myths about how your taxes will be impacted when you retire.

Darrin asks a wonderful question about how he experienced MORE taxes than he was prepared for when he retired from Federal Service.

His question highlights several areas that most Federal Employees forget about when they retire from the federal government. In this article, we are going to answer Darrin’s question about taxes in retirement and also give you, as a Federal Employee, strategies so that you do not end up in a similar situation as Darrin and so many other Feds do.

How much of my FERS pension is taxed?

95% to 98% of your FERS Pension is taxable when you retire. The only portion of your FERS Pension that is non-taxable, are the contributions that you made while working. Generally, contingent on your agency, a FERS employee’s contributions to their pension are between 2% and 5% of their gross pension. That means, the remaining percentage of your pension is taxable.

Pensions that are funded by an employer are taxed as ordinary income.

When you retire from Federal Service, most employees keep their withholding allowances the exact same as when they were working.

When your retirement application is processed by the Office of Personnel Management (OPM), they look at your pension income and make the withholdings. However, and this is critical to keep in mind, OPM is only seeing YOUR pension income.

Income that OPM does not see can include things like,

- Other employment,

- Your spouse’s income,

- Rental income,

- Investment income,

All of which can impact your income taxes.

If you would like to change the amount of taxes withheld from your FERS Pension you must complete a W-4P form. You can find the form to change your income taxes withheld from your pension here, www.servicesonline.opm.gov

How do I know what my taxes will be in retirement?

MYTH: When I retire, my taxes will be lower.

We have spent decades preparing clients that when they retire, their income taxes may not go down. There are several factors that you need to take into account when thinking that your income taxes will be lower like,

- Are you going to have other income from working with another employer?

- Are you going to have investment income?

- Is your spouse going to work full or part-time for another employer?

- Am I going to move when I retire to a State that has an income tax? There are 42 states and many localities in the United States that impose an income tax on individuals and only 8 states to-date that do not.

- Will tax legislation go into effect that increases taxes for individuals?

Keep in mind that in the United States we have a progressive tax system.

Progressive Taxes

A progressive tax system means the more money that you earn the more taxes that you pay. In the United States of America, we have a progressive tax system.

Your income taxes are based on what the government determines as your ability to pay. The less money that you earn, the less your income taxes. The more money that you earn, the more you pay in income taxes.

As a Federal Employee, you need to keep in mind how much of your retirement income will be taxable,

- Your FERS Pension is Taxable in Retirement

- Your Traditional TSP is Taxable in Retirement

- Your Social Security Benefits are Taxable In Retirement

Additionally, if you are married, such rules could also apply to your spouse’s pension, investments, and social security.

It is critical to work with a financial planner who takes your specific benefits as a Federal Employee, understanding how many of them were tax-deferred during your working years, and incorporates them into a 5-year tax plan minimally.

When we work with our Federal Employee clients, we try and develop a 5-year tax planning strategy that looks at what their liabilities are today, what if anything can be done to reduce them, and whether or not it makes financial sense for them to do ROTH Conversions to try and mitigate some of their burden in the future.

Make sure that you are doing the same! If you work with a Financial Advisor that you love, make sure this is part of your financial plan. If you’re not working with someone, let us know and we would be happy to see if we are the right fit for your planning needs.

Marginal vs. Effective Tax Rates for Retirees

There are two tax brackets as a Federal Employee that you should be aware of: marginal vs. effective.

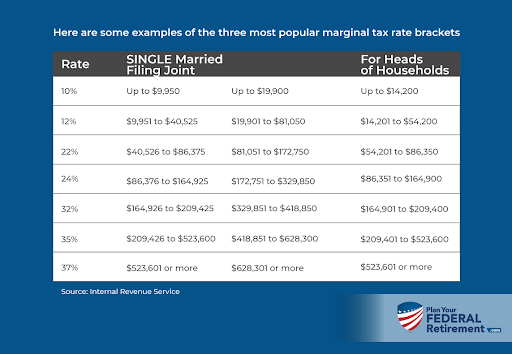

Marginal tax rates put all of your income into “brackets” according to your tax filing status. Your tax filing status is Single, Married Filing Joint, Married Filing Separate, Head of Household and Widow(er).

Here are some examples of the three most popular marginal tax rate brackets:

What marginal cannot take into account are your deductions. Marginal is a great “wag” at guessing what you may owe in taxes but it doesn’t get down into the nitty-gritty of tax math.

That job is reserved for effective tax rates.

EFFECTIVE TAX RATES

The effective tax rate is the average rate at which your earned income, such as a pension, wages, and unearned income is taxed. The effective rate is determined after your individual considerations have been made.

You can review your effective rate on your former years’ tax return. Adjust your pension to withhold at your effective rate.

A good strategy, if you’re looking to retire, is to review your effective tax rate for last year. You can make adjustments to your W-4P according to what your effective tax rate was.

In our experience, the first 3-5 years a Federal Employee retires can be a little tricky to estimate precisely what the taxes are going to be. That is most often attributed to the Fed not knowing if they’re going to work in the private sector some in retirement or how much they are really going to withdraw from their Traditional TSP or other, tax-deferred investments.

Tax planning, having a good 5-year strategy in your financial plan built out on how you’re going to handle taxes is a critical aspect for anyone retiring under FERS.