The SF 50 is the official form the government uses to determine your retirement eligibility and to calculate your federal retirement pension.

If there is a mistake or a typo on an SF-50, it will affect your federal retirement. Or if one of your SF-50s didn’t make it into your OPF, Official Personnel File, or got lost along the way – that time may not be credited towards your retirement. (And it happens more often than you would think!)

Your SF 50s are the only form of proof you have that you actually worked during a certain period in time. Paystubs or an LES don’t officially count.

In all my years of working with my federal employee clients – this is an issue that comes up frequently. Having a solid record of SF 50s is important for a successful retirement. In fact, it’s a formal part of our financial planning process with our clients. Having the wrong creditable service is such a critical issue that we review our clients SF50s together to make sure everything is in order.

Let’s talk more about what the SF 50 is, what it means to your retirement, and what you need to do with it.

What is the SF50?

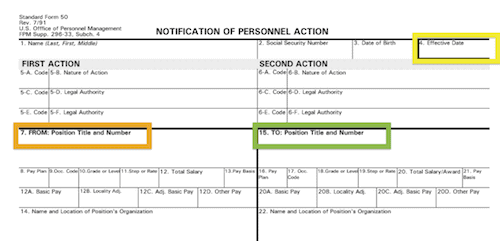

The SF-50 (Standard Form 50) is officially called a “Notification of Personnel Action.”

You should receive an SF 50 any time you had an increase in step, grade, pay or a change in jobs. On each SF 50, there is a “FROM” section that will detail your job and pay as it was before the change. Then the “TO” section will show your job and pay details as they are after the change.

You should receive at least one SF-50 a year, typically in January. But you may receive several in a year, if you have other changes in your job.

The box highlighted here in yellow is Block 4, the Effective Date of this SF-50.

The orange box on the left is the “FROM” section. Details about your job and pay as it was before the change made on this form.

The green highlight box on the right is the “TO” section. This has details about your now current job and pay info from the date of this SF 50, until another SF 50 is issued.

What Sort of Information is On Your SF50?

Your SF 50 has important information about your job and pay that affects your federal retirement.

It makes sense to do a quick once over each time you get an SF50 to make sure everything is correct.

Pay extra attention to these blocks:

Blocks 9 & 17: Special Provisions employees should pay extra attention to these codes (read “How a Typo Delayed His Retirement below…)

Blocks 12C & 20C: These are the numbers OPM will use to calculate your High-3 Salary

Block 30: Retirement System – make sure this is correct. If you are a FERS and you see FICA or FICA ONLY – that time is not being counted towards your federal retirement.

Block 31: This is your SCD… but remember, this is NOT the date OPM uses for your pension calculation. Your RSCD is the date that is used, and that does not appear on your SF 50.

Do You have ALL of your SF-50s?

Throughout your federal career, you’ve received numerous SF-50s.

Some people have kept each form. But I’ve met lots of federal employees who just threw their SF-50s away because they didn’t realize how important they were.

Either way, before you file your federal retirement paperwork, you’ll want to make sure you have a copy of *every* SF-50. Why?

Let me share a story two stories with you…

How a Typo Delayed His Retirement

One of my clients called me about a co-worker’s situation. We’ll call his co-worker Bill (that’s not his real name).

Bill was looking forward to retiring as soon as he was eligible. He picked a retirement date and filed his paperwork a few months in advance. Then he started counting down the days until his federal retirement. But a typo on one of his SF 50s would throw a monkey wrench in his plans.

About a month before his planned retirement date, Bill’s HR called. They told him he was not eligible to retire. When HR reviewed his file, they found that one of his SF50s indicated that about 6 months of his time was not creditable for retirement. Bill would need to work an extra 6 months before he would be eligible to retire.

But the problem was… Bill *was* eligible to retire, if it weren’t for that typo on his SF50. He even had pay stubs to prove he was paying into the retirement system during those 6 months.

But Bill was told that pay stubs don’t count. What counts is what’s on your SF50.

My client called to ask if I would help Bill, since he knew that I had helped other federal employees with creditable service issues. I said I would be happy to talk with Bill… but Bill never called.

I found out later that it took Bill quite a while to get things straightened out. Bill ended up delaying his retirement about a month in order to get things resolved.

This is why it’s important to review your SF-50s now, so if you find an issue you have plenty of time to deal with it.

Happy Ending: She Had ALL of Her SF-50s

In addition to making sure that your SF-50s are correct, you want to make sure that you have a copy of ALL of your SF-50s. Why?

I had a client retire after 32 years of federal service under CSRS. A few months after she retired, she got a letter from OPM.

In the letter, OPM said that after reviewing her file, they found she only had 28 years of creditable service (instead of 32 years). The letter said she was not eligible to retire, her pension checks would stop (they actually hadn’t even started yet) and she was required to go back to work.

She called me as soon as she got the letter. Fortunately, she had a copy of every SF-50 she had ever received.

We got on the phone with OPM and found out that they were missing 4 years of SF-50s. (it turns out those years were where she had changed agencies) We were able to send OPM a copy of her SF 50s, she got proper credit, and was able to stay retired.

What do you think would have happened if she didn’t have a copy of those SF-50s?

What If You Don’t Have ALL of Your SF-50s?

If you know that you don’t have all your SF-50s, it’s important to start tracking them down now.

First, request a copy of your OPF from your HR department, that should have all or most of your SF-50s. And as long as you’re getting a copy, make sure you get a copy of EVERYTHING in your OPF.

Once you have a stack of your SF 50s, put them in chronological order, by Block 4, the Effective date. I recommend starting with your first/earliest SF-50s at the top of the pile, with your most recent SF-50s at the back of the pile.

Then review them for the Three C’s…

Reviewing your SF-50s: The Three C’s…

Take your stack of SF50s and put them in order by date. Then look at each form for the three C’s…

*Correct – does every thing look correct? Any typos?

*Creditable – is the service described creditable… does it count towards retirement?

*Continuous – do you have any breaks in service, or gaps in your SF-50s?

The SF-50 is a unique form. It does not have a ‘from’ and ‘to’ date on each form. Each form only has an ‘effective date’.

On the form, the SF-50 will show your ‘old’ job information in the “FROM” section. Then the form declares that ‘as of this date’ (the effective date) – here is what is now current by listing out your new information in the “TO” section.

How do you tell if you have continuous forms? Look at the information in the “TO” section of the form you’re evaluating. You’re going to compare this block of items to the “FROM” section of your next chronological SF-50.

All of the information, right down to the dollar amount of your pay needs to match on the “TO” section of one SF-50 to the “FROM” section of the next.

If they do match up, you can be 99% sure that you have consecutive SF-50s. If they do not match up – there is a problem.

Don’t Wait To Review Your SF-50s

Ideally, you’ll review each SF-50 when you get it. It’s so much easier to catch any typos or errors when the information applies to your current situation.

Although, if you’ve never reviewed your SF-50s, now is a better time than never.

While this review may be tedious – it is very important.

Believe me, it’s worth it to spend twice as much time doing this process correctly than half as much time and missing something. 🙂

If you are missing a form, or there is a typo, you want to give yourself as much time as possible to get it corrected. Make sure you get it corrected before it impacts your federal retirement plans.

Polite Persistence Pays Off

I’ve helped many clients get situations resolved with their HR departments.

Many times clients come back and tell me that their HR said “no” to something. But when I contact their HR directly and explain the situation, we get quite a bit cleared up.

At most agencies, HR is overworked and understaffed. And they have unbelievable number of things that they’re responsible for. Once we can bring the right information to light, we all see the situation clearly.

Remember to be polite, but it’s your retirement. If you’ve worked the time, you deserve to have it count towards your retirement.

If you’re interested in personal help, click here to learn more about scheduling a federal retirement personal consultation.

Has Anyone Ever Told You How Important Your SF 50s Are?

Did you learn something new? Most federal employees have no idea how important it is to review their SF 50’s.

If you’re thinking about retiring soon, you need to make sure you’re getting the most out of your federal benefits. Sometimes people retiring early miss out on important benefits because they didn’t understand all their options. Make sure you understand your benefits *before* you retire.

Federal Employees Make Mistakes

But YOU Don't Have To

- Forgetting to Check Your Beneficiary Designations

- Expecting Pension Check to Arrive in 30 Days After Retiring

- Not Knowing the Difference Between SCD vs. RSCD

- Completing Retirement Paperwork Incorrectly

- Failing to Prepare Financially for Retirement

- Failing to Understand Tax Consequences

- Getting Bad Advice

Click below and learn how to avoid making them yourself