#146 The COLA Mirage: Why Inflation Is Quietly Shrinking Your Retirement

Listen to the Full Episode: Inflation doesn’t always show up loudly, and for many federal employees and retirees, the biggest danger is assuming COLA will protect their retirement income. In this episode of the Plan Your Federal Retirement podcast, Micah Shilanski, Managing Partner, Wealth Advisor, and Luke Eberly, Wealth Advisor, break down the “COLA […]

Does the Earnings Limit Still Apply When Your Supplement Stops at 62?

Real Question from a Federal Employee I’m currently retired from the postal service and have been receiving postal supplements. At the age of 61. I will be working full time. I will be over the allowed reduction amount. However the same year I will turn 62. So my question is since my supplement stops at […]

#145 Longevity vs. Living Today: The Retirement Balancing Act You Should Know

Listen to the Full Episode: Retirement isn’t just about making your money last, it’s about using it wisely while you still can. In this episode of the Plan Your Federal Retirement podcast, Micah Shilanski, Managing Partner, Wealth Advisor, is joined by his father, Floyd Shilanski, Managing Partner, Wealth Advisor, to unpack one of the […]

Social Security: What YOU Need to Know

https://youtu.be/9Msn-e86wL8 Social Security is one of the most talked about and misunderstood parts of retirement planning. For many federal employees nearing retirement, online discussions, headlines, and casual advice can create confusion or unnecessary worry. Understanding what’s true and what’s not can help you make smarter decisions about your benefits. Common Questions Federal Employees Ask It’s […]

#144 Finish 2025 Strong, Start 2026 Smarter: Federal Retirement Planning

Listen to the Full Episode: As the year closes, federal employees can’t afford to miss critical planning opportunities that protect their retirement and avoid costly mistakes. In this episode of the Plan Your Federal Retirement Podcast, Micah Shilanski, Wealth Advisor, and Luke Eberly, Wealth Advisor, break down real-world, end-of-year action items they are actively […]

Social Security: The Bridge Strategy!

https://youtu.be/9rU64rw2cbU When you hear the word “bridge,” you probably picture the Golden Gate or Brooklyn Bridge, not your retirement income. For federal employees, though, a bridge strategy can be a valuable way to help make sure you don’t outlive your money and to make better choices about when to start Social Security. A bridge strategy […]

#143 Tax-Saving Strategies for the Year-End: What You Need to Do Now

Listen to the Full Episode: A year-end retirement review can be a valuable step for federal employees who want to better understand their benefits and financial positioning heading into the new year. In this episode, Micah Shilanski, Managing Partner and Wealth Advisor, and Floyd Shilanski, Managing Partner and Wealth Advisor, discuss key planning areas […]

Viral Finance: Should You Trust Trends?

https://youtu.be/aXGJ0TL-QC4 From Magazines To TikTok Financial “trends” are nothing new; only the platforms have changed. Decades ago, investors chased the latest ideas from glossy money magazines and weekly newsletters, often reshuffling mutual funds or allocations every time a new “must-do” strategy hit the stands. Today, viral videos, short reels, and flashy social posts have taken […]

#142 Year End – What Planning You Need to Do

Listen to the Full Episode: Year-end is one of the most strategic times for Federal Employees to review their financial picture, retirement timeline, and tax exposure. In this episode, Micah Shilanski, Managing Partner and Wealth Advisor, and John Raleigh, Wealth Advisor, walk you through the essential steps you consider taking before December 31st to […]

Is YOUR Social Security Taxable?

https://youtu.be/xIjeO–32Lc Most federal employees are surprised to learn that up to 85% of their Social Security benefits may be taxable in retirement. In this episode, Floyd Shilanski, Wealth Advisor, explains how Social Security taxation works, what counts as “provisional income,” and why proper planning is essential to avoid unexpected tax bills. This is a critical […]

FERS Pension Going Down in 2026

https://youtu.be/M_e4Sfc8vvk We’re all feeling the impact of inflation. Groceries, gas, utilities… everything costs more. Unfortunately, federal retirees may soon feel it even more directly. For many, their FERS pension income will actually go down in 2026. Let’s break down why that’s happening and what you can do about it. Rising Health Insurance Costs Hit Hard […]

#141 Furloughed! What Federal Employees Can Do When Paychecks Stop

Listen to the Full Episode: In this episode of Plan Your Federal Retirement, Jamie C. Shilanski, RFC®, talks about one of the most stressful situations federal employees face: a furlough. Whether this is your first or fifth time experiencing one, Jamie breaks down practical, real-world strategies to help you stay financially stable, protect your […]

Wait, FEHB Is Auto-Enrolling You in Medicare Part D? Here’s What You Need to Know

https://youtu.be/eMUJ7_5dMU0 Are Federal Employees Being Auto-Enrolled in Medicare Part D? If you’re enrolled in a Federal Employee Health Benefits (FEHB) plan that now offers Medicare Part D coverage, you might be automatically enrolled when eligibleeven if you didn’t actively sign up. The question our advisors at Plan Your Federal Retirement are getting most often right […]

#140 What Federal Employees Are Really Asking About Retirement

Listen to the Full Episode: Ever wonder what questions other federal employees are asking as they plan for retirement? In this special episode, we’re taking you inside our recent in-person workshop, where we spent the day with federal employees diving deep into their benefits, tax planning, and retirement strategies. From understanding the 2026 TSP Roth […]

Do Trusts Pay Higher Taxes on Inherited TSPs and IRAs Than Individual Beneficiaries?

Real Question from a Federal Employee I am a widow and own an inherited TSP from my husband. Currently, I listed our Living Trust as primary beneficiary for the TSP. From what I’ve gathered recently, the trust is taxed the highest at around 40%. If this is true, would it be better to designate my […]

Should I Stay Or Should I Go

Federal Employment has perhaps never been more uncertain. The Cross Roads When we visit with Federal Employees, we usually run into two groups of people. Group 1: A Former military member who is now having a second career as a civilian fed. Group 2: Someone who started Federal Service in their 20s and has stayed […]

Government Shutdown: What This Means for Your Federal Retirement

Feds are facing yet another extended furlough in 2025. A furlough is when an employer, in this case the federal government, places employees on an extended unpaid period of leave. A furlough occurs because funding for the work is not available. In this case, Congress has not approved a budget to keep non-essential workers employed. […]

How Should I Allocate My TSP For Retirement Security?

Real Question from a Federal Employee As I approach retirement, what are the safest and best TSP investment and allocation strategies, any suggestions? – Andrew https://youtu.be/L3ZI3aqat2k When it comes to retirement planning, one of the biggest questions federal employees face is: How should I allocate my Thrift Savings Plan (TSP) to make sure I don’t […]

#138 Money Can Hurt, Especially Kids With Money….

Listen to the Full Episode: When it comes to money, the emotional impact is often overlooked, but it can ‘make or break’ a family’s financial future. In this episode, Micah Shilanski, Wealth Advisor and John Raleigh, Wealth Advisor discuss how inheritances, sudden windfalls, and poorly managed gifts can end up causing more harm than good, […]

Is There a Limit on the Annual Leave Payout at Retirement?

Real Question from a Federal Employee What is the maximum amount of unused annual leave that I may be paid for when I retire? – Wayne https://youtu.be/G94W56yYayk As retirement gets closer, many federal employees start to wonder about their unused leave. One of the most common questions we hear is: “Is there a limit on how […]

#137 Medicare & FEHB: Your Blueprint for Retirement Healthcare Success

Listen to the Full Episode: Healthcare is one of the most important, and often most confusing, parts of retirement. For federal employees, the combination of Medicare and FEHB (Federal Employees Health Benefits) adds unique rules, costs, and opportunities. In this episode of Plan Your Federal Retirement, Micah and John break down the myths, penalties, and […]

Buy Back Military Time and Keep Retirement Pay, Is It Possible?

Real Question from a Federal Employee Hey, I am retired Air Force 22 years a combat injury related 100 % disabled veteran. I am working civil ServiceNow. I am going to retire after 15 years of civil service. Just found out about the military buyback. But I understand if I buy my military time back […]

#136 Maximizing Your Social Security: The Insider’s Guide

Listen to the Full Episode: Social Security is one of the most misunderstood parts of retirement planning. For federal employees and their families, it’s not about whether to take it early or late; it’s about how to coordinate Social Security with your pension, TSP, survivor benefits, and taxes. In this episode, Micah and advisor John […]

What Medicare Part B Covers That FEHB Doesn’t

Real Question from a Federal Employee Do I need Medicare Part B if I have FEHB? I find it hard to believe Medicare Part B covers something that my FEHB does not so please provide some specific examples of the “gaps” and “Medical Surprises” where my FEHB does not cover something and it is covered […]

#135 Your Last Year Before Retirement: The Ultimate Prep Guide

Listen to the Full Episode: Are you a year away from retirement? The final 12 months before you retire from federal service are some of the most exciting — and most critical — months of your career. This is when decisions get real, timelines matter, and small mistakes can cost you big in the long […]

Timing is Everything: When to Claim Social Security as a Federal Employee

Real Question from a Federal Employee What age can I start collecting Social Security retirement benefits? What is my full retirement age, and how does it change if I delay or file early? – Jerry https://youtu.be/6Pc7uC4uYXs For federal employees under the Federal Employees Retirement System (FERS), deciding when to claim Social Security benefits is an important […]

#134 Retirement Readiness: The Secrets to Knowing You’re Truly Ready

Listen to the Full Episode: What does real retirement readiness look like? In this episode, Micah is joined by his father and mentor, Floyd, to reveal the overlooked aspects of retirement planning that can cause major regrets later. Drawing from years of experience, they share essential insights on mental readiness, investment strategies, the Retirement Service […]

Approaching Retirement: How to Check If You’re Prepared

Real Question from a Federal Employee Hello, I have a question. I’m a few years out from retiremen, how can I be sure I’m financially ready to stop working when the time comes? What to consider? Thank you. – Gerald https://youtu.be/mx31kx4QZmc Federal employees working under the Federal Employees Retirement System (FERS) need to understand how […]

Changes in the Retirement Process

Listen to the Full Episode: Facing the New Challenges of Federal Retirement: What 2025 Means for You Federal retirement in 2025 requires thoughtful consideration of not only financial numbers but also personal readiness and changing workplace conditions. Recent shifts in policy and evolving job satisfaction levels mean that each federal employee’s retirement journey is unique […]

#133 Smart Retirement Planning in Volatile Markets: Cash Flow, TSP, and Taxes

Listen to the Full Episode: Are today’s market swings making you nervous about your retirement? You’re not alone but the good news is, there are steps you can take to feel confident and in control. Tune in and learn how to build a resilient plan with cash reserves & smart spending, avoid common tax mistakes […]

Are You Able to Combine State and Federal Retirement Contributions?

I have 2 years state retirement contributions, 10 years military (7 years federal 3 years guard). Can I combine state and federal retirement contributions? Do I have to be a current federal employee to participate in the buyback program? Can reserve military service retirement points be used? – Tee https://youtu.be/uZPgEHLDx1s Many people who have worked in […]

#132 Understanding How the Economy and Your Retirement Portfolio Are Related

Listen to the Full Episode: In this episode of the Plan Your Federal Retirement podcast, Micah Shilanski and Christian Sakamoto dive deep into the relationship between the economy and your retirement portfolio. Markets are unpredictable. Your retirement doesn’t have to be. Learn how the economy & your retirement portfolio work together. If you’re a federal […]

Does Retiring at the End of the Month Affect TSP Contributions?

Question about TSP matching Contributions.If I retire at the end of a month, which happens to be the middle of a pay period, do I still get matching TSP contributions? – Kenhttps://youtu.be/XUjumWtBQPc Many federal employees wonder if retiring at the end of the month will affect their Thrift Savings Plan (TSP) contributions. This is a […]

#131 The Government Is… What Can You Control?

Listen to the Full Episode: Is your financial plan ready for unexpected changes? In this episode, Micah and Jamie highlight the importance of taking charge during uncertain times. Discover how to manage emotional decisions, prepare for potential job changes, and build a flexible retirement income strategy. Learn how to focus on what you can control […]

Is It Possible to Suspend FEHB and Come Back Later?

Can I suspend FEHB in retirement then start it again later if my new (private sector) employer offers health coverage benefits that I’d like to take advantage of? – Michael https://youtu.be/7ersCh5L_oQ Federal retirees have access to the Federal Employees Health Benefits (FEHB) Program, which is considered one of the top health insurance programs in the […]

Can You Qualify for FEHB in Retirement by Returning to Federal Service?

I have 15 years of federal service and am 55 years old. I have only been in the FEHB for my most recent 3 years of federal employment. I want to leave federal service soon. If I want to retire with FEHB, could I do that by reentering federal service later on for a further […]

Protecting Your Pension: How to Spot a Scam as a Federal Employee

https://youtu.be/AH8GKsjrlSQ The more confident you are that you won’t be scammed, the more vulnerable you are. Scammed, Phished, Hacked, or Conned… isn’t just for the vulnerable population anymore. It’s happening with higher intensity levels than we have ever seen before. While there is never a “foolproof” method of avoiding being victimized, there are a few […]

Is It Possible to Access Your FERS Supplement Early?

Is it possible to request a waiver to access the FERS Supplement two years early? My wife has 32/33 years but only turns 55 in August. Thanks. – Fred https://youtu.be/CdXnpGn13o4 The Federal Employees Retirement System (FERS) Supplement is a valuable benefit for federal employees who retire before becoming eligible for Social Security at age 62. […]

#128 Why “Buy and Hold” Doesn’t Always Work?

Listen to the Full Episode: Is “buy and hold” really the best strategy for retirement investing? In this podcast episode, Micah and Christian explore why this popular approach might not hold up—especially in retirement. They explain how inflation, market downturns, and income needs require a more flexible investment strategy. You’ll learn to build a written […]

Can You Delay Your Annuity and Still Keep FEHB Coverage?

Thank you for your wonderful and helpful videos on postponed retirement. The one question I have remaining is – I understand that if I retire at MRA and 10 that I cannot take my annuity without penalty until I am 62. Is there an option to continue with health benefits at time of resignation and […]

#127 Avoiding Tax Traps: What Every Federal Employee Should Know

Listen to the Full Episode: Think you know how your FERS pension, Social Security, or military retirement will be taxed? Think again. In this episode, Micah and Floyd break down the tax pitfalls federal employees often overlook—like unexpected withholding issues, taxable income from multiple sources, and the impact of rental property depreciation. They share real […]

Transferring TSP to IRA: Withdrawal Rules

First, I have listened to your podcast for year,s and it has been a wealth of information. Thank you. Now for my question…I am a 54 year old federal law enforcement officer. I plan to retire in June after 33 years of service. My plan was always to transfer my TSP to an IRA so […]

#126 Choosing Your Perfect Retirement Date: The Ultimate Checklist

Listen to the Full Episode: What does retirement really look like beyond the financials? In this podcast episode, Micah and Floyd discuss what life is like after retirement, focusing on more than just finances. They cover essential topics such as planning your daily routine, staying active, considering relocation, and having conversations with your spouse. The […]

Keeping Health Costs Low in Retirement: FEHB or Medicare Part B?

I’m 65 now, still working usps, when I retire in 1 to 2 years, I’m interested in keeping monthly health insurance down. Is it more cost effective to keep fehb only, or get Medicare part b. I know best would be both, but I want to keep monthly cost low. – Damian https://youtu.be/nOHQqhAzBV8 As a federal […]

MARKETS ARE FALLING! – What are YOUR rules on investing?

https://youtu.be/RGaefOcEvEw Every Investor should have their “Rules on Investing” in place for times of “market volatility and turmoil.” Times like this, I am often reminded of the old adage: The first rule of investing? Don’t lose money. And the second rule? Don’t forget the first. Those words, famously attributed to Warren Buffett, are echoing a […]

#125 Tax Time Survival: How Federal Employees Can Get Ahead

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah and Christian break down essential tax planning techniques, including the importance of estimated tax payments, understanding tax brackets, and how to avoid common pitfalls. Discover how proactive tax planning can […]

Preparing for Postponed Retirement: What You Need To Do?

Yes, good morning. Jeff here, wondering about having a postponed retirement. When the paperwork needs to be filled out, if I want to start that postponed retirement 2 years from now and I am actively working for the government now, when I walk out the door, if I do not have all that paperwork already […]

#124 TSP Benefits: What You Need to Know Before Retiring

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can significantly impact your financial future. In this podcast episode, Micah and Tammy delve into important topics regarding TSP withdrawals, available distribution options, and the associated tax implications. They provide insights […]

How to Calculate Your Annual Leave Payout When Retiring

Good morning, my name is Alberto. I am a Mail Handler for the Postal Service with 40 years of service. Currently, I can carry over 520 hours of annual leave into 2024. I am planning to retire in December 2025. If I don’t use any annual leave in 2025, I will accumulate an additional 208 […]

#123 TSP Withdrawals: When, How, and Why to Start

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down the three financial phases: accumulation, preservation, and distribution, highlighting the critical decisions federal employees need to make when withdrawing from the TSP. Learn about the different withdrawal options, including lump […]

I Passed On The Fork… Now What Do I Do?

https://youtu.be/-lxMYExTiGQ The Road Not Taken: What Happens When Federal Employees Make (or Avoid) Big Decisions. Understanding Federal Retirement Options: Deferred Resignation, VERA, Postponed Retirement, and Deferred Retirement With the deadline for the “Deferred Resignation” passed, we are getting a lot of questions from federal employees who are saying, “I didn’t take the deferred resignation can […]

FERS Go Bag: Is Yours Packed?

https://youtu.be/VQ0Z9PhhxEQ How prepared are you if you no longer work for the Federal Government? Maybe you accepted the Trump Administration’s “deferred resignation” package; maybe your agency did a Voluntary Early Retirement (authorized as a VERA); maybe there was a reduction in force of mass layoffs? Maybe you are one of the many federal employees that […]

#122 Estate Planning Myths and Facts: What Federal Employees Must Know

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and avoiding common mistakes that may lead to unintended consequences. In this podcast episode, Micah and Christian discuss essential estate planning topics, including the necessary documents, the dangers of outdated plans, […]

FERS Go Bag: Mapping Retirement – Navigating the Landscape

Item 5: Mapping Retirement – Navigating the Landscape One of my favorite lines is from Alice’s Adventures in Wonderland by Lewis Carroll. It comes from a conversation between Alice and the Cheshire Cat: “Would you tell me, please, which way I ought to go from here?” – Alice. “That depends a good deal on where […]

FERS Go Bag: Who Are You Going to Call?

Item 4: Who are you going to call? Come on, 1980’s babies, where are you: who are you going to call? No, who? Remember when we told you that when you were in, you were a guest, but now that you are out, you are a pest. When was the last time you dialed someone’s […]

FERS Go Bag: FEHB – Your Best Benefit as a Federal Employee

Item 3: FEHB – your best benefit as a federal employee Federal Employee Health benefits are hands down the best benefits for federal employees—so good that Congress even has them! Do we sound jealous? Well, as civilians on the outside looking in, we are incredibly jealous of your health care benefits as federal employees—they are […]

FERS Go Bag: Your Official Personnel File

Item 2: Your Official Personnel File You need a complete and thorough copy of your Official Personnel File (OPF) in your FERS Go Bag—all of it, all the documents, everything. Remember that when you are in, you are a guest, but when you are out, you are a pest. The Official Personnel File (OPF) and […]

Should You Retire at 60 or Wait Until 62?

Hello, at age 57 years and two months, I separated from federal service for a civilian job after serving 5.3 years and buying back 17.2 years of military time. I currently have a good civilian job and plan to continue working until at least age 62. (I will turn 59 in March 2025.) My question […]

Can I Keep My Spouse’s FEHB Coverage in Retirement Without Survivor Benefits?

My wife is a federal employee and will retire next year. She is going to be 50 years old. I am going to be 58 when she retires. I am on her health insurance which we want to continue having post retirement. Can I stay on her health insurance without her taking either survivor benefit? […]

#121 The Untold Story of Survivor Benefits: Protect What Matters Most

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast episode, Micah and Christian explore the details of survivor benefits—who receives what, how to plan ahead, and why your choices are significant. You’ll learn how your pension, Social Security, TSP, […]

Fork or Knife? The Truth About VERA

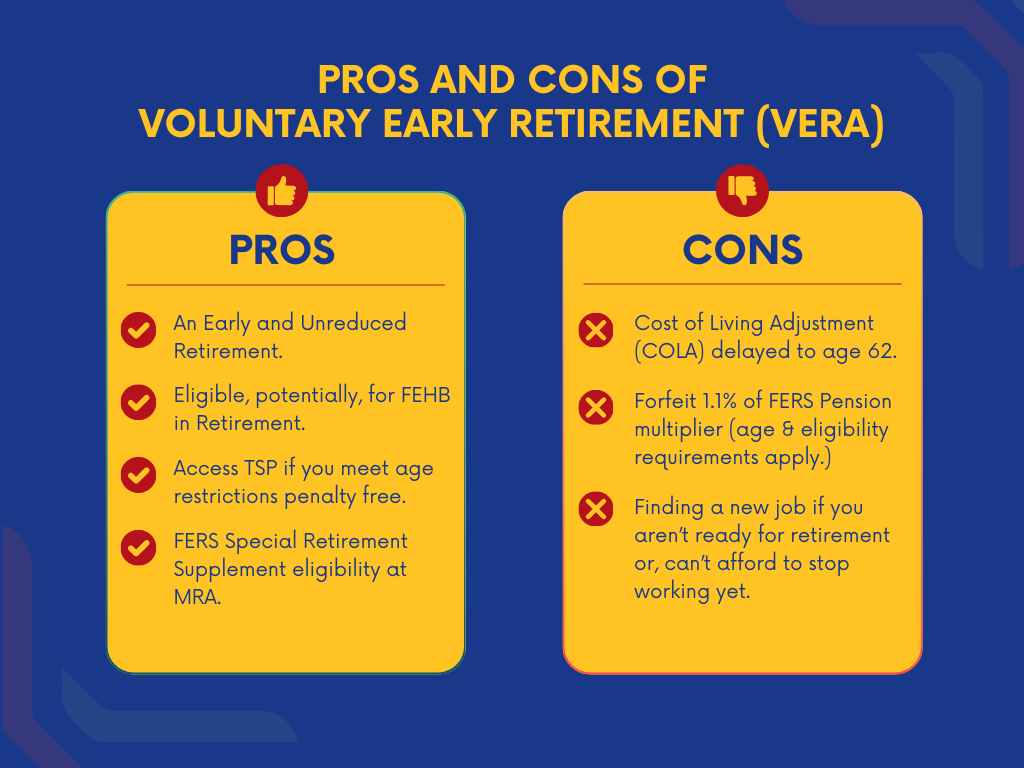

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to come, it’s important to understand the risks and opportunities involved. In this podcast episode, Micah and Tammy discuss the key factors that federal employees should evaluate before opting for Voluntary […]

VERA-Retirement-Guide-Federal-Employees

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

Fork in the Road: Frequently Asked Questions

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits professional, my primary advice—though not intended to be self-serving—is to consult your financial advisor. Someone who specializes in your benefits as a federal employee. Do not face these decisions alone; ensure you have a financial sounding board to thoroughly […]

Fork in the Road: A Comprehensive Guide to Deferred Resignation for Federal Employees

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees. President Trump has issued executive orders requiring Federal Employees working remotely since the COVID outbreak in 2020 to return to their physical offices five days a week. Everyone anticipated that […]

#120 Reduction in Force (RIF) and Job Changes – What You Need to Know!

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions can bring uncertainty, but you can stay in control with the proper preparation. In this podcast episode, Micah and Floyd share strategies to help you navigate career changes and retirement […]

Understanding Tax Implications for Survivor Benefits

Need help with federal employee survival benefits. I looking for specific help with my wife’s survivor FERS and Death Benefits. My wife worked for the Federal government and was still working when she passed. After her death I met with her employer to fill out paperwork to gain access to her TSP (401k) and FERS […]

#119 FERS Retirement Benefits, What Federal Employees Should Know in 2025

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits in 2025? In this podcast episode, Micah and Floyd discuss actionable strategies to prepare you for a secure retirement. Learn how to navigate potential Social Security reductions, plan for tax […]

Does Buying Back Military Time Affect Your CRSC?

Hi, my name is Eric. I am calling because I have a question about buying back my military time. I am retired from the from the Marine Corps. Injuries Sustained in Combat. So I received a CRSC Combat Related Special Compensation, and my question is how does that impact… because I heard that if you […]

#118 TSP Secrets: The Key to Starting Your Year Off Right

Listen to the Full Episode: Are you ready to unlock the secrets to a stronger TSP in 2025? In this podcast episode, Christian and John reveal strategies to make the most of your Thrift Savings Plan. From updated contribution limits to the benefits of compounding interest, Roth contributions, and rebalancing your portfolio, this episode is […]

Understanding the Impact of Lump Sum Annual Leave on Your FERS Supplement

Hello. My name is Joyce and I am trying to determine the best date to retire either december 31st or january 11th 2025 at the end of the last pay period. Just wanted to know the advantages of possibly waiting to retire at the end of the pay period. And if I would receive my […]

#117 The Psychological Impact of Retirement: Preparing for Life After Federal Service

Listen to the Full Episode: Ready for retirement but still trying to figure out what comes after the paycheck? In this podcast episode, Jamie and Floyd dive deep into the emotional side of retirement, something many people overlook. Discover how to handle the loss of purpose, adjust to new routines, and stay connected with others […]

TSP to Roth IRA: What Federal Employees Need to Know

I’m 60 years old with 36 years of service. I called the TSP help line and asked if I could roll over money from the traditional TSP directly to a Roth IRA I have at Fidelity. They said yes. And, sure enough, when you go on the tsp.gov website and click through Withdrawals and “Roll […]

#116 The Strategic Role of Qualified Charitable Distributions in Retirement

Listen to the Full Episode: How can Qualified Charitable Distributions in Retirement help you give strategically and reduce taxes? In this podcast episode, Christian and John dive into the strategic role of Qualified Charitable Distributions (QCDs) in retirement planning. Discover how Qualified Charitable Distributions allow retirees to meet Required Minimum Distributions (RMDs) while supporting causes […]

Buying Back Military Time and Pension

Hello, I just started federal employment this July. I served Active Duty in the Army for 9 years from 2009 to 2018. In 2018 I joined the reserves. I will be going part time in my Federal job this Sept. Does it make since to by back my military time. Would it only be the […]

#115 Essential Steps to Secure Your Federal Retirement: What You Need to Know

Listen to the Full Episode: Ready to secure your federal retirement? In this podcast episode, Micah and Christian discuss essential steps to secure your federal retirement and ensure you are financially prepared. Learn how securing your federal retirement involves managing cash flow, adjusting for inflation, and optimizing tax planning strategies. By focusing on ways to […]

Insurance Coverage And Medicare

Yes, my name is Bobby and I have a question on the life insurance coverage. I read here that it said that the basic life insurance and retirement can be continued. If all of the conditions are met, 1 of the conditions are you have not converted coverage to an individual policy. My husband has […]

#114 Boost Your Retirement Savings: Understanding FERS Contribution Rates

Listen to the Full Episode: Navigating federal retirement benefits can be complex, but understanding FERS contribution rates is key. These rates determine your eligibility, pension amount, and overall retirement plan. Understanding how FERS contribution rates impact your high-3 average salary and retirement dates is crucial for a secure financial future. Micah and Tammy discuss the […]

When do Your Years Stop Counting Towards Your FERS Retirement

“Yes, my name is Marty. I like to know about FERS, if there is a maximum amount of years that I can work and then it is no longer counted towards my retirement calculation. For instance, if I was on the Csrs, I believe the cut off is like 42 years. Is it the same […]

#113 Retirement Tax Traps: How to Avoid Surprises in Your Federal Retirement Planning

Listen to the Full Episode: Understanding how to navigate taxes in retirement is crucial for preserving your hard-earned income. From Roth conversions to Qualified Charitable Distributions (QCDs), implementing effective tax strategies can significantly impact your financial future. Recognizing the importance of Required Minimum Distributions (RMDs) and the Income-Related Monthly Adjustment Amount (IRMAA) will empower you […]

FERS Part-Time Service: Clarifying the Creditable Service Rules

Yes, my name is Martha, and I tune into as many of your podcasts as I can, for your valuable information, I have a question regarding part time work previously, I thought that each year of part time service counted as a full year towards my years of principal service. But I was listening to […]

#112 Crafting Your 10-Year Tax Plan: How to Reduce Liabilities in Your FERS Retirement

Listen to the Full Episode: Planning for your retirement requires a solid understanding of your options. Discover the best strategies for managing your Thrift Savings Plan (TSP) and learn how to access your funds without facing penalties. In this episode, Micah and Christian discuss vital topics, including various withdrawal options, the significance of your FERS […]

Navigating Earnings Limit and SRS: What Happens When You Turn 62?

If you have a birth month of Jan ro April, and the year you obtain age 61, you exceed the earnings limit, how is that overage paid, since you will have obtained 62 by the reporting time and SRS will have ended, thanks for the great podcast, I am claiming 1 million Feds reached right […]

#111 Rental Property And Estate Planning

Listen to the Full Episode: Are you ready to turn your retirement savings into a reliable income stream? Understanding your spending goals and determining your net income is not just crucial, it’s the key to managing your cash flow during retirement. Whether it’s Social Security benefits, pensions, or your Thrift Savings Plan, knowing how to […]

Understanding the FERS Supplement: Eligibility and Next Steps

FERS supplement annuity. I retired from SSA under the 25 years of service at any age in 2014. I was told I would be eligible for the supplement when I reach my MRA 56 and 6 months, which was this 06/2024. I have not received or heard anything from OPM. I’m just trying to verify […]

#110 5 Things You Need To Know As A Federal Employee BEFORE You Retire

Listen to the Full Episode: Are you ready to turn your retirement savings into a reliable income stream as Federal Employee? Navigating the complexities of your Federal Employee Retirement System benefits, Social Security, and Thrift Savings Plan is essential for a smooth transition into retirement. Learn how to manage your TSP investments, explore effective withdrawal […]

High-3 Calculation Confusion: Different Work Periods And FERS Multipliers

Hi. I have congressional experience and a break in service and I have just retired to the executive branch and I was wondering how the High-3 is calculated when I have 2 different 2 different work periods and different multipliers because congressional service when I was there was a 1.7 % multiplier anyway, if you […]

#109 How Does Retirement Income Work – A Roadmap To Financial Freedom

Listen to the Full Episode: Are you ready to turn your retirement savings into a reliable income stream? Understanding your spending goals and determining your net income is not just crucial, it’s the key to managing your cash flow during retirement. Whether it’s Social Security benefits, pensions, or your Thrift Savings Plan, knowing how to […]

Can You Access Your FERS Supplement Right After Retirement?

I can retire in october 2019 with 30 years under first, I will be 56 and I mean 10 months old and I do not think that I will be eligible for SRS until may 27th, but then I filed for my retirement the first part of April and when my retirement Counselor called, she […]

#108 Federal Finances: Navigating Retirement Prep

Listen to the Full Episode: Join Tammy and Micah, as they share their insights on navigating retirement preparation, avoiding common mistakes with OPM, and ensuring a smooth transition from federal service. Learn about the importance of accurate record-keeping, the need for correct dates and service credibility, and how to involve HR early on to […]

Reserve Military Retirement And FERS Military Retirement – Can You Keep Both?

I just saw you guide to military service credit buybacks. I didn’t see something in your guide that I think is very important: There is a huge difference between a Reserve retirement and an Active Duty ( AKA Regular) retirement. As you state in your guide Active-duty retirees must choose between their federal and active-duty […]

#107 Burning Sick Leave: Managing Sick Leave Usage Near Retirement

Listen to the Full Episode: Are you nearing retirement and wondering how to manage your sick leave best? Join Tammy and Micah in this insightful episode of the Plan Your Federal Retirement podcast as they dive deep into the intricacies of using sick leave to help optimize your federal retirement benefits. In this episode, Tammy […]

Understanding Taxes on Annual Leave Payout for Federal Retirees: Myth vs. Reality

Hello PYFR team! I love the podcast and appreciate it and all the resources you offer. My question is about taxes on the pay-out of annual leave for retirees. I assumed it would be considered income just like salary and would be taxed at whatever rate my income met for that year. But, a colleague […]

#106 How Much Should You Leave To Your Beneficiary

Listen to the Full Episode: Have you considered what happens to your assets and who will take care of your financial matters when you’re gone? Ensuring your beneficiary is provided for after your passing is a crucial part of estate planning. Join Micah and JT, as they delve into the vital topic of estate planning […]

Survivor Benefit Plan: Does Spousal Age Difference Affect Your Benefits?

I read the $1,000.00 example that you write and 50% of 1K is 500.00 a month for my wife. That makes sense and I understand. My Q is my spouse is 12 yrs YOUNGER than I am. Does the Age difference make a difference in the SBP cost? – Albert Understanding how survivor benefits work, […]

When To Start The Process To Retirement?

I’m planning to retire December 31, 2025; I will have 10 years and 8 months. When should I start the process? – Angelia https://youtu.be/oZS4cyl1JtM Planning for retirement involves multiple steps, and timing is crucial. Angela, one of our readers with over ten years of federal service, plans to retire in December 2025 and asked when […]

#105 Demystifying FERS Retirement Calculators

Listen to the Full Episode: Federal employees can use various calculators to estimate their FERS benefits, but accurate documentation and proper completion of estate planning documents are crucial for retirement planning! Missing or incomplete information can lead to unexpected consequences, so seeking help from HR or knowledgeable individuals is essential. In this episode, Micah and […]

Withdrawing From TSP Without Paying The Penalty, is it Possible?

I am eligible to retire from fed service at 57 1/2. I will have 36 years of service. I plan on using my TSP to supplement my retirement. I cant seem to find a straight answer on withdrawing my money prior to 59 1/2 without paying the 10% penalty. Some sites say I can access […]

#104 Optimizing The TSP For Retirement

Listen to the Full Episode: Are you seeking clarity on TSP strategies? Join us on our latest podcast episode, where Christian and JT decode the complexities of TSP investments. From cracking the complexities of TSP investment options, including the G, F, C, S, and I funds, to unraveling the benefits of dollar-cost averaging, this episode […]

Moving TSP Money to G Fund – Here is What You Need To Know

I am 8 years from retirement and currently invested 100% in the C fund. When should I start moving money to the G fund and should it be based on a percentage of my current balance, or should I base it on how many years of withdrawals I want to protect once fully retired i.e. […]

#103 Don’t Replace Your Expenses in Retirement

Listen to the Full Episode: Are you ready to take control of your retirement finances? Your current spending habits could shape your future retirement lifestyle more than you realize. Join Micah and Tammy in this episode as they discuss the critical aspects of retirement planning. Learn why aligning pre-retirement income with post-retirement needs is crucial […]

When Can You Collect Your SRS (Special Retirement Supplement)?

If I retire age 59 under Postponed Retirement can I collect the SRS – Kenneth https://youtu.be/KAGt4Mu4OpM Federal workers have three main parts to their retirement: a pension, Social Security, and a savings plan called the Thrift Savings Plan (TSP). This article explains when you can get the Special Retirement Supplement (SRS) if you choose to retire […]

#102 Key Things Advisors Wish Their Clients Knew

Listen to the Full Episode: It is time to discuss retirement planning, cash flow management, and potential retirement expenses! In this special episode, Micah leads a discussion with Floyd Shilanski, RCF®, a team of seasoned advisors,Christian Sakamoto, CFP®, and JT Ferrin, CFP®, to uncover the crucial aspects of retirement planning that are often overlooked. Let’s […]

Military to Civilian Transition

Hello, I appreciate your videos very much. I am active duty and retiring next year, intending on becoming a GS employee. Can you do one on the military to civilian transition with regards to TSP and other issues, besides buying back time? I have both Roth and Traditional military accounts, and I assume they will […]

#101 Secure Your Retirement with the Thrift Savings Plan

Listen to the Full Episode: Are you ready to embark on a journey towards a secureretirement? Join Micah and Tammy, as they analyze advanced retirement strategies to help you achieve financial security in your golden years. From understanding the critical importance of tax planning to maximizing your TSP benefits and optimizing retirement income, they provide […]

How do I Calculate My High-3?

How do I calculate my high three? I was a FERS employee from 1991-2000 then returned to FERS in 2022. I am 58 with a total of 23 years of credible FERS retirement because I did a military buy back of my active duty time (I retired from the Army Reserve). I know I will […]

#100 Retirement Real Talk: Honest Conversations About Life After Work

Listen to the Full Episode: Are you ready to retire? Have you considered the emotional part of this journey? Are you and your spouse on the same page about your golden years and have the same expectations? Let’s discuss long-term plans, the difficult situations that life can bring, and the importance of ensuring you enjoy […]

Federal Pension – A Guide for Former Federal Employees

I worked for the federal government from 1995 to 2000. I turn 62 in 2024. I spent my entire federal career at Nevada. I live there now. I approached that office to ask when I should begin my application for a federal pension and which office to send the required documentation to. Human resource staff […]

#99 Bonus Pod – Answering Question

Listen to the Full Episode: Join us for our bonus podcast, where we address the questions we received from federal employees before our latest YouTube Live Session. Our financial specialists, Christian Sakamoto and JT Ferrin, have taken the time to provide comprehensive answers to all the inquiries we received. Listen and discover the real-life examples […]

Optimal Retirement Timing: Should You Wait For a Potential Pay Increase?

Hi! Love your podcasts and videos! I’m having a hard time figuring out my best dates and options for retiring soon. I’m trying to determine when the best time would be to leave federal service with the USPS. I’m retired military, but never “bought back” my time. I’ve just began receiving my retirement pension at […]

#98 Do You Really Need Life Insurance in Retirement?

Listen to the Full Episode: Federal retirees face unique challenges, from income replacement to tax considerations. But what about life insurance needs and survivor benefits? Understanding the role of life insurance in your retirement planning is crucial to ensure your loved ones are financially secure in the event of your passing. In this episode, our […]

Social Security & COLA

Questions about social Security and COLA (cost of living adjustment) are among the most common. Let’s go through the basics with Floyd Shilanski, RCF, Managing Partner, Wealth Advisor. https://youtu.be/nyIFiN5ClzY

#97 How to NOT Go Back to Work in Retirement, 3 Things You Need To Know

Listen to the Full Episode: Are you ready to retire without looking back? Let’s discuss essential strategies for retirees to help ensure they can enjoy a fulfilling retirement without the need to return to work. Understanding FERS benefits is only the starting point. But do you know how important it is to understand your financial […]

Potential Consequences of Exceeding The Earnings Limit in 2024 on FERS Supplement

“In mid 2025, I will turn 62, therefore my FERS supplement will stop. I currently work PT not to exceed 2013 earnings limit. However, in 2024 I’m thinking about going fulltime to be prepared financially for when I lose the FERS supplement. What happens if I exceed the earnings limit in 2024? Will there be […]

#96 What is The MOST Important Part of Your Pension?

Listen to the Full Episode: There are a lot of complexities in federal retirement benefits and retirement planning. Let’s unravel the key aspects and pitfalls associated with them! In today’s episode, Micah and Christian discuss the importance of understanding federal retirement benefits and avoiding common mistakes. They highlight the significance of understanding cash flow as […]

Can you get a Personalized FERS Benefits Summary?

“Hello, Will OPM issue me a personal FERS Benefits Summary upon request (i.e., similar to the personalized benefit summary issued by Social Security) based on my VA creditable service and High-3 salary or do I have to wait until 60 days prior to my pension benefit start date to find out the amount of my […]

#95 Retire Happy: Essential Steps to a Successful Federal Retirement

Listen to the Full Episode: What are the essential steps to a successful federal retirement? Join, Micah and Tammy, in today’s episode as they go through the essential steps you need to take to simplify your path forward before it’s too late. From common errors in application to the importance of a well-thought-out timeline, this […]

Loan Options Toward FERS Contributions

“Can I take out a loan towards my FERS contributions? I’m a federal employee and no where close to retirement. Would it work like the TSP loan that I can just pay it back over a few years? I can’t find any information on this topic.” – Martin https://youtu.be/eki3BgyzNw4 If you work for the federal […]

#94 Why is My Retirement Losing Money?

Listen to the Full Episode: Ever wondered why your retirement is losing money despite investment diversification? Join Micah and Christian in our latest episode, where they dive deep into this question, discussing the pitfalls and challenges of investment diversification and how it may only sometimes yield the expected results. Find out why having a structured […]

Health Insurance and Taxes

My husband was retired in May of 2020 at age 65 after 20 years of service with the FBI. We kept our health, vision and dental insurances, which are deducted from his annuity. Are these premiums deductible on our yearly taxes? I did read the deductions are made post-tax. – Pamela https://youtu.be/9vBMlzSkxio?feature=shared If you have […]

#93 Your 2024 Retirement Planning Guide

Listen to the Full Episode: As the holiday season ends, it is important to take action about our retirement plans and talk about the changes in the new year! In today’s insightful conversation, Micah and Floyd explore the heartbeat of retirement—cash flow. It’s not just about money; it’s about creating a rhythm for a fulfilling […]

Annual Leave Payout and Earning Limitations

”If I receive 26k in annual leave payout does that count against the earnings limit of my supplement? Also what about the money I made for the year prior to retirement?” – Mark https://youtu.be/Qd02VVh6d1E?feature=shared Maximizing Your Earned Benefits: Understanding the Payout of Annual Leave for Federal Employees The Question: What Happens to My Annual Leave […]

#92: The Crucial Must-Do’s in Estate Planning

Listen to the Full Episode: You already know how important estate planning is for your retirement, but do you know the crucial must-do’s? In this episode, Micah Shilanski, joined by our advisors, Christian and JT, are discussing the essential aspects of estate planning and the significance of three fundamental documents for every adult aged 18 […]

61 and Your FERS Supplement

”Hi, I’m 61 years old and my FERS supplement is ending soon. What should I do when that income goes away? And how am I going to supplement that income that’s normally there?Thanks.” https://youtu.be/VJ9mMoOe7NE?feature=shared The Federal Employees Retirement System (FERS) Supplement, also called the Special Retirement Supplement (SRS), is an extra payment for some federal […]

#91: Cashflow and Retirement Income Timeline

Listen to the Full Episode: It’s time to get invaluable insights from cash flow considerations to navigating the intricate rules of the Federal Employees Retirement System (FERS). Discover the three pillars of federal employee income – pension, Social Security, and TSP/investment income. Our, Christian Sakamoto, CFP, and JT Ferrin, CFP, dive deep into the crucial […]

FEHB Disability Pension & MRA

”I receive a FERS disability pension, with less than 10 years service. My minimum retirement age by year of birth is 57, but I only have 8.5 years of service, my urgent age is 59, and I also receive my prior military retirement. Since I have less than 10 years of service i was told […]

#90: Medicare and FEHB

Listen to the Full Episode: What coverage do you have, and what coverage do you actually need?Join Micah and Tammy in this episode, where they explain everything you need to know about Medicare and Federal Employees Health Benefits, providing you with the answers you need to make informed decisions about your health coverage. Understand the […]

Maximizing Roth Gains in Retirement

I absolutely loved the episode on what you cannot do in the TSP. Naturally, it brought up other questions in my mind. Before I got smart in 2019 and started funneling all of my TSP contributions to Roth, I had designated contributions into Traditional TSP. What is a good strategy when I start withdrawing? Ideally, […]

#89: What Clients Miss When Talking With Financial Planners

Listen to the Full Episode: This episode is all about some interesting real-life client stories in the world of retirement planning that happened during this busy Surge season. Micah Shilanski, Christian Sakamoto, and JT Ferrin dive into the strategic use of Roth conversions and why it’s essential to have a long-term view of your tax […]

When is The Best Time to Take Social Security

“should I delay my social security and let my wife draw it until my FRA? I planned on drawing at 62 anyways. I am retired navy and invest in TSP, also disabled. I hope this make sense.” https://www.youtube.com/watch?v=hD8YzFrTKI0 Social Security is an important part of retirement planning for many Americans, including federal employees. This guide will help you […]

#88: Year End Tax Planning

Listen to the Full Episode: As the year winds down, it’s time to get proactive about your finances and tax planning! Join us as we explore strategies to maximize your savings, minimize your tax burden, and tackle your taxes before the last minute of the year comes. Micah and Floyd will guide you through reviewing […]

What Happens to a Surviving Spouse

“What happens to a surviving spouse if an employee dies while working, but that employee was also in the process of buying back military time? My husband has 16 years of service as a Civil Service employee (under FERS), and is currently buying back his military time (12 yrs of military service.) He’s paid a […]

#87: Irreversible Mistakes After Death

Listen to the Full Episode: Don’t let irreversible mistakes catch you off guard. Empower yourself with the knowledge you need to plan for a secure future. Let’s break down timelines, discuss essential documents like advanced healthcare directives, durable powers of attorney, and wills, and uncover common pitfalls to avoid. Join Micah and Christian as they […]

How not to get permanently stuck with Minimum Required Distributions

“If I retire after age 62, and supplement my monthly FERS pension by making small withdrawals from my Traditional TSP (assume $2,000/ month), would IRS rules determine that I was now in “distribution status,” and permanently stuck with Minimum Required Distributions every year?” – Victor. https://youtu.be/s0giZhvVqC0 What are RMDs (Required, Minimum Distributions) Remember all those […]

#86: Thrift Savings Plan with Kim Weaver

Listen to the Full Episode: Whether you’re just starting your career, planning for retirement, or already in retirement, or someone looking to understand TSP better, this enlightening episode with our special guest, Kim Weaver, will help you dive deep into the world of Thrift Savings Plan. Make informed retirement decisions and secure your financial future […]

The Importance of Filling Out Beneficiary Designation Forms

“Love your podcast! I am a Federal retiree and fine with Thrift Savings Plan (TSP) and Federal Employees Group Life Insurance (FEGLI) standard order of precedence beneficiary assignments being spouse, then children in equal shares. I understand this order of precedence is followed when no beneficiary forms are on file. I have not submitted any […]

#85: TSP Spillover and funding

Listen to the Full Episode: In this episode, host Micah Shilanski and a special guest – JT Ferrin, delve into explaining the meaning of TSP Spillover and the advantageous role of Health Savings Accounts (HSAs) in retirement savings. The TSP Spillover is an important concept that might be unfamiliar to many federal employees. Micah and […]

What if you become a survivor before your annuity kicks in?

“My husband and I both had careers with the National Park Service. He carried the family insurance for us. He retired in 2021 and did not select me for survivor benefits since I also worked for the federal government. I now want to resign and defer or postpone my retirement until I meet the minimum […]

#84: Retirement Rules living abroad

Listen to the Full Episode: Do you wonder about your options for living abroad in retirement? Are you ready for change but need to know everything you need to keep your benefits? In this podcast episode, Joe Curry, CFPⓇ, CHS, joins Micah to delve into the intricate details of retiring abroad. The episode serves as […]

FERS Eligibility

“I am currently age 32 (a bit away from retirement) and I have been with USPS for 6.5 years now. It says you are fully vested in FERS after 10 years, but I don’t think I will retire with the USPS. If I were to wait for the 10 years before separating from USPS, would […]

#83: Dual Feds FEHB Rules

Listen to the Full Episode: In this episode of Plan Your Federal Retirement Podcast, Micah and Jamie discuss the Federal Employee Health Benefits (FEHB) and how it is an excellent benefit for federal employees. But most importantly, they dive into the rules for dual Feds, which refers to a married couple where both are federal […]

Moving from TSP to a Roth

“I’m about 10 years out from retirement. I’m wanting to stop putting money into the traditional tsp and start a Roth. Is that doable?” – Robin. https://youtu.be/NrRjwRxGuUw Robin, like many federal employees we visit throughout the year, is about 10 years away from wanting to retire under the Federal Employee Retirement System (FERS). Robin is […]

#82: HR – Are they RIGHT or WRONG?

Listen to the Full Episode: Are you a federal employee planning for retirement? Do you know that negative outcomes can be prevented if only you know how to find the correct information and understand all the pieces of the Federal Retirement puzzle? But… what if the information you get from HR or OPM is different […]

What happens to your Unused Sick Leave in retirement?

“When determining creditable service for determining what my FERS annuity will be, can unused sick leave be used to get creditable service time from 20 years of service? For example, if I work 19.5 years and have 6 months of work unused sick leave, then can I insist that my annuity be 20 years so […]

#81: What To Have In Savings?

Listen to the Full Episode: How many months’ worth of living expenses do you need to have saved up and why? Do you have emergency (911 account) reserves? These questions bother a lot of people. But, the fundamental question for each of us is: What should we have in savings? Tune in to today’s podcast, […]

FERS Supplement and Earned Income

“Micah, I have a question about the earnings test for FERS Supplement. I’m a title 38 physician, planning to retire with age 60 + 20 years of service and lump sum annual leave payment of 685 hours. I believe the lump sum annual leave payout is considered earned income, so I think my first year’s […]

#80: FERS Supplement Details

Listen to the Full Episode: The FERS supplement is a great benefit of your FERS retirement package. This supplement is available to federal employees who retire before age 62 and is a substitute for social security. The amount of the supplement is calculated using the same formula as Social Security, but it is unique to […]

Advantages and Disadvantages of filing out beneficiary designation forms with TSP and FEGLI

“Love your podcast! I am a Federal retiree and fine with Thrift Savings Plan (TSP) and Federal Employees Group Life Insurance (FEGLI) standard order of precedence beneficiary assignments being spouse, then children in equal shares. I understand this order of precedence is followed when no beneficiary forms are on file. I have not submitted any […]

Ep #79: 7 Things You Can NOT Do in TSP in Retirement

Listen to the Full Episode: Retirement can be challenging, especially when it comes to managing your finances. One of the biggest mistakes you can make is assuming you can do anything you want with your thrift savings plan (TSP) after retirement. As a federal employee, you have phenomenal benefits, but as with any other tool, […]

FERS and Social Security

“I am turning 62 and I am drawing disability FERS. Can I draw social security and FERS together? And will my FERS change when I turn 62?” – Douglas. https://youtu.be/oo_HE8Lm3-Q Your ability to earn an income is your greatest asset as an employee. When that ability is taken away from an injury, it becomes critical […]

Ep #78: Transitioning to Retirement

Listen to the Full Episode: You are getting closer to retirement, but specific tasks must be completed to enjoy it thoroughly. You’ll need to take care of all paperwork, or at least have copies of everything, a few months before retirement and a few months after the process starts, and make sure that all questions […]

ROTH TSP Contributions

“I watched the very helpful video on ROTH IRA conversions. I will be retiring by the end of 2022 and I do not have any funds in the Roth TSP, but all funds have been in the traditional TSP. In hindsight, that was probably not a good idea. I am now wondering if there is […]

Ep #77: Withdrawals in Retirement

Listen to the Full Episode: You’ve been working and saving and planning for your retirement. And when you retire, you go through a psychological shift from accumulation to distribution. Here lies the importance of understanding your federal benefits and the best way to use them! The TSP is a phenomenal tool; your federal benefits, your […]

Social Security and Medicare In retirement

“I retired from PHMSA/USDOT January 2021 and I just received my first W2 form from the Department of Interior and It says that I paid money into SSA and also Medicare. I did not know that I still had to pay into Social Security after I retired. Can you please verify that this is correct […]

Ep #76: Streams of Income

Listen to the Full Episode: Cashflow is the heartbeat of retirement, so you have to know the details of your income streams, the theory, and the reality behind some of your incomes. This way – you can work on your plan. The more we plan and apply, the easier and the more successful the retirement […]

Ep #75: The Importance of Building a Financial Plan

Listen to the Full Episode: Setting goals and mapping a strategy – these are the ground rules for taking the action in your hands! No, you don’t have to be precise or super accurate – we know things change, but navigating towards a point helps you reach the correct destination when sailing. Join today’s discussion […]

FERS Postponed Retirement

“Greetings, I think I have an understanding of FERS postponed retirement, but there is one point that I have been unable resolve. I am by all measures eligible to retire now – I am 61 years old with over 42 years of service (I bought back 21 years of military time). My question – If […]

Ep #74: Choosing the best Retirement Plan

Listen to the Full Episode: One of the most essential and fundamental questions is choosing the right federal retirement plan! Do you know how much you should save for your retirement? Are you being realistic with your intentions and expectations? Do you have a retirement income? And what if there is a gap… is there […]

FERS Supplement and Earnings Limitations

“August 2023 I will turn 62 and stop receiving the OPM Social security . After August for the remainder of 2023 will I still be subject to the earnings limitation? I don’t plan to start drawing actual social security. ” – Ed. https://youtu.be/Ic1zkR3NuAg Is the FERS Supplement Subject to the Social Security Earnings Test? Yes, […]

Ep #73: Costly Mistakes

Listen to the Full Episode: Net vs. Gross income. Which one hits the door of your bank account? Changes regarding insurance? Life insurance, health insurance… Any different kinds of SCD and any tips on taxes? Do you know all these rules and details you should consider while planning your retirement? We hope you get the […]

Withdrawing from Your TSP

“Hello, I have 31k in my TSP. Is it possible to withdraw the total amount at one time? ” – Bill. https://youtu.be/ueICsrk2rtI Demystifying TSP Withdrawals TSP withdrawals are a crucial aspect of managing your retirement savings. It’s important to comprehend the various withdrawal options and the implications they have on your financial landscape. Here, we […]

Ep #72: Criminal Issues with Health Insurance and Survival Benefits

Listen to the Full Episode: Accidents happen, but some come with severe consequences. For example, when covering someone with your HSA that you shouldn’t cover, you can face severe penalties! That is why in today’s episode, Tammy and Micah cover some fraudulent issues that can come up with health insurance and survivor benefits. Listen in […]

FEHB in Retirement

“Hello , I worked for 11 years as a federal employee until age 57, now I am 62 , can I still get fehb, ie I am not enrolled in fehb since age 57 .” – Khalid. https://youtu.be/Bycv6clqwrQ Securing Federal Employee’s Health Benefits (FEHB) in Retirement: A Comprehensive Guide At Plan Your Federal Retirement (PYFR), […]

Ep #71: Secure Act 2.0 with Steven Jarvis

Listen to the Full Episode: Changes are happening, and questions have been raised! That is why we have a special guest in today’s episode – Steven Jarvis, CPA. Micah and Steven will answer the most common question out there these days and clear out all of your confusion. Join us and find out what is […]

Planning to Retire with COLA Adjustments

“When should I retire to take advantage of the planned big 2023 COLA increase? If I retire in December, will my pension benefits be increased in January 2023, or my first pension check must be in 2022 to take advantage of the COLA adjustment?” – Konstantin. https://youtu.be/SW8qEwkxjuE There are always two sides to a question […]

Ep #70: Changes in Planning Over The Years, Social Security

Listen to the Full Episode: The benefits in retirement that Federal Employees have are based on three things: Pension Social Security TSP To avoid misconceptions about one of the most essential things in your retirement planning – Social Security – we have Floyd Shilanski and his years of experience. Find out the different strategies you […]

Choosing between Deferred Retirement and Postponed Retirement

“I plan to retire at age 57 with an MRA + 10 option. I don’t plan on taking my FERS retirement out until later age 61 or 62 depending. I have the basic life insurance and single. What is the best option to defer retirement or postpone retirement?” – Floyd. https://youtu.be/fmvas8zxa_I As a federal employee, […]

Ep #69: Sick Leave for Retirement

Listen to the Full Episode: It is crucial to be hyper-intentional when it comes to your retirement! How big of a change can your sick leave make? And how important is this subject when choosing the best day for your retirement? In this episode, we detail some tweaks you can make to your retirement plan […]

Ep #68: Social Security Increase and Cash Flow

Listen to the Full Episode: Whether you are 30, 50, or 70, a subject that has a hold on you is how to improve your financial situation. How much are you saving, and how can you save more? How can you organize your income better? It is crucial to ensure you are not just […]

Does it make sense to consolidate for your retirement?

“I have been working in the federal system for 3 years and will retire within the next 5 years. I am 62. I have a good amount of money in the 403b from my previous employer, 25 years’ worth. Are there any disadvantages/advantages in rolling over my 403b into the TSP? Thank you for your […]

Buying Back Military Time Working as a Civilian

https://www.youtube.com/watch?v=2R_2ky5nZaM Does it make sense to buy back my military time now that I am a Federal Employee? If you have military time but do not receive a military pension, you can buy back your military time to count towards your creditable service for federal retirement. What is a Military BuyBack for Federal Employees? Before […]

Using Years Of Service To Calculate Your Pension

“If I started in the NAF system in 1996 and then converted to GS in 2008 we were told it would count towards retirement. From doing my research only my GS time will count. Thank you was trying to figure out my pension” – Jeanne. https://www.youtube.com/watch?v=Q5J0qu4y_To If your FERS Pension is 30% LESS than you […]

Ep #64: Spending Money in Retirement

Listen to the Full Episode: Christian Sakamoto joins the show again today to discuss cash flow and the money you spend in retirement. This is often a topic that isn’t addressed properly, and budgeting typically puts a bad taste in people’s mouths, but in this episode, you will hear why some of the greatest advisors […]

Checking Beneficiary Designations

“My wife and I updated our wills two years ago, it states that all of our estate is to go to the survivor and if something were to happen to either one of us. When the survivor dies it then goes to our two children. We’ve made the estate the beneficiary of our life insurance, […]

Ep #63: When Your TSP is Down 25%

Listen to the Full Episode: There are a couple of times a year when it’s really important to have clients come in and review things. As we move into the fall/winter season, this is one of those times for both Micah and today’s guest, Christian Sakamoto. Today Christian and Micah talk about some of the […]

Ep #61: Estate Planning

Listen to the Full Episode: Today Micah and Tammy tackle estate planning, a topic that impacts a lot of people, but that we don’t tend to want to review very often. Despite the common reluctance, there are important details that you will need to review, update, and stay on top of in this area. So […]

Ep #60: Pros and Cons of Federal Employment

Listen to the Full Episode: Misdirected advice can often be the most costly advice. So when we get advice, it’s important to hit pause to make sure it makes sense for you. If you’re in a place where you’re weighing the pros and cons of leaving federal service, don’t miss this episode. Tammy and Micah […]

Ep #59: You Ask, We Answer

Listen to the Full Episode: Christian Sakamoto joins the show again today to help answer some of the top questions we get from people who want to make sure they’re on track for retirement. He will help tackle common misconceptions about being ready for retirement and discuss the details of what actually makes the biggest […]

Ep #58: Roth Conversion Options

Listen to the Full Episode: Have you noticed that the markets are down? Did you know there are some key opportunities to look into when this happens? Well, it just so happens that a phenomenal financial advisor, Christian Sakamoto, is joining the show today to chat with Micah about looking into doing Roth conversions. Listen […]

Ep #57: The Myths Before Retirement

Listen to the Full Episode: Sometimes there are misconceptions we have that lead to big mistakes before retirement—and they all stem from one main problem. In this episode, Micah and Tammy discuss some of the biggest pre-retirement mistakes people make and how you can put a plan in place that allows you to avoid making […]

Ep #56: Moving Investments Into Your TSP

Listen to the Full Episode: Many people want to move investments into or out of their TSP, and there are a lot of questions surrounding this lately. Listen in as Micah and Tammy bring up some of the most common questions and dive into what you need to know in order to make solid decisions […]

Ep #54: Bad Advice

Micah and Tammy have been seeing lots of mistakes and missteps happening lately, with more people reaching out to see whether they were wrong or right—and often having to find ways to fix the things that weren’t right. So in today’s episode, they’re jumping in to address a few of the situations they have been […]

Ep #53: To Buy or Not To Buy Your Military Time Back

The question of whether to buy back military time is something that affects a lot of people. This episode features Christian Sakamoto, a great advisor from our office who has valuable insight to share on this topic. Today, he and Micah discuss the key areas that you need to be aware of to decide whether […]

Ep #52: How Much Do You Want to Spend in Retirement?

Micah is flying solo in today’s podcast to answer this indirect question that he gets when meeting with clients. He discusses how to decide what you want to spend in retirement and shares the tools he uses to help people plan for that. Listen in as Micah goes over the issues he has with budgets […]

Should I buy back 20 years of military time?

“Greetings, I am retired from the Army after 20 years as a Staff Sergeant. I am currently a GS 14 with 11 years under FERS. When I retire do I keep my military retirement monthly check and a fed GS retirement separate from the military time? Or should I buy back the time and retire […]

Conflicting Information About My Lump Sum Annual Leave

”I have gotten conflicting information about my lump sum annual leave. I plan on retiring on 12/31/21. I know that I will get my lump sum A/L payment a few weeks into 2022. Will the IRS count this as income for the tax year 2021 or 2022? Also, will taxes on the lump sum A/L […]

Can you deduct your FEHB premiums in retirement?

I am aware that after I put in ten years’ federal civilian creditable service and then retire, my FERS annuity will be reduced monthly by 10% for the surviving spouse 50% annuity and that FEHB premiums will be deducted as well. My questions: Are the FEHB premiums in retirement deductible? Is the 10% deduction taxable? […]

Follow Up Friday – Derailing Your Retirement

Learn more about the things that can sabotage your retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Follow Up Friday – Why Mid-Career Is the MOST Important Time

Learn the important differences between retiring at 60 and retiring at 62. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Follow Up Friday – The Questions You Should Have Asked

Tips for figuring out the best plan for your retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Follow Up Friday – Court Orders That Can Half Your Retirement

What you need to know about how a divorce can impact your retirement planning. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Follow Up Friday – TSP and Social Security

Questions to ask yourself to ensure you’re properly balancing your social security and TSP so you get the most benefit. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Follow Up Friday – What’s The Best Distribution Rate From Your TSP?

What you need to know about your TSP benefits so you can avoid risk and maximize your retirement funds. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Follow Up Friday – Why Life Events Matter

How to protect and prepare your loved ones for unexpected life events. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Follow Up Friday – How Much Life Insurance Do You Need?

The importance of looking over your policies, reevaluating your beneficiaries and everything you need to know about FEGLI. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Follow Up Friday – Best Day to Retire

How to properly plan for the day of your retirement. Listen to the Full Episode: Enjoy the show? Use the Links Below to Subscribe:

Ep #23: Best Day to Retire

With more retirement planning and with every year that retirement gets closer, the question is often asked, “What day is best to retire?” Tammy and Micah sit down to set the record straight when it comes to choosing a retirement date. They share how people tend to focus on maximizing benefits and where else you […]