“When should I retire to take advantage of the planned big 2023 COLA increase? If I retire in December, will my pension benefits be increased in January 2023, or my first pension check must be in 2022 to take advantage of the COLA adjustment?” – Konstantin.

There are always two sides to a question about money:

The technical side, The emotional side.

At first, when we start talking with federal employees approaching their retirement they want to make sure that they are, “getting the most out of their benefits.”

After all, as a federal employee, you have worked a long career and want to make sure that you are optimizing your retirement strategy so as not to “lose out” on anything just as you prepare to exit federal service.

The Technical Side

Many federal employees want to wait to retire until they are able to maximize the pay increase that they have received. This pay increase could come in the form of a Step Increase or a Cost of Living Adjustment (COLA).

If you want to know how long you must work in order to benefit from one such increase in pay, the answer is no less than one full year.

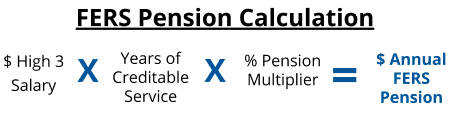

Your FERS Pension is calculated by

To answer the technical question, how long do you need to stay working for a COLA adjustment to make a difference in your retirement pension, you need 12+ Months to really make any significant changes in your pension.

The more months that you have, the more your Hi-Three will be impacted.

The reason question though is – when do you stop? Each year, you run the potential of your income reasonably increasing therefore your high three will continue to increase as well.

The Emotional Side

The real question is, when do you want to retire and what is your strategy?

If you wait to retire until you make the most of each step increase and each COLA increase, you may find yourself always chasing the horizon.

Before making the decision to retire, there are several important financial questions you should be taking time to think about.

Here are some of our TOP 5-Questions you should address when planning for retirement:

- Do you have enough money saved for retirement so as not to outlive your savings?

- What is your spending plan during retirement?

- As a FERS employee, you’re eligible for Social Security, what is your strategy for receiving those benefits?

- What is your 10 year tax plan?

- How will you use your TSP in retirement? What is your plan during market downturn?

- Do you have your estate plan in order so that if you pre-decease your spouse, they understand what survivor benefits (if any) you have elected.

If you think that you’re ready to speak with a financial professional about these, and any other questions that you might have, about your retirement here is how.

How to start planning your retirement from Federal Service

1. Check Your Eligibility: To retire under FERS, you need to meet specific age and service requirements. For immediate, full benefits, you must be at least 62 years old with five years of service, or 60 with 20 years of service, or have reached your Minimum Retirement Age (MRA) with 30 years of service. MRA varies from 55-57, depending on your birth year.

Full Retirement and Age 62 Benefit By Year Of Birth

Year of Birth 1. | Full (normal) Retirement Age | Months between age 62 and full retirement age 2. | At Age 62 3. | |||

A $1000 retirement benefit would be reduced to | The retirement benefit is reduced by 4. | A $500 spouse’s benefit would be reduced to | The spouse’s benefit is reduced by 5. | |||

66 | 48 | $750 | 25.00% | $350 | 30.00% | |

66 and 2 months | 50 | $741 | 25.83% | $345 | 30.83% | |

66 and 4 months | 52 | $733 | 26.67% | $341 | 31.67% | |

66 and 6 months | 54 | $725 | 27.50% | $337 | 32.50% | |

66 and 8 months | 56 | $716 | 28.33% | $333 | 33.33% | |

66 and 10 months | 58 | $708 | 29.17% | $329 | 34.17% | |

67 | 60 | $700 | 30.00% | $325 | 35.00% | |

| ||||||

2. Understand Your Benefits: Your retirement income will come from three sources – the FERS basic benefit, Social Security, and the Thrift Savings Plan. Make sure you understand how much you’ll receive from each source. As a Federal Employee you may be eligible for the FERS Special Supplement as well; this becomes an important dynamic of your income planning process.

3. Prepare Your Paperwork: About a year before you plan to retire, start gathering all necessary documents. You’ll need forms like the SF-3107, Application for Immediate Retirement, and SF-2818, Continuation of Life Insurance Coverage. You will also need to start collecting all of your Standard Form 50’s from your Official Personnel File (OPF); yes, all of them!

4. Meet With a Retirement Specialist: Your agency likely has a retirement specialist who can help guide you through the process and answer any questions you may have. This is a good time to start asking questions and getting a better understanding of OPM’s expected timelines for processing your retirement application. Many federal employees are shocked to learn that only receive one check per month in retirement.

5. Apply for Retirement: You should submit your retirement application to your agency’s human resource office at least a couple of months before your planned retirement date. Yes, you have to show up to work on your final day!

6. Consider Post-Retirement Health and Life Insurance: If eligible, you may continue your health insurance and life insurance coverage into retirement. Make sure to check the requirements and costs. Learning how your FEHB and Medicare work together will help you better understand the second greatest concern retirees have in retirement: health care.

7. Plan for Taxes: Your FERS retirement benefits will be subject to federal income tax. You may need to have federal income tax withheld from your pension and Social Security payments. Also, be aware that your state may tax these benefits as well. WE like our clients to have a 10 year tax plan when possible. As a Federal Employee, most of your benefits are going to be taxable since a significant portion were probably tax-deferred during your working years.

8. Review Your Financial Plan: Meet with a financial advisor who specializes in federal employee benefits to discuss how your income sources will cover your expenses in retirement and whether you have enough savings to last through your retirement.