“I have almost 5 years of Federal Service (FERS—approximately 15 days short). I have over 7 years of honorable active duty service. I retired from the Air Force Reserves with 23 years of service and will receive a retirement in 5 years. Question: can I still buy these 7 years of active duty years towards my Federal Service (FERS) retirement? Thanks! Tom”

Yes, as a Federal employee you should look at buying your military service back. There are few cases where we see that the match does not pencil out.

Buying your time back from serving in the military, in order to have it count towards your time as a Federal Employee is a unique opportunity for Federal employees.

Tom has asked a great question, should he buy back his 7 years of military service to use towards his FERS retirement? Will buying back his military time have an impact on his FERS Pension?

We get this question a lot from former military members who have entered the Federal Employee Retirement System and it is really worth exploring. In this article, we are going to take you through what Military Buy Backs look like for Federal employees and give you enough information to hopefully make an informed decision if you should buy your own military time back.

Your FERS Pension

One of the unique aspects of working for the U.S. Federal Government is that employees who meet the eligibility qualifications can retire from their career in Federal Service and receive a pension for the rest of their lives.

In order to qualify for a FERS Immediate Pension, a Federal Employee must,

- Retire at the Minimum Retirement Age (MRA) with at least 10 years of creditable service for a reduced pension,

- Retire at age 50 with 20 years of creditable service or,

- Retire at any age with 25 years of creditable service.

What is Creditable Service under FERS?

With some small exceptions, Creditable Service for Federal Employees under FERS is defined by the Office of Personnel Management (OPM) as:

- “Federal covered service, that is, service in which the individual’s pay is subject to FERS retirement deductions, such as service under a career or career-conditional appointment,

- Unused Sick Leave under FERS can be used to increase an individual’s total creditable service for annuity computation purposes only;

- Federal service performed before 1989, where an employee’s pay is not subject to retirement deductions, such as service under a temporary appointment, as long as a deposit is paid. There are a few exceptions to the rule that the service must have been performed before 1989.”

During your years of service in one of the military branches a portion of your salary, around 1.3%, was withheld as a retirement contribution. If you retired from military service before being eligible for a pension, this withholding was refunded to you when you out processed. In addition to your own retirement contribution made during your working years, your employer made one as well. Roughly, this equals out to about 3% of your pay.

Had you remained enlisted in the military for 20 years or more, you could qualify for military retirement and receive a pension.

The calculation for your pension is contingent on when you enlisted. When you enlisted you were placed under the retirement system based on the date of your enlistment and in some cases, the choice that you made. (This is normally when the former military members we work with like to remind us that sitting in the recruiter’s office they didn’t get a lot of choices – we get it!)

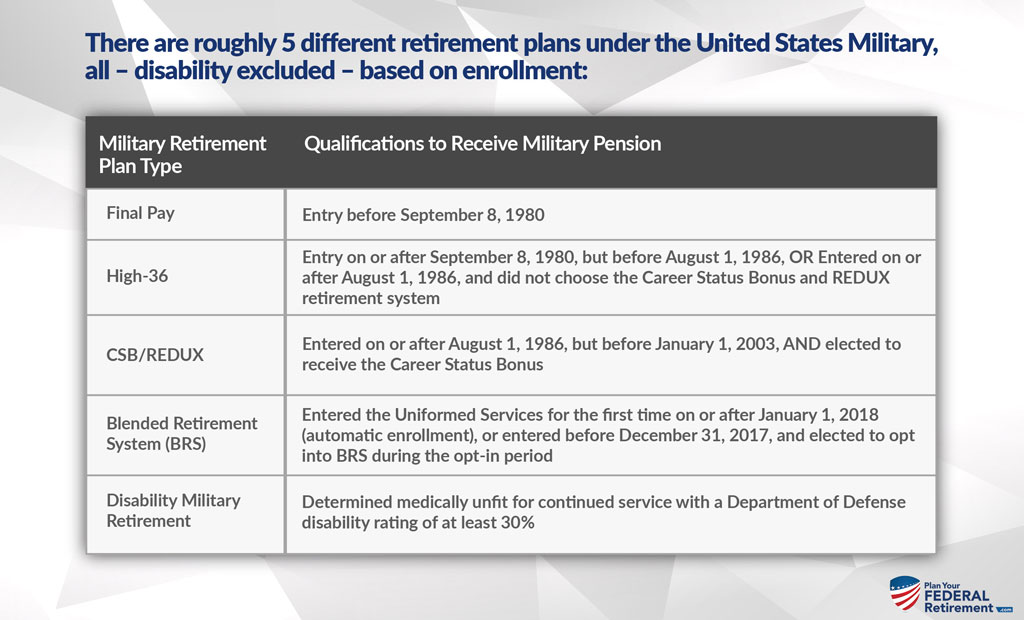

There are roughly 5 different retirement plans under the United States Military, all – disability excluded – based on enrollment:

Military Retirement Plan Type | Qualifications to Receive Military Pension |

Final Pay | Entry before September 8, 1980 |

High-36 | Entry on or after September 8, 1980, but before August 1, 1986, OR Entered on or after August 1, 1986, and did not choose the Career Status Bonus and REDUX retirement system |

CSB/REDUX | Entered on or after August 1, 1986, but before January 1, 2003, AND elected to receive the Career Status Bonus |

Blended Retirement System (BRS) | Entered the Uniformed Services for the first time on or after January 1, 2018 (automatic enrollment), or entered before December 31, 2017, and elected to opt into BRS during the opt-in period |

Disability Military Retirement | Determined medically unfit for continued service with a Department of Defense disability rating of at least 30% |

Often times Military Members will elect to leave uniformed service mid-career. Most service members, choose to do this after completion of their second enlistment or, 7 to 12 years of service.

When you transition from military service to the civilian world, most employers won’t have an option for you to use your military service to qualify for retirement under their defined benefit plan. But the Federal Government does because uniformed or not the employer remains the same: The Federal Government.

Now let’s look into whether or not you SHOULD buy back your military time.

Redeposit of Military Time

If you left military service before being eligible for military retirement, your contributions to the retirement system and your employer’s contributions were refunded to you.

When you out processed from military service you received this refund. This is the amount that you must redeposit unto the Federal Employee Retirement System (FERS) plus some interest.

The interest to redeposit your military time is assessed from the date that payment of your refund to the date you make your redeposit. The interest rate is compounded annually.

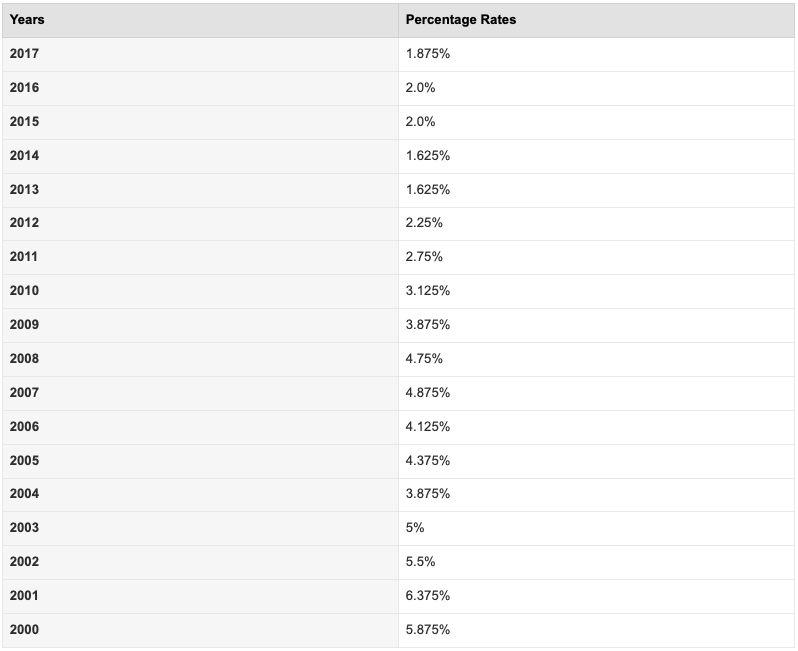

The interest rate to buy back your military time for eligibility to retire under FERS may be far less than you think. Here is an example in recent years what the published interest rate was:

How to Make Payment for Creditable Service

Once you have reviewed your out-processing documents and determined what you received as a refund for your military time, you can begin to calculate the interest each year.

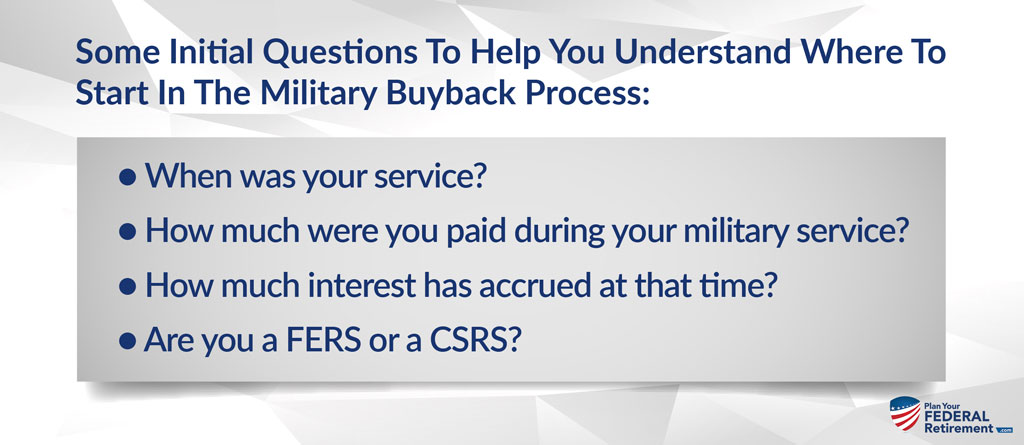

When was your service?

How much were you paid during your military service?

How much interest has accrued at that time?

Are you a FERS or a CSRS?

If you have your military pay records – that is the best. However, if you no longer have a copy of your pay records, you can submit a copy of your DD-214 and send a request to your particular branch of the military’s pay center.

Take the amount of military base pay you received during your service, and multiply that amount by a percentage: CSRS use 7%, but FERS use 3%.

The formula for Military Buyback towards Federal Retirement

Once you have that number, you now need to add interest.

The interest rate is different for each year – and of course, the longer you wait to do a military buyback, the more interest you will have to pay on top of your initial percentage of base pay. It is not uncommon for interest to be 2 or 3 times the amount of your initial percentage of base pay.

BUT – do not despair. Even with tons of interest – you will still almost always get a greater benefit in your pension than what you have to pay to buy back your time with interest.

Military Buyback: Let’s Look at an Example…

Bob served 3 years as an enlisted member of the military: 1973, 1974 and 1975.

Later in 1988, Bob began his federal career under FERS. He now has 22 years of service.

Bob wants to know if he should buy back his military time.

First, we need to total up Bob’s military base pay:

Example of Military Buyback for Federal Retirement

Now for the interest:

For an easy example, we’ll say Bob was hired under FERS on Jan 1, 1988.

Bob’s ‘grace period’ on military buyback was from Jan 1, 1988 – Jan 1, 1990. The first date interest will be added to his deposit is a year following the grace period: Jan 1, 1991. Interest will continue to accrue until Bob pays the entire deposit due.

For Bob’s example, if he were to pay back his deposit now, it would be approximately $1,300 including the interest.

Can you buy back time with no interest?

There is an interest-free ‘grace period’ of two years. If your military service was before your federal career, the grace period generally starts the day you were hired under FERS or CSRS.

Interest is accrued once a year – so technically, if you paid the deposit for your military time right before the third anniversary of your federal hire date – you can probably get by without paying any interest on your time.

However, most of the federal employees I’ve talked with were not even aware of this grace period. Or they just didn’t understand how big a benefit it is to buy back their prior military service. And by then, the grace period had long since been over.

If I buy my military time back, how will it effect my pension?

Your Federal Pension is determined by your High-3 Salary, your Years in Service and your CSRS or FERS Pension Multiplier.

If you buy back your military time – it will increase your Years in Service. And the more Years in Service you have, the larger your pension will be.

Let’s Go Back to Our Example…

Bob is now 57 years old and has 22 years of federal service.

Right now, Bob is planning on working another three years. By then, he’ll be age 60 and he will have 25 years of service. He will be eligible to go out on an immediate and unreduced pension (since he will be age 60 with 20+ years of service).

For easy numbers, let’s say Bob’s High-3 Salary was $100,000.

By age 60, if he doesn’t buy back his military time, Bob will have 25 years of service.

We take $100,000 x 1% x 25 years in service = $25,000 Annual FERS Pension

However, with a military buyback, Bob could add an extra three years of service to his calculation:

$100,000 x 1% x 28 years in service = $28,000 Annual FERS Pension

By buying back his military time and adding three years to his creditable service, Bob will receive an extra $3,000 a year in his FERS pension, for the rest of his life.

And if he chooses to leave a survivor annuity to his wife – her survivor annuity will be based on Bob’s higher amount.

So in our example, even though his military time cost him $1,300. But it increased Bob’s pension by $3,000 a year, for every year, for the rest of his life.

You can find more specifics in Chapter 23 of OPM’s CSRS/FERS Handbook.

"Does it make sense for me to buy back my military time?"

Everyone’s personal situation is different. And how much your military service increases your pension depends on other factors, like your High-3 Salary.

When considering if a military buyback makes sense for you – you should also think about retirement eligibility.

Another benefit to buying back military time is that in addition to the higher retirement pension, you may be eligible to retire sooner.

So if you’re right on the ‘cusp’ of being eligible to retire – buying back your military time might make you eligible to retire sooner than you had thought.

I can tell you that in my years of working with federal employees, I have not yet once seen a situation where it did not make sense for a person to buy back their ‘unused’ military time.

Even so, it is still important to understand your retirement benefits and run the calculations for your own personal situation.

Are You Thinking About Retirement?

Federal retirement benefits are complex. You’ve devoted years, probably decades of your life to your federal career. Make sure you understand your federal benefits BEFORE you retire.