“If I retire after age 62, and supplement my monthly FERS pension by making small withdrawals from my Traditional TSP (assume $2,000/ month), would IRS rules determine that I was now in “distribution status,” and permanently stuck with Minimum Required Distributions every year?” – Victor.

What are RMDs (Required, Minimum Distributions)

Remember all those years you worked for the Federal Government and put money into your Traditional TSP? Well, those monies weren’t taxed on the federal level.

As an incentive to encourage people to save for retirement independently AND to encourage Employers to help Employees save, tax-deferred accounts allow employees to NOT pay federal income taxes today on money they are saving for retirement.

That is – until the person reaches the age of “Required Minimum Distributions,” or as most people call it, “RMDs.”

Not paying taxes now does not mean you can avoid that money being taxed forever. Aunt IRS is always looking for the right time to show up, and if you don’t schedule her, she will insist on arriving when you reach your RMD age.

The federal government requires retirees to take a minimum distribution from their retirement accounts once they have reached a certain age threshold. The primary reason for these mandated distributions is so the government can begin collecting taxes on the money that was contributed to these accounts on a pre-tax basis and has been growing tax-deferred.

How are RMDs calculated (Required, Minimum Distributions)

The Internal Revenue Service (IRS) has a formula for calculating how much you need to take out of your tax-deferred retirement accounts each year after you have reached the age requirement. How nice of them.

Note: Retirement accounts are considered individual assets. The formula for a married couple in one household applies to each person’s retirement accounts – not combined.

To determine your RMD, the IRS has a “simple” formula for you to follow:

Step 1. Determine the Account Balance: First, you need the account balance as of December 31 of the previous year for the retirement account for which you calculate the RMD.

Step 2. Find the Appropriate Life Expectancy Factor: The IRS provides life expectancy tables to help you determine your RMD. The table you’ll use depends on your circumstances:

- Uniform Lifetime Table: This is the most commonly used table. You’d use this if your spouse is not more than 10 years younger than you or isn’t the sole beneficiary of the account.

- Joint and Last Survivor Table: Use this if your spouse is the sole beneficiary of the account and is more than 10 years younger than you.

- Single Life Expectancy Table: This is primarily used by beneficiaries of retirement accounts.

You’ll find these tables in the IRS’s Publication 590-B. For each age, there’s a corresponding distribution period (life expectancy) number.

Step 3. Perform the Calculation: Divide the account balance by the life expectancy factor.

Example of Calculating an RMD (Required Minimum Distribution)

For example, if you turned 75 in 2023 and your account balance was $100,000 at the end of the previous year, and using the Uniform Lifetime Table you find a life expectancy factor of 22.9, your RMD would be:

RMD = \frac{100,000}{22.9} = $4,366.38

This means you’d be required to withdraw at least $4,366.38 from your retirement account in the current year.

I have multiple retirement accounts, how do I calculate my RMD?

Most pre and retirees have multiple retirement accounts earmarked as retirement savings.

- Individual Retirement Arrangements (IRA)

- TSP

- Even 401(k) or 403(b)’s from other employers outside of the federal government.

RMDs must be calculated for each one, though some rules allow aggregation for certain account types, like IRAs.

To avoid such situations, many individuals either set up automatic distributions with their financial institutions or work with financial advisors, like those at Plan Your Federal Retirement, to monitor and manage their RMDs.

If you ever find yourself unsure about RMDs it is 100% worth the time and money to consult with a professional vs. trying to figure it out on your own and making an irrevocable decision (especially when significant penalties are in place).

What happens if I do not take my RMD (Required Minimum Distribution)?

Always take your RMD. The penalty for not taking your RMD is significant!

- OLD PENALTY ALERT (Prior to 2023): The penalty for not taking the full amount of your RMD is steep. You will be taxed at 50% of the amount you should have withdrawn but didn’t. This penalty is in addition to the regular income tax you owe on the distribution.

- NEW PENALTY ALERT (After 2023): Starting in 2023, with the introduction of SECURE 2.0, this harsh penalty tax for missed or insufficient RMDs is reduced to 25%. Moreover, if the error is rectified within a two-year “grace period,” the penalty drops even further to just 10%. Additionally, the new rules set a three-year time limit for imposing the RMD penalty tax.

Why is there a penalty if you do not take your RMD? The government wants money. You did not pay taxes on tax-deferred dollars for several years but at some point, that dog will come home to rest. The penalty is so significant because the government wants to ensure that people are not simply using these retirement accounts to avoid taxes indefinitely.

The primary purpose of these accounts is to provide income in retirement, not just to be a tax shelter.

Do RMD (Required Minimum Distributions) ever stop?

Yes, when the tax-deferred account balance has been exhausted. Or more bluntly, when there are no more funds left to tax. Once you reach the age where you’re obligated to start taking RMDs, you must continue to take them annually for the rest of your life or until the account is fully depleted.

This is one of the reasons that our Financial Advisors make sure that they are talking with our federal employee clients about ROTH conversions.

What age do I need to take RMDs?

SECURE 2.0 contains several changes affecting RMD (Required Minimum Distributions):

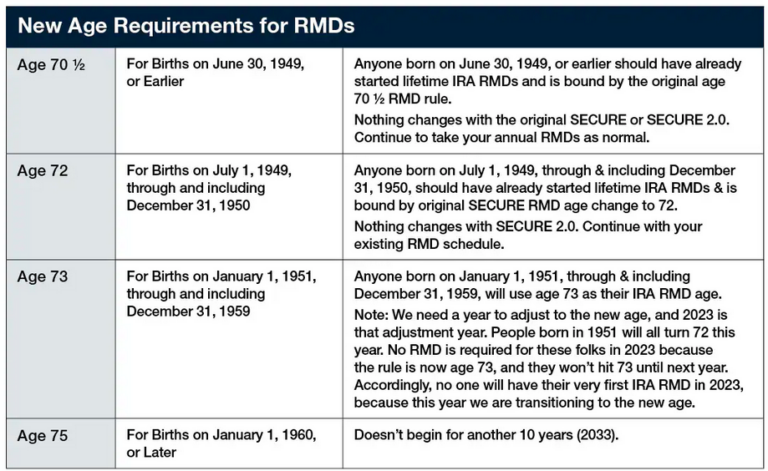

- The provision that has received the most attention concerns certain retirement account owners who may now delay their RMDs even longer. While the SECURE Act of 2019 increased the RMD age from age 70 ½ to age 72, SECURE 2.0 increases the age to 73 and as late as age 75.

- Participants in Roth employer plans (i.e., 401(k)) no longer have to take lifetime RMDs from these accounts.

- The new legislation also reduces the penalty tax for not taking, or taking less than, your RMD due for the year.

- Provisions of the law streamline the statute of limitation rules for certain errors related to your IRA.