Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees. President Trump has issued executive orders requiring Federal Employees working remotely since the COVID outbreak in 2020 to return to their physical offices five days a week.

Everyone anticipated that when President Trump took office, there would be radical changes for Federal Employees but I doubt anyone really knew (knows?) to what extent. When we work with Federal Employees, one of our major focuses center around what can we control and what options do you have when it comes to your financial success.

This time is no different. Federal employees still need to answer questions like,

Should I retire from federal service?

Am I eligible or even ready to retire?

Am I financially prepared to retire or no longer work for the government?

If I accept the deferred resignation, what benefits do I keep or lose?

Our goal is to walk you through some of those options and discuss how this information might impact you and your family.

To begin with, let’s tackle the most pressing and deadline-sensitive issues: returning to the office or submitting a voluntary, deferred letter of resignation (opm.gov/fork/faq)

What is the “fork in the road”: the email that two million federal employees received in January 2025 made it clear: employees who were working remotely can choose to return to the office and embrace the four pillars of “reshaping the government” outlined by the Trump Administration, or submit their deferred resignation by facing the deadline.

Two options but thousands of decisions to be made.

How to know if you should retire from Federal Service?

There are two sides to this equation that we will keep coming back to: the emotional and the finanical. The emotional component is just as important but unlike the financial aspect, that one is harder to solve. Financial components are just math and well, at the end of the day the numbers are going to be what they are going to be.

The first question we want you to answer is, are you eligible to retire from Federal Service?

There are – for the purpose of this conversation – two types of retirement: immediate and early.

To be eligible for immediate retirement or an early retirement, federal employees must meet these requirements:

Immediate Retirement:

Age 62 with at least 5 years of service,

Age 60 with at least 20 years of service,

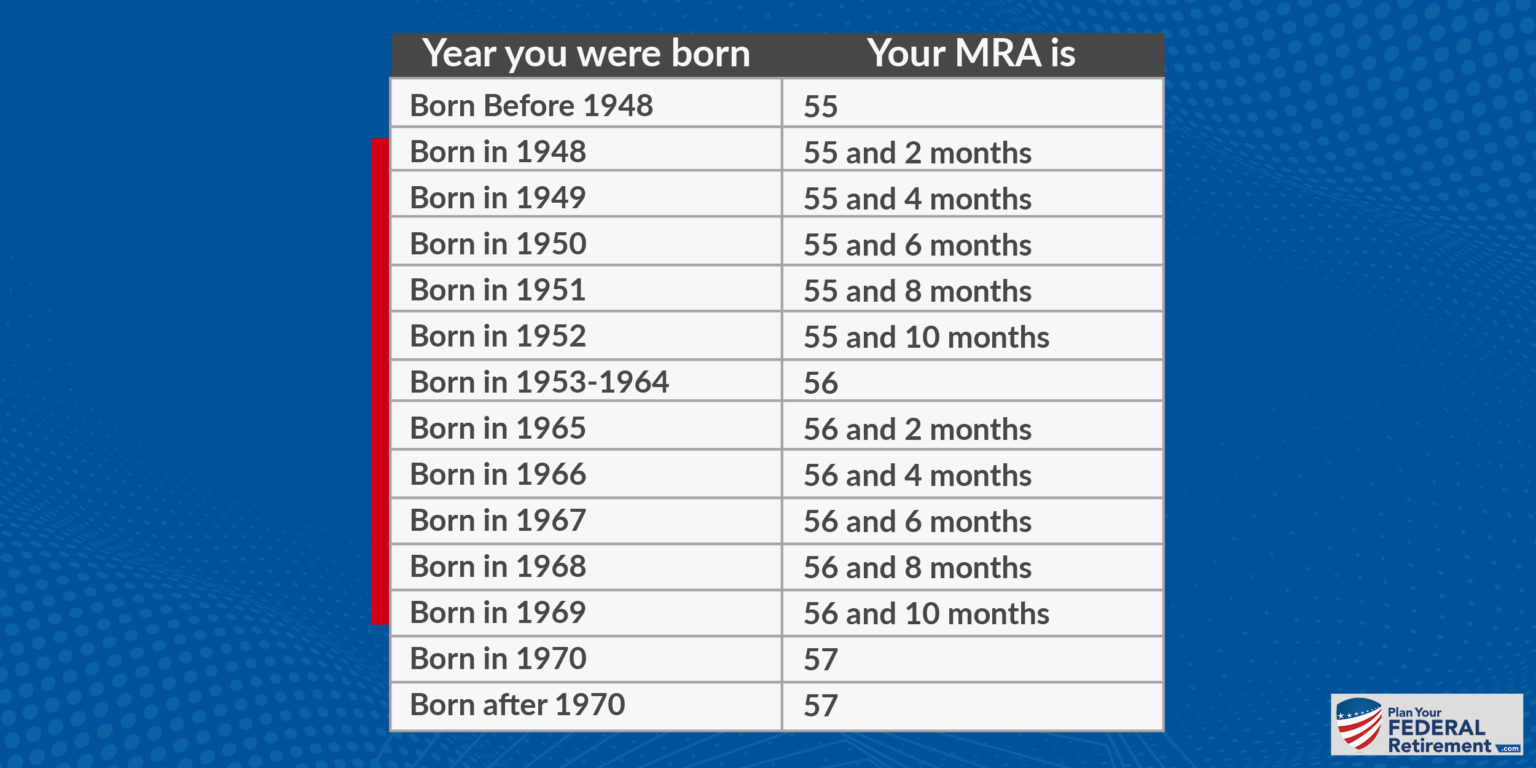

Minimum Retirement Age (MRA) with at least 30 years of service. The MRA varies between 55 and 57, depending on your birth year.

Early Retirement (MRA+10):

You can retire at your MRA with at least 10 years of service, but less than 30. However, opting for this will subject your pension to a reduction by 5% for each year you are under age 62 unless you delay the commencement of your benefits.

What benefits do federal employees keep in retirement?

Under an immediate retirement, federal employees might be eligible for benefits like:

- Pension benefits: OPM calls this an annuity. We call it a pension so as not to confuse consumers with the insurance product available, called an annuity.

- Federal Employee Health Benefits.

- Federal Employee Group Life Insurance: contingent on your personal circumstances FEGLI might be appropriate. This is one you will really want to shop around and determine if it is the most approropate option for you as there are many competitive products in the private sector.

- Federal Employee Long Term Health Insurance Program: if you have elected to participate in the Long Term Care program, for a premium.

- Survivor Benefits: offered to federal employees but like most of the decisions that you make, depends on your personal circumstances. The manner in which you complete your retirement form (SF-3107) can determine if you have disinherited your spouse so it is really, really important to make sure that you work with someone to help review your application before you submit it. There is no “undo button” when it comes to retiring right.

Confused about your benefits? Take an online benefits class.

If it has been some time since you last took a benefits class, you can enroll in our online program today.

Click here for the FERS Retire Right self study program that will walk you through:

FERS Annuity Benefit & Survivor Benefits:

- FERS Annuity: A pension benefit calculated based on years of service and salary, available upon retirement. Eligibility and amount depend on age, years of service, and the salary of the highest-earning years.

- Survivor Benefits: Options to provide financial benefits to surviving spouses or other designated beneficiaries. The retiree can choose to reduce their annuity to provide a survivor benefit.

Social Security:

- Federal employees contribute to Social Security and are eligible for benefits upon reaching retirement age. Benefits are based on lifetime earnings and the age you start benefits.

Thrift Savings Plan (TSP):

- A retirement savings and investment plan for federal employees, offering a variety of funds in which employees can invest. Retirees can choose from several withdrawal options, including lump sums, monthly payments, or annuities.

Federal Taxes:

- Pensions, Social Security benefits, and withdrawals from the TSP are subject to federal income taxes. Retirees need to plan for tax implications based on their total retirement income.

Long-Term Care Insurance:

- Provides coverage for costs associated with long-term care needs that aren’t covered by health insurance, Medicare, or Medicaid. Federal employees can enroll in the Federal Long Term Care Insurance Program (FLTCIP).

Life Insurance:

- Through the Federal Employees’ Group Life Insurance (FEGLI), employees can carry life insurance into retirement if they have been enrolled in FEGLI for the last five years of their federal service or for the majority of the time they were eligible to participate.

Health Insurance:

- Retirees can continue their Federal Employees Health Benefits (FEHB) program if they’ve been enrolled for the five years immediately before retirement or from their first opportunity to enroll.

Medicare:

- Generally available for individuals aged 65 and older, providing health insurance coverage. It works alongside FEHB, where Medicare typically becomes the primary insurance, and FEHB serves as secondary insurance.

Estate Planning:

- Involves planning for the management and disposal of a person’s estate during life and after death. This includes creating wills, trusts, powers of attorney, and other legal documents to ensure assets are distributed according to the individual’s wishes.

This class is available online and ondemand for you and your spouse to dive deep into your benefits and the options that you have.

How do you know if you have enough money to retire from federal service?

As a financial advising firm that focuses on helping federal employees get to and through retirement, there is one goal that we are constantly thinking about: help our clients not outlive their retirement savings.

When federal employees are facing the option to retire, one of the things that we want them to do three years ahead of time is to start living off of their anticipated retirement income while they are still working.

You worked your entire lifetime and anticipated having a check every two weeks coming in that dictated what financial decisions you were able to make. Cashflow determines most of our lifestyle choices and in retirement, that will not be any different. Oh, except you will receive one, monthly check from OPM vs. every two weeks under an immediate retirement.

There is no magical number that every single person needs to have before they can retire because that number is different for everyone. Someone may need $2,000,000 before they can retire while others only need $800,000. There are a lot of thoughts, theories and articles that try and give a one-size-fits-all solution but in our opinion, it doesn’t matter what works for everyone else – you need to determine what works best for you.

What we know, after helping thousands of people retire, is that the first 18 months of your retirement – you are going to overspend. It’s just going to happen. All the things you were never able to do because you were constricted by work, are going to be available to you now and most of them well, they are not free.

That is why we believe that living off of your retirement income, before you retire is critical. Make the adjustments while you still have income coming in.

When should federal employees use their retirement savings?

Your federal retirement benefits are only a few fractional pieces of your retirement plan. Important pieces but pieces to a much bigger puzzle.

Think of your retirement from federal service as a three-legged stool.

As a Federal Employee who retires under an immediate retirement: you have your Pension (OPM calls this your Annuity), your Social Security benefits (maybe also the FERS Special Supplement depending on your situation), and your Thrift Savings Plan as well as personal retirement savings like IRA’s and ROTH IRA’s.

After OPM scrubs your Official Personnel File and determines what your pension will be, they will start to send you a monthly check. If you are eligible for Federal Employee Health Benefits (FEHB) in retirement, make sure that you are taking the premium payment into consideration. Remember, while you were working your premiums were pre-tax and when you retire, they will be post-tax. One of the most common missteps we see Feds make when trying to calculate their retirement income is forgetting about good old Aunt IRS showing up. Taxes are still relevant for retirees.

Once you have determined what it takes for you to live the lifestyle you want (or, can afford) in retirement you need to weigh that against what you will earn from your FERS Pension. Do you have enough money or will you need to start leaning on other legs of your retirement stool: Social Security and/or your TSP?

Starting Social Security as a Federal Employee

Curious about when to start social security benefits? Our financial advisors dive into this topic here.

There are three key times in which you can consider taking social security,

Early Retirement (Age 62): You can begin receiving Social Security benefits at age 62, but your benefits will be permanently reduced.

Full Retirement Age (66 to 67): If you start receiving Social Security benefits at your full retirement age, you will receive the full benefit amount based on your earnings record. The full retirement age is 66 for people born between 1943 and 1954 and gradually rises to 67 for those born in 1960 or later.

Delayed Retirement (Up to Age 70): You can choose to delay receiving Social Security benefits past your full retirement age to increase your monthly benefit. Benefits increase by a certain percentage (depending on your birth year) each year you delay until age 70, which is the maximum benefit start age.

Just because you CAN start taking social security at age 62 does not mean necessarily that you should. Remember, this is one leg of your stool and one that needs to last throughout your lifetime. Lots of people we chat with think that starting social security at the age of 62 is the only way that they will receive “all of their money” back from the years that they paid into the Social Security system – that’s an emotional response. Make sure when you are planning your retirement that you weigh emotional and financial decisions with equal judgment. It might make sense for you to start SSA early and it might not, this is contingent on your personal financial situation.

You might have other resources available to you that allow you to delay taking social security.

When to use your Thrift Savings Plan (TSP) for retirement?

People are living longer and that means they need more money in retirement savings than ever before.

We hear about a lot of ways that Feds drained their TSP prematurely by not understanding the consequences of their decisions. There are many ways that Feds can decimate their TSP by making decisions that they think are for their betterment long term: large distributions, forgetting to income tax plan or – and this one is so painful to watch: using the TSP to pay off your mortgage! Have we seen this strategy make sense before, absolutely! Does it for most people we chat with – no.

You need to have a 10-20 year plan on how you are going to optimize your retirement savings. You do not have to put all of your weight on one side of the stool all at once.

Before making big decisions on how best to use your retirement nest egg, work with a financial advisor who understands your benefits and long-term financial goals. You may have the best strategy already mapped out for you and your family but it never hurts to bounce it off someone who has your long-term best interest in mind.

A financial professional has generally helped other people plan their retirement.

You are, hopefully, retiring just once.

What does retirement really look like for federal employees?

Earlier, we discussed the financial impacts of retirement and what we think you need to prepare for but as we move along, there are some that cross from pure mathematical equations into emotional ones that have financial impact.

When we ask our federal employee clients about retirement one of the first questions is, where do they want to live in retirement?

It’s amazing to think that just as you are about to stop working you may make the biggest move of your life. Pack up the house that you have lived in for 20 years, say goodbye to friends and off you go to live where the kids / grandkids are or the weather is better. We see retirees do this all of the time.

When you retire, where do you want to live? Are you staying in the same State or even, the same house?

Does the house that you raised your family in make the most sense for you to age in place? Are you looking forward to all the landscaping upkeep or does doing so mean a few more aches and pains for the next week?

Once we determine where you want to be then we can factor in the financials like: house payments, property taxes, income taxes and the cost of healthcare in that specific area.

If you are planning on moving to another State, have you considered renting an Airbnb in that area for about 3 months (longer than a vacation time frame) and really getting to know the different neighborhoods, communities and Churches? How you spend your days in retirement and just because Zillow shows you your “dream home” online doesn’t mean that life there will be a dream. You want to spend some time feeling the surrounding areas out and determine what your day-to-day might look like.

Are you ready to retire emotionally?

How will you account for days when the novelty of retiring wears off? When you stop feeling like it is a vacation or you are playing hookey, what will you do? It isn’t all-day golf and gardening for many retirees.

We see many retirees, especially those who were in charge of running agency-wide projects, struggle with their sense of purpose in retirement.

How many people do you socialize with outside of your work community?

When you do not have work occupying so much of your existence, what will?

You want to sit down with a good old-fashioned day planner or printed calendar and account for your time. Determine what you want to do and have the capacity for.

Retirement doesn’t mean you fall into a period of uselessness but it can be a slippery slope if you are not carefully accounting for what you will do beyond work.

Is your spouse ready for you to retire?

Will you need to continue to work while your spouse is retired? Have you had conversations with one another about what that will look like for your household?

If one of you is going to keep working does that mean full-time or part-time? An aspect that many forget to plan for is that one person may be fed up with working and ready to stop entirely while the other spouse finds joy and purpose through being busy. This often leads to one spouse working full or part-time for the first one to three years that a person retires from federal service.

Make sure that you are having these conversations sooner than later.

Are you considering a second career?

Every time that we offer a federal employee benefits class we ask the audience, “who loves their job” and hands burst into the air. So many people love the mission but no longer want to do the day-to-day workload.

Changes in workforce, changes in administration, changes in inner agency policies – this all takes a toll over time and you may find that you love your work but no longer feel the need to work for the Government.

Have you cleaned up your resume and floated it by a few companies you would like to work with? Many of our Feds that retire and find themselves too young to stop working entirely enjoy doing another career that interests them or volunteering and non-profits.

We work with many Federal Employees who choose to work only so far as their social security benefits are not offset.

ABOUT THE AUTHOR

Micah Shilanski, CFP®, is a distinguished financial planner known for his deep commitment to providing proactive advisory services to his clients. As the founder of Plan Your Federal Retirement, Micah has dedicated his career to helping federal employees understand and optimize their benefits to help ensure a secure and prosperous retirement. His experience is widely recognized in the industry, making him a sought-after speaker and educator on financial planning and retirement strategies.

Micah’s approach is client-centered, focusing on creating personalized strategies that address each individual’s unique needs. His work emphasizes the importance of comprehensive planning, incorporating aspects of tax strategy, investment management, and risk assessment to guide clients toward achieving their financial goals.