Voluntary Early Retirement Authority (VERA) for Federal Employees: Eligibility, Benefits, and TSP Rules

Frequently Asked Questions about Voluntary Early Retirement Authority (VERA) for federal employees.

Does Deferred Resignation under the “Fork in the Road” qualify as a VERA?

Yes, the deferred resignation qualifies as a Voluntary Early Retirement for eligible employees. This article will walk you through what you need to know as a federal employee accepting a VERA.

What is a VERA: Voluntary Early Retirement Authority

The Voluntary Early Retirement Authority (VERA) authorizes voluntary early retirement. Most federal employees refer to this option by the authority’s acronym, “VERA.”

The VERA allows agencies to increase voluntary retirement during periods in which agencies are reshaping, reorganizing, or a reduction in force.

Critical: a VERA is not the same as a Voluntary Separation Incentive Payment, so keep this in mind if you decide to retire from federal services.

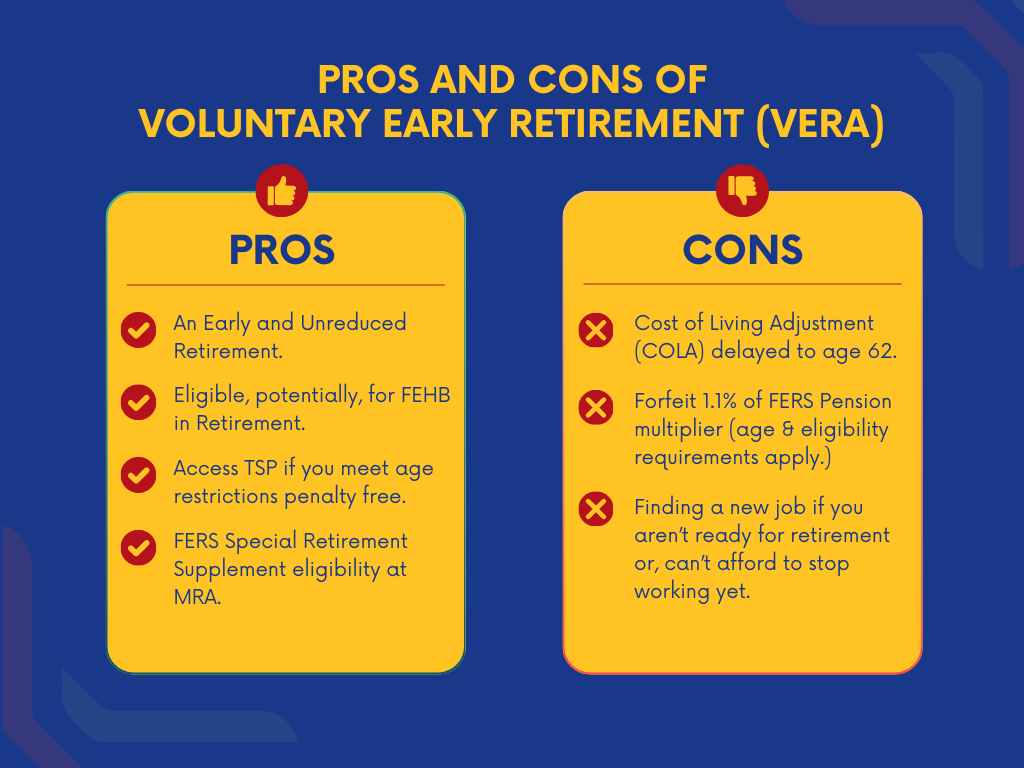

As with all decisions, federal employees want to evaluate what they will be giving up by accepting a VERA (hint: FERS Special Supplement is something you want to pay attention to here).

Am I eligible for a VERA?

In order for a federal employee to be eligible for a Voluntary Early Retirement Authority (VERA) package, they still have to meet certain criteria.

There are six requirements and considerations that you want to take into consideration when trying to determine if you are eligible. Meet the minimum age requirements under VERA. Under 5 U.S.C. § 8414(b)(1), an employee qualifies for early retirement if they:

- Are at least 50 years old with at least 20 years of creditable federal service, or have completed at least 25 years of creditable federal service, regardless of age.

- Have been continuously employed by the agency for at least 31 days before the date that the agency initially requested OPM approval of VERA;

- Hold a position that is not a time-limited appointment;

- Have not received a final removal decision based upon misconduct or unacceptable performance;

- Hold a position covered by the agency’s VERA; and

- Retire under the VERA option during the agency’s VERA window.

As these requirements are built into the FERS Employee statutes, OPM does not have the authority to arbitrarily change them for each agency.

Your agency has to apply to participate in a VERA; as an individual federal employee you can’t just ask for a VERA. Your agency must be approved first.

Can I use my annual leave to qualify for a VERA?

Your annual leave (remember, annual and sick leave are different) does NOT count towards your eligibility to obtain an immediate pension under the VERA. Meaning, you may want to ensure you use it before your voluntary early retirement in this particular situation if appropriate.

The “Fork in the Road Deferred Resignation” is not the same as a Reduction in Force (RIF). in a RIF, your annual leave can be used to help you:

- Gain title (be eligible for) an immediate pension and/or

- Continue health insurance coverage into retirement.

As a federal employee, your health insurance benefits are your BEST benefits. We have green-glasses from the outside looking in reviewing them. They’re phenomenal, and as you move into the next chapter of your life, important not to forfeit because you didn’t understand the rules around being eligible to keep them.

Work with a Federal Employee benefits expert to help you strategize how and when to use your annual leave. Remember that your agency cannot keep you on payroll beyond the date you first become eligible for your pension, so timing matters.

Keep in mind though that Annual Leave and Sick Leave are not counted the same.

What happens to Sick Leave if I take a VERA?

Sick leave cannot increase your eligibility for retirement; meeting your years of retirement service credibility. However, it can increase your pension benefits.

Do I keep health insurance if I take a VERA?

Your health insurance is your BEST benefit, and we want to ensure you keep it in your retirement if you are eligible.

If you are taking a Voluntary Early Retirement, you might be eligible to keep your health insurance in retirement as long as you meet the criteria for doing so:

- Eligible for an Immediate Retirement and,

- Have been enrolled in FEHB for the last 5 years.

Eligible for an Immediate Retirement

Immediate retirement refers to retiring from federal service with an immediate annuity. Choosing immediate retirement allows federal employees to maintain their FEHB benefits into retirement, provided they meet the length of service requirement mentioned above.

You must have Continuous Coverage.

Maintaining continuous enrollment in the FEHB program throughout one’s federal career is crucial to ensure uninterrupted FEHB coverage in retirement.

To be eligible for FEHB you must have been enrolled in FEHB for 5 years. Gaps in enrollment may impact eligibility for FEHB benefits after retirement.

The most frequently misunderstood question that we get about Federal Employee Health Coverage is whose coverage it needs to be?

If you are a dual-fed (two married people who are both federal employees) and enrolled in your spouse’s federal employee health benefits, this counts towards your five consecutive years. It does not have to e a self-only plan to qualify.

Expert Tip: make sure that you have a complete copy of your Official Personnel File (OPF) before you retire.

Do I get the FERS Special Retirement Supplement if I take a VERA?

Yes, you are still eligible for your FERS Special Supplement under a Voluntary Early Retirement. However, you will not necessarily receive that FERS Special Supplement right away.

If you retire under a VERA, you will receive your FERs Special Supplement when you reach your Minimum Retirement Age (MRA).

What is the Special Retirement Supplement?

FERS consists of 3 different components: the FERS annuity (pension), Social Security, and the Thrift Savings Plan (TSP). The Special Retirement Supplement (SRS), AKA the FERS Supplement, was designed for federal employees who retire before they can start taking out from Social Security, which is age 62. It is an extra supplemental income to bridge the gap from retirement to age 62.

Who is eligible for the Special Retirement Supplement?

In order to be eligible for the Special Retirement Supplement, you have to retire under one of the following rules:

- Retire at your MRA with 30 or more years of creditable service

- Retire at age 60 or older with 20 or more years of creditable service

- Retire with Special Provisions (such as a firefighter, LEO, air traffic controller, and more) and be either 50 years old, or have 25 years of service.

The eligibility is the same as qualifying for an immediate pension; therefore, an early retirement (retire at MRA or older with at least 10 years of creditable service) does NOT qualify for an SRS.

How is the Special Retirement Supplement calculated?

Your SRS is calculated for you by OPM. They use a formula involving your earnings history to calculate your benefit computation years, which they then use Social Security law to finally arrive at your SRS pension amount. A much simpler way of finding how much your SRS would be is by using the estimated SRS formula, shown below:

(Years of Creditable Service / 40) x Your Age 62 Social Security Benefit

Your SRS will almost always be lower than what your gross SS benefit will be, because the formula that OPM uses to calculate your SRS does not begin accruing until age 21 for Actual Pay.

When does the Special Retirement Supplement start and end?

If you qualify for the SRS, it will begin once you collect your first pension check after you retire. It will continue to be paid out to you until the month that you turn 62. You don’t actually have to take your Social Security at age 62 – you can delay it as late as 70 years old. But regardless of what age you take your Social Security, your SRS will end at age 62.

How do I apply for the FERS Special Retirement Supplement?

From what we’ve seen, OPM does a great job of calculating the SRS for you so you really don’t have to worry about it. There are no forms or applications you have to fill out; it will happen automatically.

Expert Tip: keep in mind that you will not receive a COLA adjustment until you reach age 62. Therefore, your pension will most likely go down every year as the cost of health insurance premiums increases.

When to ask for help?

Avoid making irreversible retirement mistakes by simply not understanding your benefits. As a FERS employee, your benefits are complex. Make sure that you are taking the time to ask the questions that you need to Retire Right from Federal Service.

If I take a VERA what happens with my TSP?

As a Federal Employee, the Thrift Savings Plan (TSP) is an important tool in your retirement toolbox.

During your working years, you and your agency were able to participate in funding your retirement through employee and employer contributions to your TSP.

When you retire voluntarily under a VERA:

If you separate at age 55 and older, you can access your TSP without penalty. Note: This is important to understand because if you separate at age 54, you cannot access the account until age 59 ½ without penalty.

If you are 59 ½: you can access your TSP without incurring the 10% penalty.

“Exceptions to 10% Early Withdrawal Penalty for your TSP

The SECURE Act 2.0 builds on a list of existing exceptions to the 10% early withdrawal penalty, which may

apply if you take a withdrawal before age 59 ½.

The following are the new exceptions introduced by the SECURE Act 2.0:

- Employer retirement plans: Prior to the SECURE Act 2.0, the 10% penalty was waived for withdrawals

from an employer plan by an employee who departs from their job at the age of 55 or later, or at age 50

for qualified public safety employees. The SECURE 2.0 Act broadened this exception to include public

safety officers with at least 25 years of service with the employer sponsoring the plan, irrespective of age. Additionally, the exception now applies to state and local corrections officers, as well as private-sector firefighters.

- Emergency expenses: Up to $1,000 per calendar year of payments used for emergency personal

expenses.

- Terminal illness: Payments made to an individual with a terminal illness.

- Disaster relief: Payments made as a qualified disaster recovery distribution as defined and limited by

section 72(t)(11) of the Internal Revenue Code.

- Domestic abuse: Up to $10,000 (or 50% of the vested account balance, whichever is less) of any payment received within one year following domestic abuse.

Important tax issues to keep in mind when devising a TSP strategy for retirement:

- Traditional TSP: All traditional TSP distributions are subject to federal income tax and possibly state income taxes. It’s important to understand your state income tax rules.

- Roth TSP: Roth money is separated into two sources: contributions and earnings. You’ve already paid tax on your contributions, so they are never taxed when distributed. Earnings may also be distributed tax-free, but only with a qualified withdrawal. The earnings portion of a non-qualified distribution is taxed and may be subject to the early withdrawal penalty.

- Qualified withdrawals from Roth TSP: A qualified withdrawal meets the following conditions: 1.) Five years have passed since January 1 of the calendar year you made your first Roth TSP contribution, and 2.) You have reached age 59½, have a permanent disability, or are deceased.

- Early withdrawal penalty: Unless an exception applies, traditional TSP funds distributed before age 59½, and the earnings portion of a non-qualified Roth TSP withdrawal, may be subject to a 10% early withdrawal penalty. Roth TSP contributions are never taxed or penalized upon distribution. See the TSP’s Tax Rules about TSP Payments for a complete list of exceptions to the early withdrawal penalty.

- First RMD: The first RMD year is when you turn 73 or the year you separate from service, if later. The first RMD may be delayed until the required beginning date (RBD), which is April 1 of the year following the year in which you turn 73 or the year following the year you retire, if later. If you miss this deadline, you could face a 25% penalty. Note: the TSP will automatically issue a payment in March of the year following the year you turn 73 or the year following the year you retire, if later, to make sure you do not miss the deadline.

- Subsequent RMDs: Must be distributed by December 31 of each year. If you do not withdraw enough to satisfy your RMD, the TSP will send out an automatic payment in December equal to the amount needed to satisfy your RMD for the year.

- RMD Age: The SECURE Act 2.0 changes the age at which you must start taking RMDs to 73 (if you were born between 1951 and 1959) and 75 (if you were born in 1960 or later).

- Mandatory federal tax withholding: TSP federal tax withholding rates vary based on the type of withdrawal.” (National Active and Retired Federal Employees Association. (2024, April). TSP withdrawal options for separated participants. NARFE.)

As you get ready to leave federal service, here are four key steps to take:

- Ensure that the Thrift Savings Plan (TSP) has your most up-to-date mailing address.

- If you have outstanding TSP loans, decide whether to:

- Pay them off in full,

- Keep them open by setting up monthly payments, or

- Allow them to be foreclosed, understanding that the remaining balance and accrued interest will be treated as taxable income.

Final Thoughts: Avoid Costly Mistakes in Your Federal Retirement

Navigating Voluntary Early Retirement Authority (VERA) and understanding its impact on your pension, health benefits, and TSP can be overwhelming. The decisions you make today will shape your financial future—so don’t leave them to guesswork!

To ensure you Retire Right and avoid costly mistakes:

🎙 Listen to our Podcasts – Get expert insights and real-world strategies from federal retirement specialists.

📚 Join Our “Retire Right” On-Demand Class – Learn step-by-step how to maximize your benefits and retire with confidence.

Take control of your retirement today— watch, learn, and retire smarter!