Without a doubt since its inception in 1997, the ROTH retirement account has gained tremendous popularity. Named after the Delaware Senator, William Roth, under the established Taxpayer Relief Act of 1997, the term “ROTH” today generally means how a particular investment is treated for Federal Income Tax purposes.

When you invest in a traditional account your contributions are being made on a pre-tax basis. The monies you put it are not taxed until you withdraw them.

However, with a ROTH retirement account, the money that you put in is taxed today at your current tax bracket. When you withdraw the money, providing you are doing so by the Internal Revenue Code’s rules on making qualified distributions, the funds are tax-free.

ROTH Individual Retirement Account (IRA)

A ROTH IRA is an investment account that is established outside of the Federal Government. It is different than the ROTH Component in your TSP for one really, really important reason.

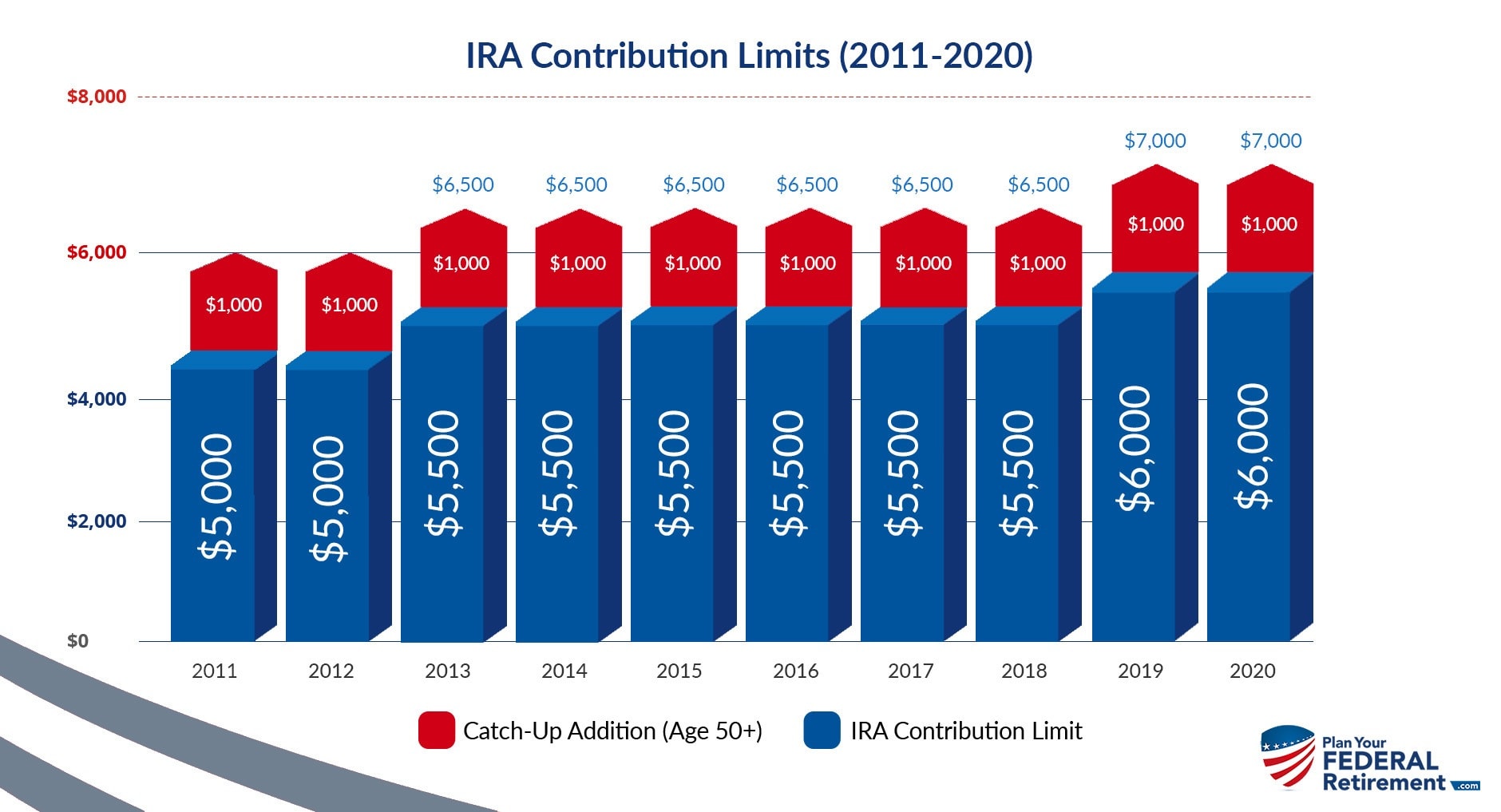

When you invest in a ROTH IRA, you are subjected to annual contributions limits based on age and earnings.

In 2019 the annual limit to participate in a ROTH IRA is $6,000.00. This is NOT the ROTH TSP limit, which we will address.

It is important to know that with the ROTH IRA there are income limits based on your Adjusted Gross Income. If your AGI is in excess of about $186,000 a year, you begin to phase out of participating in the ROTH IRA. There are options like a “back door contribution” that could be considered after you have discussed them with your financial professional and tax professional.

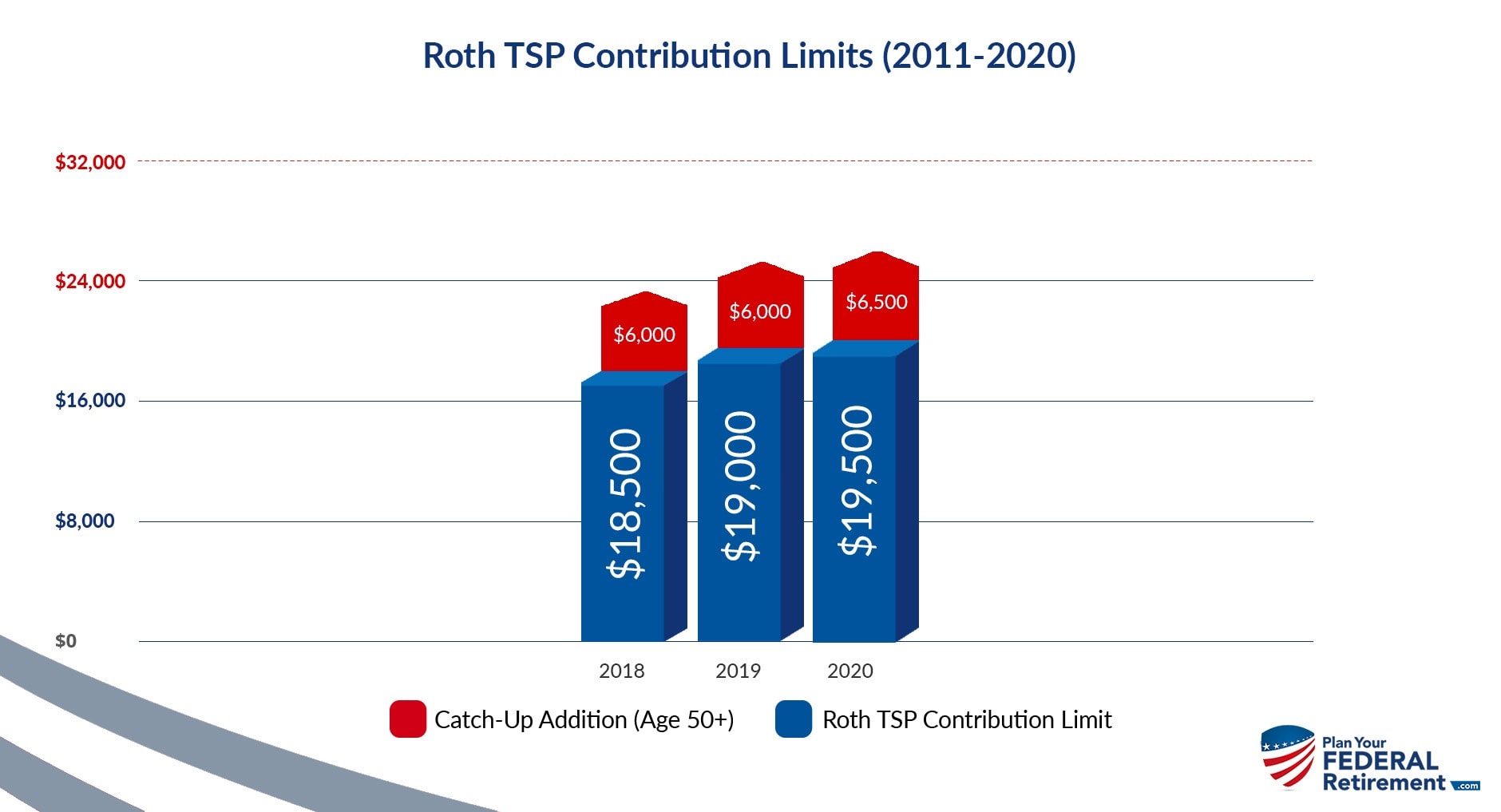

The TSP ROTH Contribution Limits

Here is another reason that we love the TSP as a savings and accumulation tool. In the private sector, your annual contributions to a ROTH IRA are capped at $6,000.00 in the year 2019 with a $1,000 catch-up contribution allowed for those ages 50+.

However, your TSP contribution limits are $19,000.00 and an additional $6,000.00 catch-up contribution for those ages 50+.

Federal Employees could put up to $25,000.00 into their TSP as ROTH contributions if they are ages 50+ in the year 2019.

A ROTH IRA and a TSP Roth Contribution are two entirely different retirement vehicles with different rules. They are not related to one another other than how they are taxed. If you decide to change your contributions to the ROTH, remember that can and most likely will impact your Federal Income Taxes.

Can you fund both a ROTH IRA and make TSP ROTH Contributions?

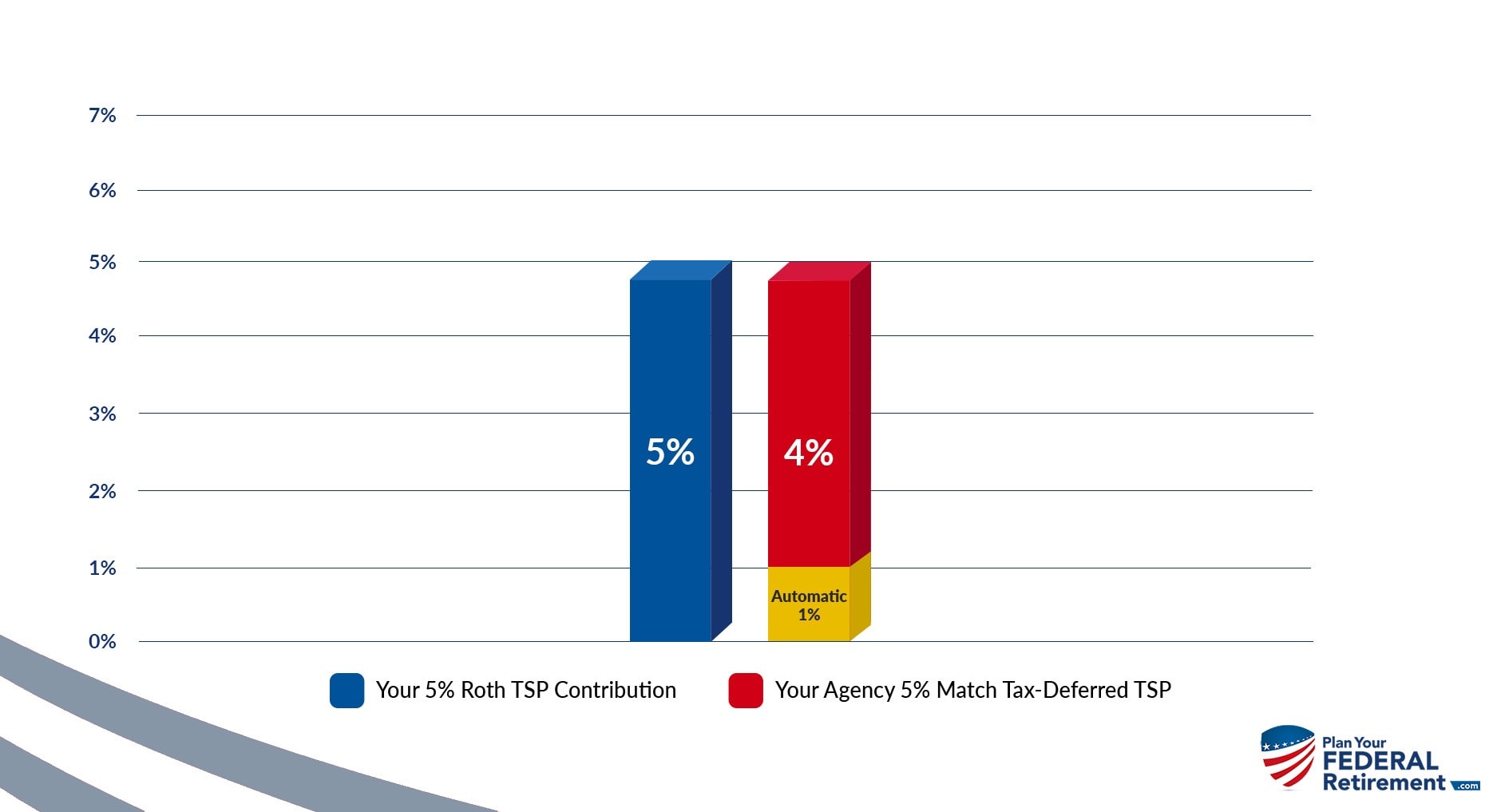

Yes. They are different retirement plans. Keep in mind though that the 5% match made by your employer will always be on a tax-deferred basis. The 5% Employer Match made by the Federal Government goes into the tax-deferred portion of your TSP and not your ROTH even if Y-O-U make 100% ROTH contributions.

Happy Planning!