Question

“Is the money that I withdrawal from my TSP in retirement all taxed as ordinary income or are the contributions that I made taxed as ordinary income and the earnings that I made taxed as capital gains?

– Marvin

Qualified Retirement Account

Your Thrift Savings Plan (TSP) is a qualified retirement plan. That means the structure of the plan meets the requirements of the Internal Revenue Code Section 401. In meeting these requirements, the TSP is eligible to receive certain beneficial tax treatment.

The benefits of this tax treatment help the employer and the employee alike. During your working years, the TSP allows you to make annual contributions as part of an elected salary deferral option.

When you participate in the TSP and are actively making contributions you have two options as to how you want your contributions to be:

- Tax-Deferred – the traditional TSP which allows you to make pre-tax contributions to the plan,

- Taxed – the ROTH TSP which allows you to make post-tax contributions to the plan.

When you go to retire or want to draw money out of your TSP, tax planning will be a critical component to your overall financial plan.

Tax Planning for the TSP

Tax Planning is just as important when you go to retire as it is while you are working.

Too often we meet with Federal Employees who think their federal income taxes will be simplified in retirement; that they will not need to think about this particular aspect of their financial planning.

There are several types of Federal Income Tax; here are some of the most important for you as a Federal Employee to think about:

- Ordinary Income Tax,

- Tax-Deferred,

- Capital Gains Tax and,

- Tax-Free (our personal favorite).

Ordinary Income Taxes range from 0% up to 37% contingent on the parameters that the Internal Revenue Service imposes year to year on income. Ordinary income taxes are what you pay on your wages as you earn them.

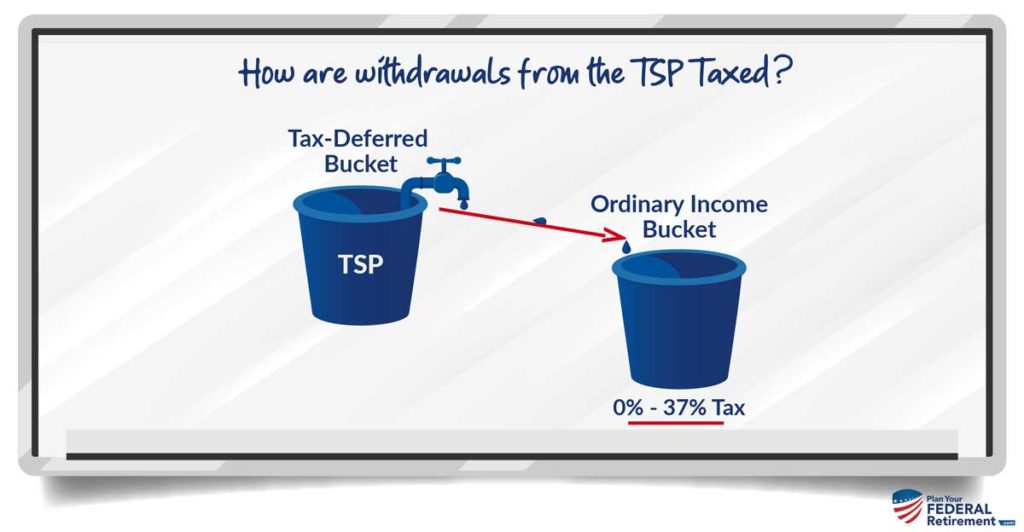

Tax-Deferred means that we are making pre-tax contributions. The monies elected to put into your TSP using the traditional, tax-deferred method means that those monies are not yet taxed. You are putting off paying taxes on those monies until you go to withdrawal them from the plan presumably when you stop working and anticipate your income to be lower.

By taking money out of the Tax-Deferred status it is taxed at your Ordinary Income Tax Rate.

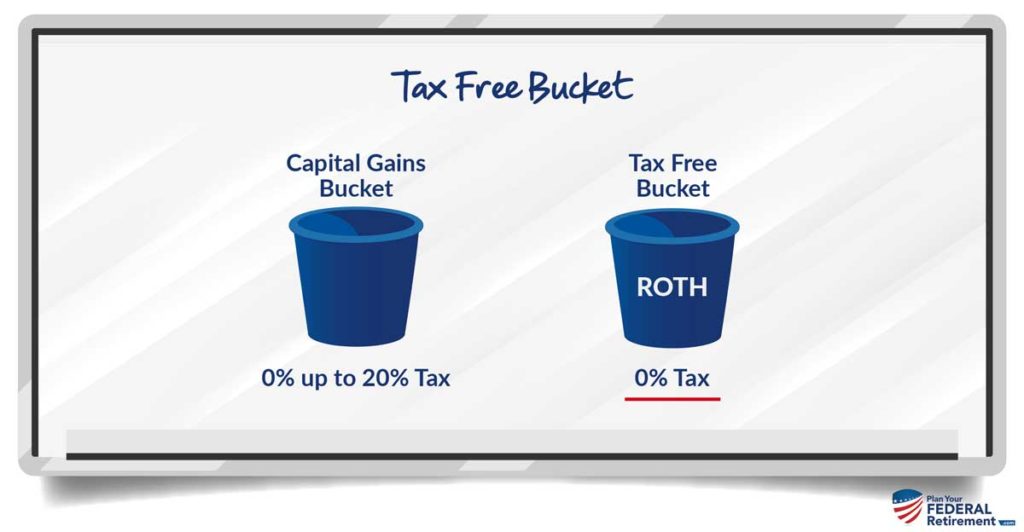

You pay Capital Gains Taxes on the profit that you made from the sale of an investment. You may be familiar with having to pay taxes on any capital gains that you made from the sale of investments if you have an individual brokerage account.

Tax-Free sounds too good to be true but that is the beautiful component of the ROTH TSP. The ROTH TSP allows you to put post-tax contributions into the TSP. That means, you already paid ordinary income taxes on your contributions. Therefore, as long as you meet the requirements of the plan being open longer than 5 years and are older than age 59 1/2 you are eligible to make withdrawals from this account tax-free. This includes earnings.

How are withdrawals from the TSP taxed?

Now let’s answer Marvin’s question. Money withdrawn from the Tax-Deferred TSP account in retirement is taxed as Ordinary Income and not as Capital Gains.

When you elect to make contributions to the tax-deferred portion of the TSP, you are deferring paying ordinary income taxes until later when you withdrawal the monies.

When you elect to make contributions to the tax-free (ROTH) component of the TSP, you are choosing to pay taxes now. After you have met the plan requirements you will withdrawal the monies tax-free.

In Marvin’s case, he is putting money into the Tax-Deferred TSP. Therefore, when he goes to withdrawal those funds from the TSP, he will have to pay ordinary income taxes at his rate on the monies received.

Tax Planning in Retirement

Understanding the various tax buckets is critical to the longevity of your financial plan in retirement.

Make sure you take the time to plan how your withdrawals will work throughout your retirement from tax-deferred accounts.

As always, if you have questions about your Federal Employee Benefits let us know.