“Dear Micah, Thank you for this series. I can retire in October 2019 with 30 years under FERS. I will be 56 years and 10 months old and did not think that I would be eligible for the SRS until age 57. I filed for my retirement the first part of April and when my retirement counselor called me she told me that I will be eligible for SRS immediately upon my retirement in October because I have 30 years in and that I do not have to wait until age 57 to draw the supplement. Have you come across this particular issue with any of your clients? Very Respectfully,” – MartiMarti – this is a great question! There is so little information about how the FERS Supplement works that we understand entirely why you may be a little concerned before accepting a Voluntary Early Retirement. In this article on the FERS Supplement we are going to:

- Provide you with the FERS Supplement Calculation,

- Eligibility Rules for FERS Supplment,

- Provide information on income taxes when it comes to your FERS Supplement and,

- Tell you how to start your FERS Supplement.

Voluntary Early Retirement Authority

In order to retire from Federal Service under FERS and receive your benefits, like your pension, you have to meet the eligibility requirements for an immediate retirement. Eligibility for an immediate retirement means that you have met your Minimum Retirement Age (MRA) and have the required years of creditable service completed. If you meet one of the following sets of age and service requirements, you are entitled to an immediate retirement benefit:| Age | Years of Service |

|---|---|

| 62 | 5 |

| 60 | 20 |

| MRA | 30 |

| MRA | 10 |

- Meet the minimum age and service requirements –

- At least age 50 with at least 20 years creditable Federal service, OR

- Any age with at least 25 years creditable Federal service;

- Have served in a position covered by the OPM authorization for the minimum time specified by OPM (usually 30 days prior to the date of the agency request);

- Serve in a position covered by the agency’s VERA plan; and

- Separate by the close of the early-out period.

Eligibility for FERS Supplement

To be eligible for the FERS Supplement, you must meet two qualifications:- You must be an active FERS employee with 30 years of creditable Federal Service,

- You must be your Minimum Retirement Age (MRA) or be age 60 and have 20 years of creditable service.

How to Calculate your FERS Supplement

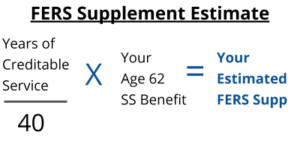

In order to estimate your Supplement amount, you’ll want to have your annual Social Security statement handy. You’ll also need to know how many years of creditable service you would have at your estimated retirement. The calculation for the FERS Supplement is multiple steps. In order to calculate your FERS Supplement, you will need to know what your Social Security Benefits are at age 62 as well as the years of creditable service you have from your Federal Employment. Here is how to estimate what your FERS Supplement may be.

Example on How to Calculate FERS Supplement

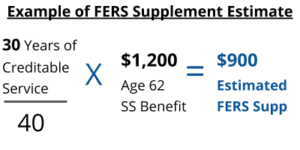

Say Sue is a FERS, and she will retire with 30 years of creditable service. She has reached her MRA, which is 57. And her age 62 Social Security benefit will be $1,200 a month. Approximately how much will her FERS Supplement be?

Reduction in FERS Supplement

The Supplement is treated much like Social Security Income. And if you take any Social Security income before your Full Social Security Retirement Age (Your FRA varies from 65 to 67 depending on the year you were born) your Supplement is subject to a reduction and possibly taxes. If you will have earned income (ex: a part-time job) after you retire from Federal service, your Supplement may be reduced. The reduction is significant and because the income threshold is so low, it will impact many FERS retirees. Especially FERS who plan to get another job, even a part-time job, after they retire from Federal service. Back in the 1990’s, there were some big changes to the way Social Security was taxed. The government decided that they would reduce the amount of Social Security (and FERS Supplement) someone could receive before they reached their Full Retirement Age (for Social Security) and if they earned more than a certain amount. These changes continue to impact the FERS Supplement today. In 2019 the earnings limit is $17,640 What counts toward that limit? Earned income – which is essentially any income you receive as a W-2 wage. So if you earn more than $17,640, your FERS Supplement will be reduced. For every $2 you earn above the limit, your FERS Supplement will be reduced by $1.Here’s How the Reduction Works –

Let’s go back to our example with Sue. Say Sue gets a part-time job after her federal retirement. That job pays her $30,000 a year, which is $12,360 over the income limit. Half of $12,360 is $6,180, which is her annual reduction. Divide that by 12, and we get a reduction $515 a month. Earlier, we estimated Sue’s Supplement to be $900 a month. Once we factor in her reduction, we see that Sue’s Supplement will really be closer to $385 a month. But we have one more hurdle before we really know what Sue’s net amount will be. Taxes…Taxes and the FERS Supplement

When we discuss the Supplement in the FERS Pre-Retirement classes I teach, some people think, “If the government already reduced my FERS Supplement – surely they wont’t tax it too.” Well – they can – and they do. While the reduction in the FERS Supplement is calculated by the Social Security reduction rules; the way the FERS Supplement and Social Security are taxes is different. While the majority (but not all) of your Social Security income will likely be subject to tax; ALL of your FERS Supplement will be subject to ordinary income tax.Looking at Our Example…

Going back to our example with Sue – she has a part-time job that pays her $30,000 a year. In our example, her Reduced FERS Supplement was approximately $385 a month. Taxes are complex, but for the sake of easy numbers let’s say she pays taxes at a rate of 15%. 15% of $385 would be $58, leaving Sue with a FERS Supplement of $327 a month.Mind the Gap: FERS Supplement to Regular Social Security

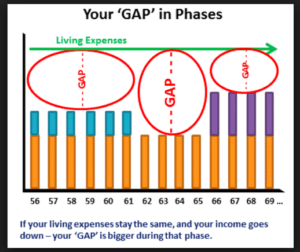

The FERS Supplement will stop the month you turn age 62. And it stops whether or not you have started drawing Social Security at age 62. Some people may choose to start drawing Social Security at age 62 – but others will want to delay until later. Why delay? The longer you wait, the higher your benefit will be. That is, up until age 70. The amount will not increase if you wait any longer than age 70 to draw Social Security. But if you delay drawing Social Security to get a larger benefit – it means you have to go that many more years without the monthly benefit. This can create a money gap – and it’s important to plan ahead for it.

How to Apply for the FERS Supplement

There is no website or online application to apply for the FERS Supplement. If you are eligible to receive the FERS Supplement in retirement than you will receive the allotment automatically. You do not have to “apply” for the FERS Supplement. Likewise, you do not have to cancel or stop your FERS Supplement at age 62. That will cease when you reach age 62 automatically as well. The Government seldom forgets to stop a retirees FERS Supplement, don’t worry! 🙂 However, once you retire you may want to confirm that OPM has your particular file flagged as eligible for the FERS Supplement.How to verify your FERS Supplement Enrollment

When you retire from Federal Service, you will receive a small retirement booklet in the mail. The booklet looks like a piece of junk mail; we cannot tell you how many people throw out their retirement benefits booklet confirming their FERS Retirement information from OPM because they mistook for nothing of consequence. Contained with your FERS Retirement booklet from OPM you will see confirmation of your eligibility to receive the FERS Supplement. The OPM mails you the booklet after they finalize your retirement, a process called certifying your retirement. On average it takes OPM around 3-9 months to process FERS Retirement files. The booklet contains all of the information about your retirement to verify its accuracy. You will see your gross, net pension as well as all of the deductions and survivor benefits. Additionally, you will see your FERS Supplement verification. You have a limited amount of time after you have retired from the Federal Government to ensure the accuracy of your FERS information. To verify that you will receive the FERS Supplement, review your Retiree benefits booklet that OPM has sent you via post. If you find that you are eligible for the FERS Supplement because you:- Have reached your minimum retirement age (MRA) and have at least 30 years of creditable service

- Or have reached your minimum retirement age, are age 60+ and have 20 years of creditable service.

Federal Employees Make Mistakes

But YOU Don't Have To

- Forgetting to Check Your Beneficiary Designations

- Expecting Pension Check to Arrive in 30 Days After Retiring

- Not Knowing the Difference Between SCD vs. RSCD

- Completing Retirement Paperwork Incorrectly

- Failing to Prepare Financially for Retirement

- Failing to Understand Tax Consequences

- Getting Bad Advice

Click below and learn how to avoid making them yourself