When most people think of FERS survivor benefits – they think of the survivor annuity.

But you should know that there are actually many different survivor benefits in the Federal Employee Retirement System (FERS).

FERS has several items with survivor benefit options or important beneficiary designations that you should know about, including:

- FERS Survivor Annuity or Pension

- FEHB Health Insurance

- FEGLI Life Insurance

- FERS Supplement (in some cases)

- Last FERS Paycheck

- Social Security

- TSP – Thrift Savings Plan account

Let’s cover the primary FERS survivor benefit – the Survivor Annuity:

FERS Survivor Annuity / Pension

When you retire, you have the option of providing a survivor annuity.

This means that when you die, your survivor will continue to receive a portion of your pension every month.

There are three different survivor annuity options you can choose…

- Full FERS Survivor Annuity – 50% of Your Pension

- Reduced FERS Survivor Annuity – 25% of Your Pension

- No Survivor Annuity

If you are married, you will need your spouse’s written permission to choose anything other than the full survivor annuity.

It’s important to make sure you know about all your options before you make your selection.

Let’s take a closer look at each choice:

1. ) Full FERS Survivor Annuity Option

The first thing you need to know about the “full” survivor annuity benefit is only 50% of your regular monthly pension.

Because it is called the “full” survivor benefit – some people think this means their survivor continues to get the full pension – but this is not the case.

If you choose the full FERS survivor annuity option – your survivor will receive 50% of your monthly pension after you pass away.

There is a cost to this benefit. In most cases, it is 10% of your regular monthly FERS pension.

This is a permanent reduction to your FERS pension. The 10% will be deducted from your retirement pension each month until you pass away.

It doesn’t matter if you pass away 1 year, or 100 years after you retire: each month, your pension will be reduced by 10%. When you die, your survivor will receive 50% of your pension for the rest of their life.

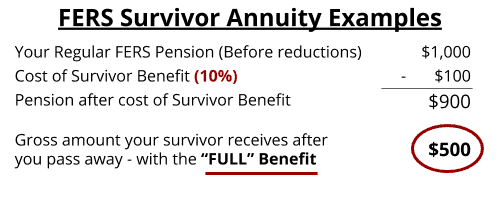

Example of Full FERS Survivor Annuity

For easy numbers, let’s say your regular monthly FERS pension was $1,000.

You select the full FERS survivor annuity benefit at retirement, so your pension is reduced by 10%. In our example, your pension would be reduced by $100. You would now receive $900 each month.

When you pass away, your survivor will get 50% of your regular monthly pension – which would be $500 a month.

***If your survivor is someone other than your spouse – your cost may be higher than 10% – but the benefit amount to your survivor would be the same.***

It’s also important to remember the amounts we’re looking at are ‘gross’ numbers. There will be additional deductions for FEHB, taxes, etc. Click here to learn more about the 7 Reductions that affect your FERS pension.

2.) Reduced FERS Survivor Annuity Option

You can also choose to offer a reduced survivor benefit. With this option, your survivor will receive 25% of your monthly pension after you pass away.

In most cases, the cost for this benefit is 5% of your regular FERS pension.

Again – this reduction to your FERS pension is permanent. 5% will be deducted from your retirement pension every month until you pass away. When you die, your survivor will receive 25% of your pension for the rest of their life.

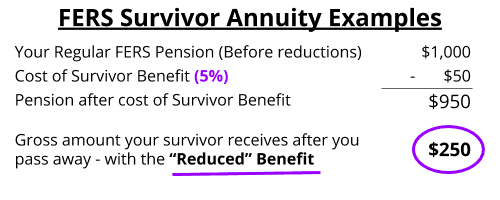

Example of Reduced FERS Survivor Annuity

Let’s continue with our example where your regular monthly FERS pension was $1,000.

At retirement you select the reduced survivor annuity benefit, so your pension is reduced by 5%. In this example, your pension would be reduced by $50. During retirement – you would now receive $950 each month.

When you pass away, your survivor will get 25% of your regular monthly pension – in our example $250 a month.

***If your survivor is someone other than your spouse – your cost may be higher than 5% – but the benefit amount to your survivor would be the same.***

And again, we’re just talking about “gross” numbers here for this example. The amount you and your survivor receive will be reduced by FEHB premiums, taxes, etc.

3.) Choosing No FERS Survivor Benefit

You also have the option not to choose any survivor annuity. If you are married, you will need your spouse’s permission to make this choice.

I generally don’t recommend people choose No Survivor Annuity – unless you are in a unique situation where you don’t have a survivor.

But for most people, it makes sense to consider a Full or Reduced FERS Survivor Annuity Benefit.

Even if your spouse doesn’t need the money – there are important reasons to consider offering a survivor benefit.

What If My Spouse Doesn’t *Need* the Money?

Even if you don’t think your spouse will need the money – you should still consider offering a survivor benefit.

The biggest reason is… Health Insurance.

If your spouse is not receiving a survivor annuity benefit – they will not be eligible for FEHB health insurance after you die.

Even if your spouse is on your FEHB plan during retirement – once you die – if your spouse is not receiving a survivor annuity they will lose their health insurance.

For this reason – I recommend that most Federal Employees consider offering *at least* the reduced survivor annuity. Even though a reduced annuity may not be enough to cover the entire cost of FEHB premiums your spouse will have to pay – the reduced FERS survivor benefit option at least keeps their foot in the door with FEHB.

Even if your spouse won’t need the money – having health insurance will still be very important. Especially when you consider the cost of getting private insurance.

Making Changes *After* Retirement

You make your choices for survivor annuity benefits when you file your retirement paperwork.

But what if you change your mind later?

You have a 12 month window after you retire to make changes to your FERS survivor annuity choices. After that time has passed – you will only be allowed to make changes in the event of marriage/divorce or death of the survivor.

Important Information for Divorce/Re-Marriage

If you have been divorced and re-married, you will need to pay close attention to your survivor benefit options.

Each situation is different: I have seen cases where the Federal Employee was required to provide full survivor benefits to their former spouse (which means nothing is left for the current spouse) – and cases where no survivor benefits were required.

You will want to refer to your court documents. The court order will determine how much your former spouse will receive. If you are required to provide a full survivor benefit to your former spouse – then there is nothing left for your current spouse to receive.

Consult your attorney if you have any questions about what is required for your situation. And be sure to look for an attorney who understands federal benefits – because in my experience few do.

The Most Important Thing You Can Do For Your Spouse

One of the most important things you can do for your spouse is to make sure they will be taken care of if you pass away.

This means…

- Taking care of all of your beneficiary designations – RIGHT NOW

- Having a will/trust in place

- Having enough money saved to take care of survivors

- Putting all of your financial documents in order

- Establishing a relationship with a financial planner that you *both* like and trust

Even if you’re uncomfortable discussing these matters – you owe it to your loved ones to ensure they will be taken care of even after you’re gone.

Pension Max – And Why it’s a BAD Idea…

There are many things in the world of financial planning that sound great in theory – but turn out to be bad in reality. Salespeople trying to pitch Pension Max to Federal Employees is a personal pet peeve of mine. The idea of Pension Max is really clever. But when it’s done in real life it’s usually fouled up and leaves a disastrous wake of consequences.

Over my years of working with federal employees, I’ve met with many who had been sold Pension Max before they met with me. And 9 times out of 10 it was all messed up. There are a few rare cases where it can make sense – but on the whole – I feel very strongly that it’s a bad idea for most federal employees.