“First off, great content on your site! A plethora of information for Federal employees that is extremely invaluable for retirement planning. Regarding the FERS Supplement and VERA, does the supplement start at MRA or does it start immediately after retirement (under VERA) even if the age is way under 57? The scenario as follows: If an employee has 25 years of service but only age 49, will the FERS supplement start at age 49, and last until age 62?” – Eugene

Eugene asks a great question about how the Federal Employee Retirement Systems Supplement works when a Federal Employee chooses to retire under the Voluntary Early Retirement Authority (VERA).

To understand how VERA works for FERS, let’s first review what the normal rules of eligibility are for Federal Employees.

Immediate Retirement Eligibility for FERS

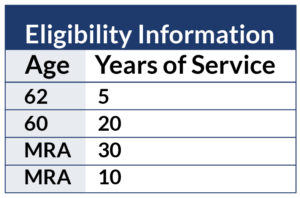

Federal Employees are eligible for an immediate retirement if they meet one of the following sets of age and service requirements, you are entitled to an immediate retirement benefit:

Keep in mind that if a Federal Employee retires at the MRA with at least 10, but less than 30 years of service, your benefit will be reduced by 5 percent a year for each year you are under 62, unless you have 20 years of service and your benefit starts when you reach age 60 or later.

You may want to keep in mind these requirements particularly to understand if you can qualify for a FERS Supplement benefit as well.

In order to retire with an immediate retirement benefit you must meet all of the above eligibility requirements. Unless, you receive a notice of action by the Voluntary Early Retirement Authority (VERA).

Voluntary Early Retirement Authority (VERA) Eligibility

In order for a Federal Employee to be able to retire under a Voluntary Early Retirement Authority (VERA) they have to be invited to participate. Normally, this is an action that occurs across an agency for several reasons. VERA’s can occur when agencies consolidate, reduce personnel or have budget constraints.

If you receive an application to apply for a Voluntary Early Retirement, you will want to read the notice in its entirety because not all early retirements are the same.

You will also want to have a solid understanding of what benefits as a Federal Employee that you get to retain into retirement, if you retire under a VERA.

- FERS Pension

- FERS Supplement

- Thrift Savings Plan

- Federal Employee Group Life Insurance

- Federal Employee Health Benefits

- Social Security

To work through an example of what benefits you can keep under a Voluntary Early Retirement. Particularly, to see if you are eligible for participation in the FERS Special Supplement if you retire under VERA.

FERS Benefit Timeline

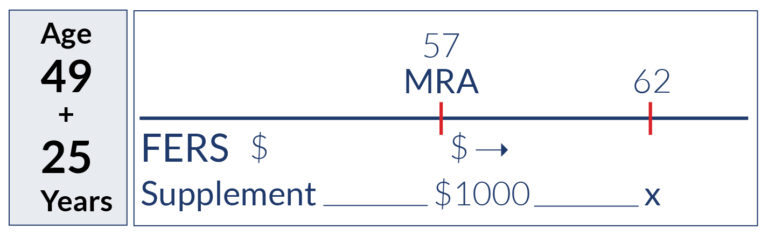

Grab a sheet of paper and draw out your retirement timeline. Here is an example,

When Eugene retires, he may be eligible under the VERA for his FERS Pension. To determine what his pension may be, Eugene should know a few numbers.

FERS Annuity Calculation

FERS Special Supplement

Eugene asks a great question, if he retires under a VERA will he receive the FERS Special Supplement starting at age 49 when he is eligible to retire under a VERA?

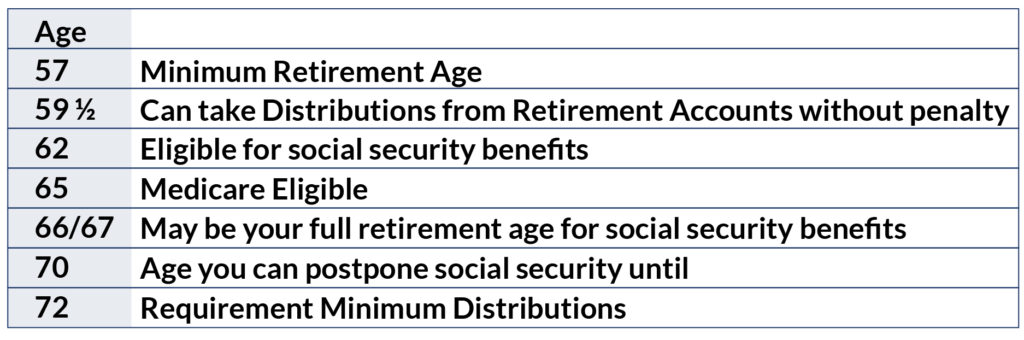

For individuals born in 1970 or after, their Minimum Retirement Age is age 57. The earliest eligibility people have to start their social security benefits is age 62.

Because retirees who retire before age 62, are not eligible for social security benefits the Federal Government provides Federal Employees with a FERS Special Supplement.

The FERS Special Supplement is designed to act as a bridge between when you retire and when you are first eligible for social security benefits. Remember, just because you are eligible to take social security at age 62 does not necessarily mean that you should. There are severe penalties for starting social security early at age 62 vs your full retirement age.

Since Eugene is being offered a VERA he will not receive his FERS special benefit until he reaches his Minimum Retirement Age. Since Eugene is retiring at age 49 under the VERA he will have to wait until he reaches his Minimum Retirement Age of 57 before the FERS Special Supplement will start.

Federal employees receive the FERS Special Supplement until they reach age 62. Once a retiree turns age 62 the FERS Special Supplement will automatically turn off because you are eligible – though it doesn’t mean you should necessarily – file for social security benefits. Your FERS Special Supplement will stop automatically; the federal government is pretty good about turning off that benefit.

Cash Flow is King in Retirement

Eugene’s question highlights why the most important factor in retirement is cash flow. Draw out your retirement timeline and really dive into whether or not you have enough cash to support you during retirement especially because as a Federal Employee so much of your retirement involves important milestones like: