“I am retiring on 12/31 at the age of 56 – will my FERS Supplement calculation include 2019 earnings – after they get reported to Social Security. I know the Supplement is based on estimated SS at 62 – and would make a difference given the inclusion of 2019 earnings. But this will take time to show up at SS – since they update earnings after reported by the Agency….which can take 30-60 days. ” – Doug

This is such a great question because Doug is asking what appears to be a simple question but one with some underlying issues that are often, in our experience, missed by Federal Employees when planning for their retirement.

Doug, we are going to dive into the FERS Supplement mechanics, Social Security earnings and how to avoid a “pension pickle” by notifying the Office of Personnel Management (OPM) ahead of time.

What is the FERS Supplement

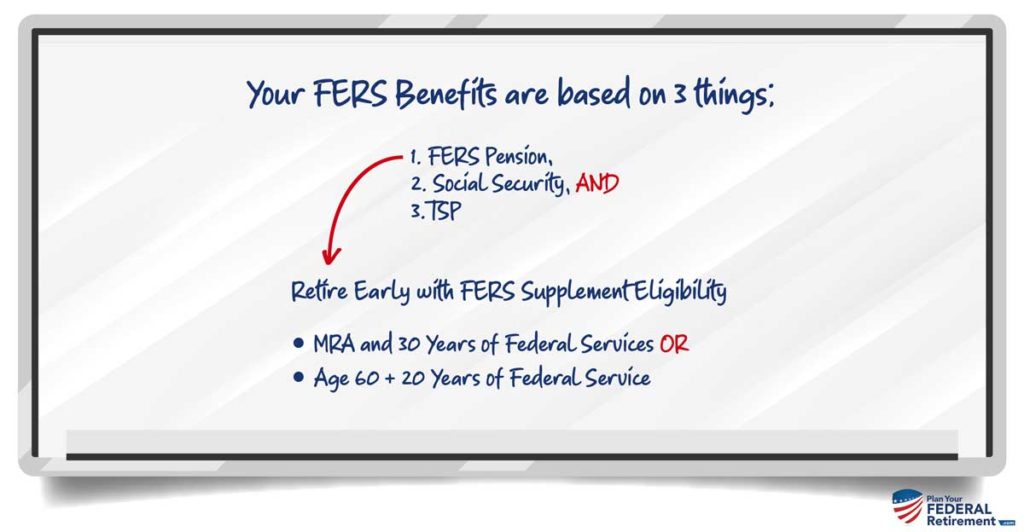

The FERS Supplement is also called the Special Retirement Supplement or SRS. It is designed to help bridge the money gap for certain FERS who retire before age 62. It will supplement your missing Social Security income until you reach age 62.

But not all FERS are eligible to receive the Supplement.

The first rule might sound obvious – but people really do ask… Yes, you must be in the FERS Retirement system to get the FERS Supplement.

And the Supplement is unique to FERS – there is no counterpart to the Supplement in the Civil Service Retirement System (CSRS).

The second requirement is that you must have a normal immediate retirement, not an early retirement (MRA+10). This means you must have 30 years of creditable service and meet your MRA. Or you can have 20 years of creditable service and be age 60.

And while you can seek a normal immediate retirement at age 62 with 5 years in service – the Supplement is only paid until age 62. So if you retired at 62 with 5 years of service, you would not get this benefit.

How to Calculate FERS Supplement

The calculation for the FERS Supplement is extremely complex and time-consuming. If you’re interested in an exact calculation, check out the OPM CSRS/FERS Handbook, Chapter 51, Retiree Annuity Supplement

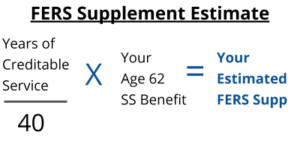

Most people are fine with an estimate for initial planning purposes. The easiest way to get a ballpark on your Supplement involves your Age 62 Social Security benefit.

In order to estimate your Supplement amount, you’ll want to have your annual Social Security statement handy. You’ll also need to know how many years of creditable service you would have at your estimated retirement.

The estimate formula is…

Years of Creditable Service: this is the number of years that count towards your retirement, and possibly some military time. (Time in military service counts here *only* if it was performed during a period covered by military leave with pay or leave without pay from civilian service. See Section 51A2.1-3 of the CSRS / FERS Handbook)

40: this is a fixed number and does not change

Your Age 62 SS Benefit: You’ll find this number on page 2 of your Social Security statement. And it doesn’t matter what age you plan to start receiving Social Security – for this formula, you must use the age 62 Social Security benefit amount.

You can see that almost by design, the Supplement will be less than your Age 62 Social Security benefit. Unless, of course, you have 40 years of service.

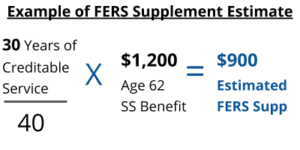

Let’s walk through an example together…

Say Sue is a FERS, and she will retire with 30 years of creditable service. She has reached her MRA, which is 57. And her age 62 Social Security benefit will be $1,200 a month.

Approximately how much will her FERS Supplement be?

Well, we take 30 years of service divided by 40 (30/40) = .75 Now take .75 times $1,200 (her age 62 SS benefit) = $900.

So Sue’s Supplement will be approximately $900 a month. And she’ll receive this supplement once she retires and up until the month she turns 62.

But we’re not done quite yet.

That is an estimate of the gross amount, but what is the approximate net amount Sue will receive?

Will Sue’s Supplement be subject to any reductions? And will it be subject to taxes?

Very likely. The government giveth, and the government taketh away.

Is the FERS Supplement offset by earnings?

Yes, the FERS Supplement can be reduced by earnings but before you get overly concerned generally, unless you have a substantial increase in income, this is only marginally impacted.

Doug, it will take longer than 30 to 60 days most likely for the Social Security Administration to report earnings to OPM that will offset your FERS Supplement. Sometimes, it can take 1 to 2 years before the adjustments are completely made.

The Average Indexed Monthly Earnings (AIME) is used to calculate a person’s Social Security benefits. AIME evaluates 35 years representing your earnings during your highest years of earning income, up to age 60. Once this is calculated, it uses the indexes of those years to factor in wage growth.

What is Considered Earned Income for FERS Supplement Offset

On average it takes the Social Security Administration about one to two full calendar years before they update your benefits within their system. This is because often, they are waiting on income to be reported and verified by the Internal Revenue Service so it doesn’t always happen quickly.

Here is the second part of Doug’s question that is often missed, the earnings limitation.

The way that the Federal Employee Retirement System (FERS) is set up is to provide Federal Employees with what we call a “three legged stool retirement”.

You have your pension at retirement, your Thrift Savings Plan and Social Security.

Some Federal Employees are eligible to retire under the FERS rules before they reach their first eligibility to draw social security, at age 62.

The supplement was designed as a bridge the time between an employees retirement from Federal Service and when they are eligible to start drawing social security benefits.

Remember, eligible to draw social security at age 62 does not always mean that you SHOULD draw it at age 62. Read our articles on whether or not you should start social security early before making a decision.

The time that you retire from Federal Service, in Doug’s case we are saying age 56, to the time he is eligible to first begin social security, age 62, Doug is going to have an earnings limitation on how much income he can earn before offsetting his benefits.

FERS Supplement Earnings Limitations

The FERS Supplement begins to be reduced once you have over $18,240 of earned income.

For every $2.00 over the earnings limitation that you receive in earned income, the FERS Supplement will be reduced by $1.00.

If you retire in your 50’s you may want to a part time job or do some other type of work that provides you with income. Pretty quickly you can see how earning more than the earnings limitation of $18,240 can occur.

If you have employment and your earning exceed the earnings limitation, make sure that you let the Office of Personnel Management (OPM) know so that your supplement can be offset.

If you do not let them know, you may find that in a couple of years when your earnings have been updated by the Social Security office that your supplement or pension, contingent on your timeline, will be adjusted automatically.

There is no penalty associated with the reduction but if you are not planning for it, you may be surprised when it happens.

Earned income is defined as income that is derived from sources like,

- Wages, salaries, tips, and other taxable employee compensation;

- Self-employment income;

- Union strike benefits;

- Disability retirement benefits received prior to minimum retirement age;

- Net earnings from self-employment if:

- You own or operate a business or a farm or

- You are a minister or member of a religious order

To provide contrast, here are some sources of income that are NOT considered earned income:

- Your FERS Pension

- Rental property income

- Interest and dividends

- Pensions or annuities

- Social security

- Unemployment benefits

- Alimony

We seen the mistakes that people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

7 CRITICAL MISTAKES

Federal Employees make

✗ Forgetting to check your beneficiary designations

✗ Expecting pension check to arrive in 30 days after retiring

✗ Not knowing the difference between SCD vs. RSCD

✗ Completing retirement paperwork incorrectly

✗ Failing to prepare financially for retirement

✗ Failing to understand tax consequences

✗ Getting bad advice

Click the button below and learn how to avoid these mistakes while planning YOUR retirement