“Micah, I have a question about the earnings test for FERS Supplement. I’m a title 38 physician, planning to retire with age 60 + 20 years of service and lump sum annual leave payment of 685 hours. I believe the lump sum annual leave payout is considered earned income, so I think my first year’s retirement earned income is going to obliterate the earnings test. And if I understand the reduction in the FERS supplement correctly, for my age 61 year the supplement will be reduced to $0. This almost makes me want to consider staying until age 62 for the better 1.1% multiplier. Appreciate your input, thanks Micah.” – Richard.

As a federal employee, you have an AMAZING benefits package as a retiree. Not only do you potentially have the opportunity to maintain your FEHB (your best benefit! At least from our perspective) in retirement but you also have several retirement income sources:

● Your FERS Pension (OPM calls this your FERS annuity)

● Thrift Savings Plan

● Social Security

● Personal Retirement Savings

And for those who qualify you may be eligible for the FERS Special Supplement too.

What is the FERS Supplement?

The FERS Supplement is an important part of your FERS retirement benefits. It is designed to help fill the gap between your federal retirement and the time when you become eligible for Social Security benefits. The supplement provides you with extra income during this transitional period.

Who is Eligible for the FERS Supplement?

To qualify for the FERS Supplement, you need to meet certain requirements. Here’s what you need to know:

- Retirement under FERS: You must have retired under the Federal Employees Retirement System (FERS). This system covers employees from different federal agencies.

- Minimum Retirement Age (MRA): You need to have reached your Minimum Retirement Age (MRA). Your MRA depends on your birth year. If you were born before 1948, your MRA is 55. For those born in 1970 or later, the MRA is 57.

- Retirement Eligibility: You must have retired under FERS with a non-disability retirement that entitles you to an annuity. This means you should have met the service requirements and other conditions for retirement under FERS.

How is the FERS Supplement Calculated?

The calculation of the FERS Supplement involves a few factors. Let’s take a closer look:

Estimated Social Security Benefit: We estimate your Social Security benefit at age 62. This estimation considers your FERS-covered service and assumes that you won’t earn any additional income after retirement.

Earnings Test: The FERS Supplement is subject to an earnings test. If your earnings from work exceed a certain limit set by the Social Security Administration, your FERS Supplement amount may be reduced or even

eliminated. It’s important to plan your post-retirement income carefully to make the most of the FERS Supplement benefits.

How to Apply for the FERS Supplement

Applying for the FERS Supplement is a straightforward process. Let me guide you through the steps:

- Contact OPM: Get in touch with the Office of Personnel Management (OPM), the agency responsible for federal retirement programs. They will help you start the application process.

- Submit Required Documentation: OPM will provide you with forms and instructions to complete your application. Make sure to provide accurate and complete information to avoid any delays or issues with your FERS Supplement calculation.

- Review and Approval: OPM will review your application and determine if you are eligible for the FERS Supplement. Once approved, you will start receiving the supplement along with your regular FERS annuity

How to Stop Your FERS Supplement

When you turn age 62 and are first eligible for social security benefits (though that does not mean you should necessarily take them!) your FERS Special Supplement will stop.

Automatically.

OPM is pretty reliable about that. No additional forms are needed for this benefit to come to a stop.

Benefits and Things to Consider

The FERS Supplement offers several benefits that can enhance your retirement income. Here are some key advantages:

- Extra Income Bridge: The FERS Supplement acts as a bridge, providing additional income between your FERS retirement and when you become eligible for Social Security benefits. Remember, being eligible to draw social security as early as age 62 does not mean you should.

- Protection Against Inflation: The FERS Supplement benefits are adjusted yearly to account for inflation. This helps maintain the value of your retirement income over time.

When planning for the FERS Supplement, keep these factors in mind: Tax Considerations: The FERS Supplement is subject to federal income tax.

Should you start social security at age 62 when your FERS Special Supplement stops?

When we meet with federal employees and discuss their financial situation, we discuss the pros and cons of when to start social security in depth.

When you build out your retirement income timeline, there are going to be several income sources that start and stop. For example, your FERS Special Supplement might start as early as age 57 and it will end at age 62.

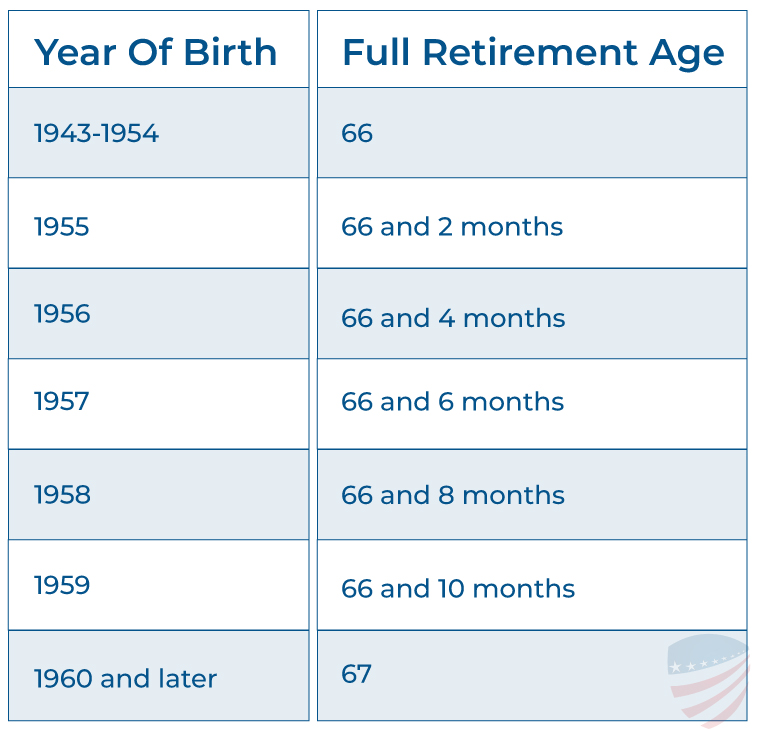

Note: keep in mind that your Minimum Retirement Age (MRA) and your Full Retirement Age FRA are N-O-T the same. OPM uses your MRA to assess your retirement eligibility. The Social Security Agency uses your FRA for when you are eligible for social security benefits.

Does that mean you should start your social security benefits when your FERS Special Supplement ends?

It depends. What are your retirement income goals? How much money do you need in retirement to fill your retirement income GAP?

Can you consider NOT starting an “early retirement” with social security and delaying to maximize your retirement benefits?

Early Retirement (Age 62):

Benefit: You can start receiving Social Security benefits as early as age 62.

Penalty: However, starting early comes with a drawback. Your benefit amount will be reduced compared to what you would receive if you wait until your full retirement age.

Full Retirement Age (FRA):

Benefit: Your full retirement age is determined by your birth year and typically ranges from 66 to 67. If you start receiving benefits at your FRA, you will receive your full benefit amount.

No Penalty: There are no penalties for starting at your full retirement age.

Delayed Retirement (Age 70):

Benefit: If you choose to delay receiving benefits beyond your full retirement age, you can earn delayed retirement credits, which will increase your benefit amount.

Bonus: By waiting until age 70 to start receiving benefits, you can maximize your monthly benefit amount, as the credits earned for delaying retirement stop accumulating at this point.

Social Security Excess Earnings and the FERS Special Supplement

Your unused sick leave is not considered as earned income for the FERS Special Supplement test. Rather, it is considered separation pay as it was previously earned.

The social security office will assess excess earnings and reduce your benefits based on earned income.

Do you have questions like richard? Think it is time to meet with a federal employee benefits specialist one on one? We would love to visit with you about your personal situation and answer any questions you have about your federal benefits.