Keeping Health Costs Low in Retirement: FEHB or Medicare Part B?

I’m 65 now, still working usps, when I retire in 1 to 2 years, I’m interested in keeping monthly health insurance down. Is it more

FERS Retirement Planning is all about understanding the Federal Employees Retirement System (FERS), which forms the foundation of your retirement benefits. We’ll guide you through the eligibility criteria, benefit calculations, and critical milestones to ensure you make the most of your federal retirement package.

Planning your retirement under FERS requires careful consideration of various factors, such as age and years of service, and choosing the right retirement date. To learn more or find answers to your specific questions, check out our content below.

I’m 65 now, still working usps, when I retire in 1 to 2 years, I’m interested in keeping monthly health insurance down. Is it more

https://youtu.be/RGaefOcEvEw Every Investor should have their “Rules on Investing” in place for times of “market volatility and turmoil.” Times like this, I am often reminded

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Yes, good morning. Jeff here, wondering about having a postponed retirement. When the paperwork needs to be filled out, if I want to start that

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Good morning, my name is Alberto. I am a Mail Handler for the Postal Service with 40 years of service. Currently, I can carry over

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

https://youtu.be/-lxMYExTiGQ The Road Not Taken: What Happens When Federal Employees Make (or Avoid) Big Decisions. Understanding Federal Retirement Options: Deferred Resignation, VERA, Postponed Retirement, and

https://youtu.be/VQ0Z9PhhxEQ How prepared are you if you no longer work for the Federal Government? Maybe you accepted the Trump Administration’s “deferred resignation” package; maybe your

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Hello, at age 57 years and two months, I separated from federal service for a civilian job after serving 5.3 years and buying back 17.2

My wife is a federal employee and will retire next year. She is going to be 50 years old. I am going to be 58

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

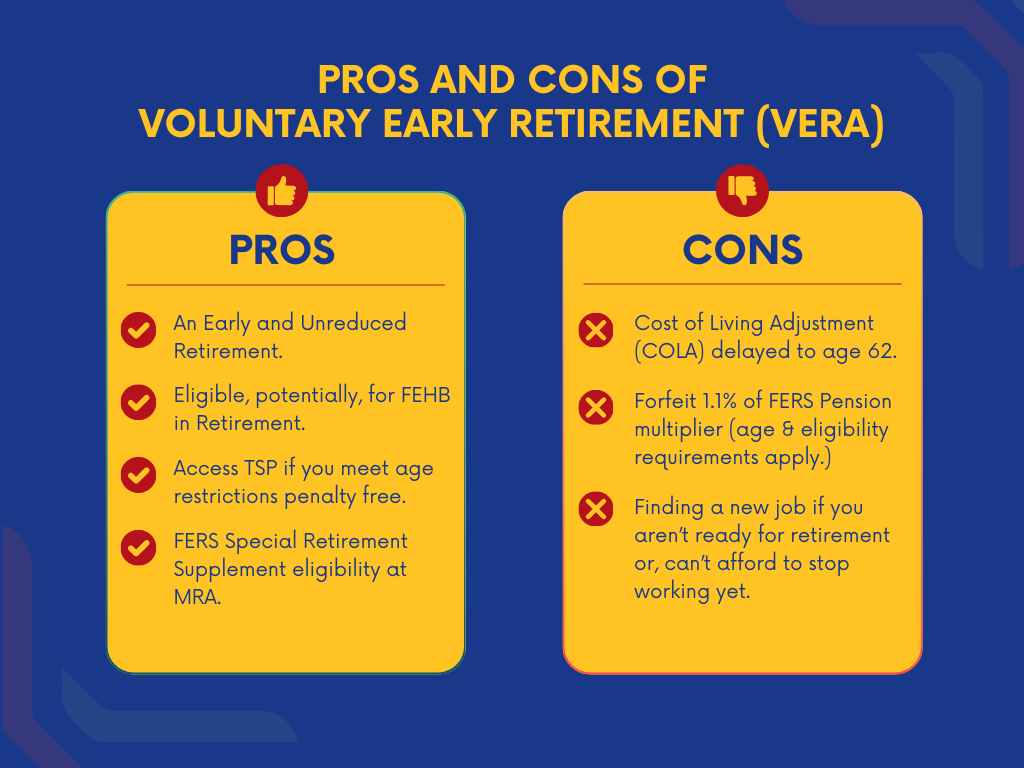

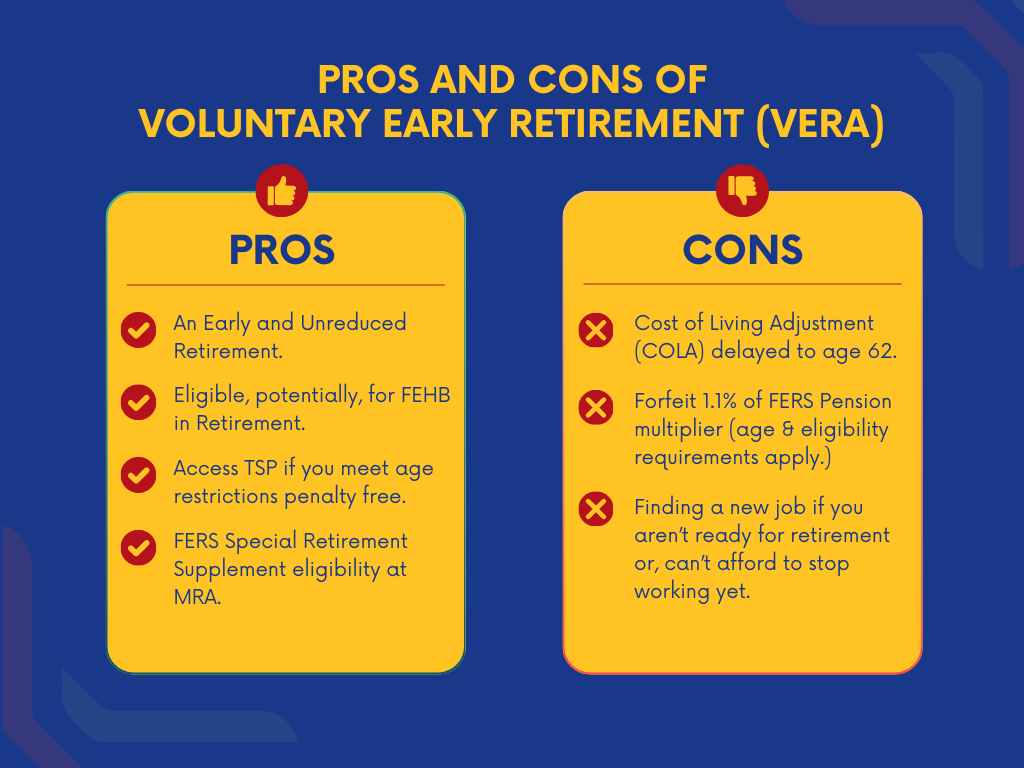

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits professional, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Need help with federal employee survival benefits. I looking for specific help with my wife’s survivor FERS and Death Benefits. My wife worked for the

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

I’m 65 now, still working usps, when I retire in 1 to 2 years, I’m interested in keeping monthly health insurance down. Is it more

https://youtu.be/RGaefOcEvEw Every Investor should have their “Rules on Investing” in place for times of “market volatility and turmoil.” Times like this, I am often reminded

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Yes, good morning. Jeff here, wondering about having a postponed retirement. When the paperwork needs to be filled out, if I want to start that

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Good morning, my name is Alberto. I am a Mail Handler for the Postal Service with 40 years of service. Currently, I can carry over

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

https://youtu.be/-lxMYExTiGQ The Road Not Taken: What Happens When Federal Employees Make (or Avoid) Big Decisions. Understanding Federal Retirement Options: Deferred Resignation, VERA, Postponed Retirement, and

https://youtu.be/VQ0Z9PhhxEQ How prepared are you if you no longer work for the Federal Government? Maybe you accepted the Trump Administration’s “deferred resignation” package; maybe your

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Hello, at age 57 years and two months, I separated from federal service for a civilian job after serving 5.3 years and buying back 17.2

My wife is a federal employee and will retire next year. She is going to be 50 years old. I am going to be 58

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits professional, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Need help with federal employee survival benefits. I looking for specific help with my wife’s survivor FERS and Death Benefits. My wife worked for the

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

I’m 65 now, still working usps, when I retire in 1 to 2 years, I’m interested in keeping monthly health insurance down. Is it more

https://youtu.be/RGaefOcEvEw Every Investor should have their “Rules on Investing” in place for times of “market volatility and turmoil.” Times like this, I am often reminded

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Yes, good morning. Jeff here, wondering about having a postponed retirement. When the paperwork needs to be filled out, if I want to start that

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Good morning, my name is Alberto. I am a Mail Handler for the Postal Service with 40 years of service. Currently, I can carry over

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

https://youtu.be/-lxMYExTiGQ The Road Not Taken: What Happens When Federal Employees Make (or Avoid) Big Decisions. Understanding Federal Retirement Options: Deferred Resignation, VERA, Postponed Retirement, and

https://youtu.be/VQ0Z9PhhxEQ How prepared are you if you no longer work for the Federal Government? Maybe you accepted the Trump Administration’s “deferred resignation” package; maybe your

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Hello, at age 57 years and two months, I separated from federal service for a civilian job after serving 5.3 years and buying back 17.2

My wife is a federal employee and will retire next year. She is going to be 50 years old. I am going to be 58

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits professional, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Need help with federal employee survival benefits. I looking for specific help with my wife’s survivor FERS and Death Benefits. My wife worked for the

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits

I’m 65 now, still working usps, when I retire in 1 to 2 years, I’m interested in keeping monthly health insurance down. Is it more

https://youtu.be/RGaefOcEvEw Every Investor should have their “Rules on Investing” in place for times of “market volatility and turmoil.” Times like this, I am often reminded

Listen to the Full Episode: Tax season can be overwhelming, but federal employees can stay ahead with the right strategies. In this podcast episode, Micah

Yes, good morning. Jeff here, wondering about having a postponed retirement. When the paperwork needs to be filled out, if I want to start that

Listen to the Full Episode: It’s crucial to evaluate your TSP decisions as you approach retirement. Understanding the various benefits associated with your TSP can

Good morning, my name is Alberto. I am a Mail Handler for the Postal Service with 40 years of service. Currently, I can carry over

Listen to the Full Episode: Understanding your TSP withdrawal options is essential for a successful retirement. In this podcast episode, Micah and Christian break down

https://youtu.be/-lxMYExTiGQ The Road Not Taken: What Happens When Federal Employees Make (or Avoid) Big Decisions. Understanding Federal Retirement Options: Deferred Resignation, VERA, Postponed Retirement, and

https://youtu.be/VQ0Z9PhhxEQ How prepared are you if you no longer work for the Federal Government? Maybe you accepted the Trump Administration’s “deferred resignation” package; maybe your

Listen to the Full Episode: Estate planning involves more than just creating a will; it’s about ensuring financial security, protecting your loved ones, and

Hello, at age 57 years and two months, I separated from federal service for a civilian job after serving 5.3 years and buying back 17.2

My wife is a federal employee and will retire next year. She is going to be 50 years old. I am going to be 58

Listen to the Full Episode: Planning for the future involves understanding what happens to your benefits after you are no longer here. In this podcast

Listen to the Full Episode: Are you considering early retirement under VERA? Before you make a decision that could affect your benefits for years to

Are you a federal employee considering Voluntary Early Retirement Authority (VERA)? This comprehensive guide breaks down eligibility, benefits, and financial impacts, including how VERA affects your pension, health insurance (FEHB), and Thrift Savings Plan (TSP). Learn the key steps to avoid costly mistakes, understand your FERS Special Retirement Supplement, and maximize your retirement benefits.

🎙 Watch our YouTube Podcast for expert insights.

📚 Join our “Retire Right” On-Demand Class to make informed decisions.

Read now to take control of your federal retirement!

What should Federal Employees facing the Fork in the Road do? As a Federal Employee Benefits professional, my primary advice—though not intended to be self-serving—is

https://youtu.be/EQqQhWMzTKs Federal Employees need to know what to anticipate if they choose to accept the Deferred Resignation package issued January 2025 to civilian federal employees.

Listen to the Full Episode: What does a Reduction in Force (RIF) or job change mean for your federal benefits and retirement plans? These transitions

Need help with federal employee survival benefits. I looking for specific help with my wife’s survivor FERS and Death Benefits. My wife worked for the

Listen to the Full Episode: What impacts will the latest tax law changes, Social Security projections, and market uncertainties have on your FERS retirement benefits