When you take a FERS Retirement – you’ll receive a monthly pension for the rest of your life. How do you calculate this amount?

First – we need to calculate your ‘gross’ pension – then we’ll take a look at your ‘net’.

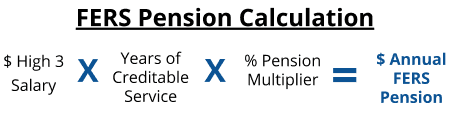

Your gross FERS pension is calculated based on three things…

- Your High-3 Salary

- Years of Creditable Service

- Pension Multiplier

Your FERS retirement pension is calculated by taking…

The calculation looks simple.

The complexity comes in how you calculate your High-3 Salary, and what really counts towards your Years of Creditable Service.

Let’s take a closer look at each of these elements of the FERS pension calculation…

#1) Your High-3 Salary

Your High-3 is the highest average *basic pay* you earned during any 3 consecutive years of service. I want to emphasize *basic pay* here – because not everything you receive in your paycheck counts toward your High-3.

Your basic pay is the basic salary you earn for your position. It includes shift rates and locality pay; but does not include COLA, overtime or bonuses. Want help calculating your High-3 Salary? Click Here.

#2) Your Years of Creditable Service

Once you know your High-3 Salary, the next step is to calculate your Years of Creditable Service.

Your creditable service is the most complex part of the FERS pension calculation. Well – once you know the number it’s straight-forward… but it’s finding that number that can take time.

Here’s the problem… the time you think you have may be different than the time OPM says you have. And only the time OPM says you have counts for retirement.

So how does OPM calculate your creditable service?

By looking at your SF-50s.

You get an SF-50 each time there is a change in your job or pay. You get at least one SF-50 a year, but sometimes more. If there’s a problem with one of your SF-50s, or one went missing – it’s going to affect your creditable service.

Where Do You Start? RSCD vs. SCD

Many people think that their creditable service starts with their SCD – but this is not true.

They see SCD (service computation date) on their LES and SF-50 – but that is *not* the date OPM uses for your retirement calculation. SCD is for leave purposes only.

Your creditable service is based on your RSCD (retirement service computation date).

Technically, OPM uses your RSCD to determine the beginning of your Years in Service for the pension calculation.

You can find your *Estimated* RSCD on your Personal Statement of Benefits. But, this is just an estimate. OPM does not calculate your official RSCD until *after* you retire.

But you can determine your RSCD by a thorough review of your SF-50s.

What if you haven’t reviewed your SF-50s? For a rough estimate, you can just use your SCD as a place to start. Just remember that SCD does not always equal RSCD.

Count the number of whole years, months and days of creditable service from your RSCD to your planned retirement date.

When OPM calculates your creditable service, they only look at years and months.

Any days (less than 30) are simply dropped from the calculation. They don’t round up, they only round down.

When adding military time (that you bought back) to your civilian time, you don’t drop the days until you’ve added everything up.

To convert years, months (and days) into years use the Time Factor Table.

***If you had temporary time, took leave without pay, or had a break in service be extra careful when calculating your RSCD. You should also pay extra attention if you are planning on retiring very close to your required years in service. Federal Employees have been called back to work 6 months after they retired (or thought they retired) because when OPM calculated their RSCD – they didn’t have enough years in service to be eligible for retirement. Don’t let this happen to you!***

How Does Military Time Affect Your Creditable Service?

Lots of Federal Employees have had prior military service.

If you have active honorable military service that isn’t already being ‘used’ towards a military retirement – there is a very good chance that you can ‘buy’ that time back and have it count towards your federal retirement.

Learn more about Military Buyback and Creditable Service for Federal Retirement.

#3) Your Pension Multiplier

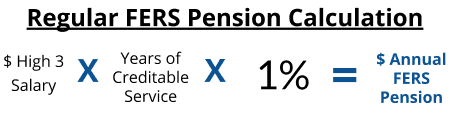

For most FERS, their pension multiplier is 1%.

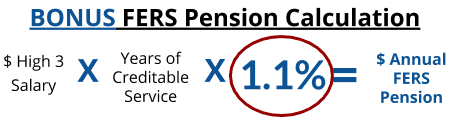

However if you are age 62 or older at separation, with 20 or more years of service, your multiplier will be 1.1%

Examples of FERS Pension Calculation:

So your FERS retirement pension is determined by three factors, your High-3 Salary, your Years of Creditable Service and your Pension Multiplier.

For most FERS, their pension multiplier is 1%. So their FERS Retirement pension formula comes together as…

Let’s take an example. For easy numbers, let’s say your High-3 Salary is $100,000. You have 25 years of creditable service. If you are younger than age 62, your pension multiplier would be 1%.

In this example, your pension would be calculated as…

$100,000 x 25 Years x 1% = $25,000/year

………………………………………….or $2,083/month

But now let’s say you were at least age 62 with 25 years of service.

In this case, your pension multiplier would be 1.1% and your pension formula would come together as…

In this case – if you were age 62, with 25 years of service and a High-3 Salary of $100,000 your pension would be calculated as…

$100,000 x 25 Years x 1.1% = $27,500/year

…………………………………………or $2,291/month

If you’re thinking about working until age 62, with 20 or more years of service – check out our page on the FERS Age 62+20 Retirement Bonus.

Gross vs. Net

Once you know your gross pension – the next step is to figure out your net. There are 7 possible reductions to your FERS pension, and most federal employees will have at least 3 (Survivor benefit, taxes & FEHB). There could be a big difference in your gross vs. net pension.

For more information, look for Section 50B3.1-3 “Reductions in Annuity” of OPM’s CSRS FERS Handbook, Chapter 50.

Looking For More FERS Retirement Pension Examples?

Check out our main page on FERS retirement rules, then each set of rules has an additional page where you can find examples of pension calculations for those FERS Retirement rules.

Find your specific FERS Retirement Rules on our main page about FERS Retirement Eligibility Rules.

Are You Getting The Most Out of Your FERS Retirement Benefits?

Federal Retirement benefits are complex. There are so many ins and outs, exceptions and special rules it can seem overwhelming. But it’s critical that *You* understand your retirement benefits *before* you retire. Too many federal employees separate from service without understanding their benefits and they don’t get the most out of their benefits.