Be prepared! Your Federal Pension check is usually delayed. Even if you have turned in all of your paperwork on time – in does not guarantee that you will immediately receive your Federal retirement check.

How Long Before I Get My First Retirement Check?

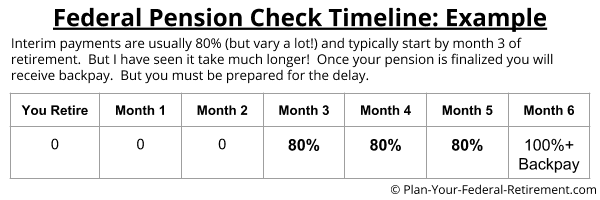

In my experience, most Federal Employees will not receive their first retirement check until 3 months after they retire. And that is if all goes well. I have seen it take much longer for the first pension check to arrive.

On top of the delay, it’s important to know that the first checks, interim payments, will not the be full amount of your federal pension. I tell my clients to expect their interim payments to be about 60% – 80% of their final pension amount.

You will not receive 100% of your monthly pension until OPM has reviewed your file and officially calculated your benefits. It may take approximately 3 *more* months for that to happen.

In most cases, when you finally do receive your first 100% check, you will also get a check with the difference between your interim payments and the full amount you should have been paid plus interest.

So you will eventually get all of your pension money – it takes time. But most federal employees are not prepared for the delay.

As another example, to put that in different terms – if you retire on January 1st, your 80% check will probably start arriving around April 1st. But your 100% check will probably not arrive until July 1st!

Remember, these are just estimates. It all depends on how backlogged OPM is.

Example of Delay for Federal Pension Checks

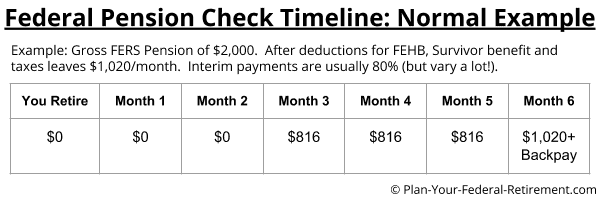

Let’s put some numbers in an example. For easy numbers let’s say you were expecting a Gross FERS pension check of $2,000/month. Don’t make the mistake of counting on receiving all of the $2,000. Too many federal employees make the big mistake of planning their retirement based on “gross” numbers, when they really need to plan on the “net” – the actual amount they will receive.

So in our example your Gross FERS Pension is $2,000/month. But we’ll need to take 10% ($200) out for a survivor annuity. We’ll also need to take approximately $580 out for FEHB family plan (of course this varies by state and by plan). And finally we’ll take $200 out for taxes (your taxes vary based on your personal circumstances). That leaves us with at *net* FERS Pension of $1,020.

When you retire, you won’t be receiving $1,020/month for quite a while. Let’s say your interim payments are 80% of your expected amount, so they come to $816/month. If all goes well, your interim checks may start arriving around Month 3 of retirement. But remember – that is just a guess. Interim payments can take longer.

In this example, here’s what a timeline of your federal pension and interim payments might look like…

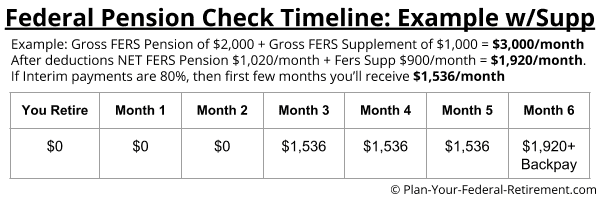

Example of Delay for Federal Pension + FERS Supplement

If you are eligible for the FERS Supplement, that is also subject to the delay and interim payment. Let’s look at another example where you were going to receive a gross FERS pension of $2,000 and a FERS Supplement of $1,000/month. For the FERS pension – we’re going to go with the same numbers of our previous example where we took out the cost of the FERS survivor annuity, FEHB premiums, and an estimate for taxes that leaves you with $1,020/month of *net* FERS pension.

In this example, we’ll say for easy numbers that your Gross FERS Supplement was going to be $1,000/month. And that after taking out approximately $100 for taxes that your *NET* FERS Supplement will be $900/month. So in this example you have $1,020/month of net federal pension and $900/month of net FERS Supplement, for a combined total of $1,920/month.

If your interim payments are 80% of your total (remember – they might be less!) – that would mean your interim payments would be $1,536/month. And you might begin receiving those interim payments around the 3rd month of your retirement. Ideally by month 6 of retirement your federal pension has been finalized and you will begin receiving $1,920/month along with back pay plus interest.

So again – eventually you will get all of the federal pension you are owed. But you must be prepared financially to get through this gap.

Be Prepared Financially

Unfortunately there is no way to accurately predict when your interim payments will start – or how much they’ll actually be.

I have seen it take 8 months for a Federal Employee to receive their *first* retirement check! That means if they retired on January 1st – their first check didn’t arrive until September 1st!

What if your first check takes that long to arrive? Do you have enough money in savings?

During your career, I encourage you to have at least three to six months living expenses in cash reserves.

But when you are getting ready to retire – you want to have 2 years of living expenses in a savings account. Not in stocks, or bonds – in a plain old savings account or money market account.

This way, if you do not receive your Federal retirement check for several months, you will still have enough money to pay the bills.

How Much Money Is In Your ‘Cash Bucket’?

Your ‘Cash Bucket’ is the most important of your three ‘Buckets of Money’ when it comes to your federal retirement. It’s what will help you get through the long wait for your first federal pension check and more.

But the Cash Bucket is also one aspect most federal employees overlook when getting ready for retirement. Learn more about your ‘Cash Bucket’ and how much money you should have in it before retirement.

Are You Prepared for Retirement?

If you’re getting ready for retirement – you want to be sure you’re not missing anything. Above all, be sure you understand all of your options *before* you separate for service.