Your Best Benefit as a Federal Employee

Your Federal Employee Health Benefits (FEHB) are the BEST benefits you have as a Federal Employee.

We are going to say that one more time, a little louder for the people in the back, your Federal Employee Health Benefits are the best benefits that you have as a Federal Employee.

We are on the outside looking in and are green with envy when it comes to your federal employee health insurance benefits.

We are not Federal Employees, and we work with hundreds of families across the country, some of which are in a dual Federal Employee household, both adults are Federal Employees, and some that are one Fed and one private sector or stay at home adult. Whenever we compare insurance plans between what the Federal Employee has and is able to maintain in retirement, seldom do we ever find anything that compares.

For a little background on Tracy’s question, she is referring to Immediate Retirement Rules for an Unreduced Pension. Tracy is asking us why, in a previous article, we did not include the group of employees who are eligible for retirement under a Minimum retirement age + ten years of Federal Service rule (MRA + 10).

We are going to dive into Tracy’s question and provide some insight as to what the rules are to maintain your FEHB in retirement

Types of retirement for Federal Employees

As a Federal Employee, when you retire from service you have to chose which type of retirement you are applying for, there are several:

Disability Retirement -Considerations when applying for disability retirement.

Early Retirement – Early retirement outlines Minimum Retirement Age (MRA) and annuity computations as well as Discontinued Service.

Voluntary Retirement – Voluntary Retirement eligibility is based on your age and the number of years of creditable service and any other special requirements.

Deferred Retirement – If you are a former Federal employee who was covered by the Federal Employees Retirement System (FERS), you may be eligible for a deferred annuity at age 62 or the Minimum Retirement Age (MRA).

Postponed Retirement – you must wait until you’re eligible for MRA+10 Retirement *before* you separate from service.

Though each of these involves retiring from Federal Service, they are not the same. In order to qualify for maintaining your health insurance in retirement you have to meet certain criteria.

Maintaining FEHB In Retirement

In order for a Federal Employee to maintain their health insurance in retirement they must,

The requirements for a Federal Employee under FERS to maintain their FEHB into retirement are:

Qualification #1: You must retire with the eligibility of an immediate, unreduced pension.

Qualification # 2: Have been continuously enrolled (or covered as a family member) in any FEHB Program plan for the five years of service immediately preceding retirement.

Qualification #1

For a Federal Employee to be eligible for retirement of an immediate, unreduced pension they fall under one of three categories:

Age Based Rule | Years of Service as a Federal Employee |

Minimum Retirement Age | 30 Years of Creditable Service |

60 Years of Age | 20 Years of Creditable Service |

62 Years of Age | 5 Years of Creditable Service |

You can retire from the Federal Government under a MRA+10 retirement option which means that you have,

Age Based Rule | Years of Service as a Federal Employee |

Met the Minimum Retirement Age | Have 10 Years of Creditable Service |

Under an MRA + 10 retirement, your pension will be reduced by approximately 5% for every year in which you are under the age of 62.

Qualification #2

The second qualification in order to maintain your FEHB in retirement is to certify that you have been enrolled in FEHB for at least 5 consecutive years prior to applying for retirement or as soon as enrolling in FEHB became available.

When you apply for retirement with your Human Resources department, your Official Personnel File will be audited and certified before it goes to the Office of Personnel Management (OPM).

As part of this review process, your HR will indicate the date you first enrolled in FEHB as well as the date that you were first eligible to enroll in FEHB.

In order to maintain FEHB in retirement, you must have been enrolled for the last 5 years prior to retiring from the Federal Government or, when it was first eligible for you to enroll.

Tricare and FEHB

If you are / were enrolled in TriCare prior to working with the Federal Government your Tricare enrollment time counts towards your consecutive years of FEHB enrollment.

This only applies to Tricare and not other insurance coverage.

Your Spouse and FEHB

In order for your spouse to receive FEHB in retirement they must meet the following qualifications:

Qualification #1 for Spouses to Maintain FEHB in retirement: they must be eligible to receive, or are receiving a survivor pension.

Qualification #2 for Spouses to Maintain FEHB in retirement: they must be enrolled in FEHB prior to your death.

Qualification #1 for Spouses to Maintain FEHB in Retirement: They must be eligible for a survivor benefit.

When you apply for retirement from Federal Service you as the Federal Employee will complete the application form SF-310.

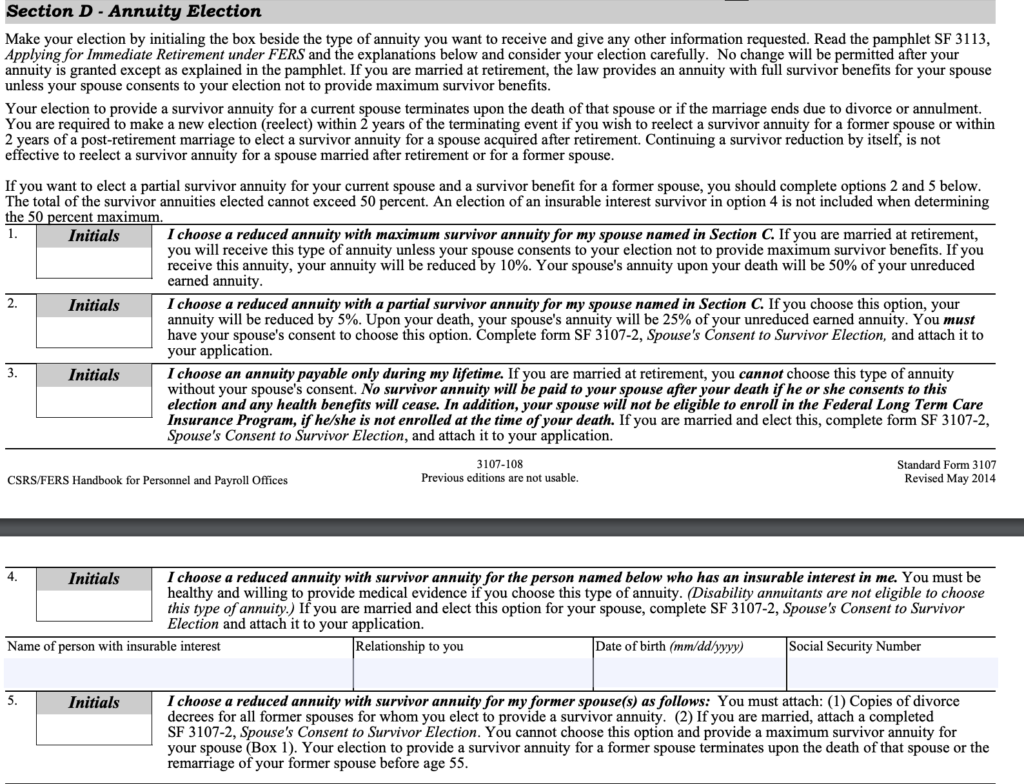

In Section D of the SF-3107 you will be required to elect what type of Survivor Benefits that you wish to leave your legally married spouse.

In order for your spouse to maintain FEHB in retirement, you must leave them a survivor benefit.

Yes, you can elect a reduced amount and they will still be eligible to participate in FEHB after your passing.

If you select Option 3 on the SF-3107 your spouse will NOT be eligible to maintain FEHB after you pass. This option means that your pension will not be reduced and is only payable during your lifetime. Once you pass, no benefits are available to your survivor.

Qualification #2 for Spouses to Maintain FEHB in Retirement – they must be enrolled in FEHB before you pass away.

In order to qualify for FEHB in retirement for YOU as the Federal Employee, you must have been enrolled for the last 5 consecutive years.

In order to qualify for FEHB as a survivor YOUR SPOUSE must have been enrolled in FEHB before you as the Federal Employee passed away.

The 5 year rule for survivors does not apply. The rule is that they must be enrolled, there are no time qualifications.

FEHB is the best benefit that you and your survivor have as a Federal Employee. In order to maintain that coverage into retirement or for your survivors to after you pass, you have to understand the eligibility rules. We just discussed the qualifications to maintain this coverage above.

As Financial Planners for Federal Employees, we work with hundreds of Feds all across the United States. This provides us with a unique opportunity to conduct financial planning for employees who are:

Single Federal Employees,

Married Federal Employees (dual Feds),

Married Federal Employees (one Fed, one private sector spouse),

Married Federal Employees (one Fed, one stay at home spouse),

Widowed Federal Employees.

Because we work with so many Federal employees, we want to take a moment to walk you through a situation we see a lot of as an example,

This involves a Federal Employee who is married to a Non-Federal Employe who works in the private sector.

Bob – Federal Employee

Sue – Non-Federal Employee, works in the private sector

Bob applies for an immediate unreduced annuity upon meeting his eligibility criteria for retirement. He has been enrolled in FEHB for the last 15 years.

Upon completing his SF-3107, he wants to ensure that Sue is taken care of if anything happens to him. Bob works with his HR and elects to leave the maximum survivor benefit possible for Sue. This allows Sue to receive 50% of Bob’s pension upon his passing. Keep in mind that it is NOT within the scope of your HR to provide you with financial advice, they cannot – they are not licensed to do so. They can help answer all of the “how this process works,” questions you have but they cannot tell you what you need to do.

Sue is a few years younger than Bob and not quite ready to retire from her private sector job.

Each November, during their working years, Bob and Sue would sit down during open enrollment and review their health insurance options. For the last 10 years, it has been cheaper for Bob to be enrolled in a Self-Only Plan under FEHB and Sue to maintain her Self ONly plan with her employer. Not only is it less expensive of a premium but Sue really likes her providers and changing health insurance plans would be a hassle.

When Bob passes a few years later, Sue is devastated and decides that she is going to retire and move closer to their kids so she can be near family.

When Sue is going through her Survivor Package from OPM, she discovers that she will receive 50% of Bob’s pension but is NOT eligible to enroll in FEHB.

Because Sue was not previously enrolled in FEHB, she is disqualified from enrolling on Bob’s passing even though she was left a survivor benefit.

In order for your spouse to receive FEHB in retirement they must meet the following qualifications:

Qualification #1 for Spouses to Maintain FEHB in retirement: they must be eligible to receive, or are receiving a survivor pension.

Qualification #2 for Spouses to Maintain FEHB in retirement: they must be enrolled in FEHB prior to your death.

Bob had ensured that Sue met the first qualification but together, they elected not to meet the second.

In this scenario, which we see too often, Sue must purchase health insurance on the open marketplace or, resume working with an employer who can provide coverage.

If you are unsure what your options are, we think it is important that you consider working with a Financial Planner, who is licensed to give you financial advice, to make a plan for pre-retirement, retirement and survivor situations.