The Road Not Taken: What Happens When Federal Employees Make (or Avoid) Big Decisions. Understanding Federal Retirement Options: Deferred Resignation, VERA, Postponed Retirement, and Deferred Retirement

With the deadline for the “Deferred Resignation” passed, we are getting a lot of questions from federal employees who are saying, “I didn’t take the deferred resignation can I still….”

It’s tough to make a life-altering decision with a proverbial clock ticking in the background. This stalled many federal employees from making decisions on their careers with the federal government. Now, as federal employee benefits experts, we are visiting with a lot of feds who are asking, “Now, what do I do?”

First, let’s start with some basics because words, well, they matter here.

In the complex world of federal employee retirement, it’s crucial to understand the various options available and their implications. Not all retirement options are the same nor do they come with the same benefit package.

Let’s break down four key concepts: the deferred resignation offer, Voluntary Early Retirement Authority (VERA), postponed, and deferred retirement so that you can understand the basics of each.

We are seeing a lot of feds use these terms synonymously lately and wanted to spend a few critical minutes clarifying.

Deferred Resignation Offer: The fork in the road.

In January 2025, federal employees received an email presenting a deferred resignation offer. This program allowed eligible employees to:

- Resign effective September 30, 2025

- Maintain current compensation and benefits until the resignation date

- Be exempt from “Return to Office” requirements

- Accelerate their resignation date if desired

The offer was part of a broader federal workforce reform plan, which included changes to office policies, performance standards, and workforce size.

The deadline to accept this offer has closed, and our understanding is that it will not open again in the same manner, but in this environment, stay tuned; it’s all subject to change.

Ok, now let’s talk about the word that everyone is getting a crash course in lately: the Voluntary Early Retirement Authority (VERA).

Voluntary Early Retirement Authority (VERA)

VERA is a tool that agencies can use when undergoing substantial restructuring, reshaping, or downsizing. Your agency has to participate to offer you a VERA.

Key points about VERA include:

- Allows agencies to temporarily lower age and service requirements for retirement eligibility

- Aims to increase voluntary separations and minimize workforce disruption

- Applies to both Civil Service Retirement System (CSRS) and Federal Employees Retirement System (FERS) employees

- Requires OPM approval before an agency can offer it

- Employees cannot choose a VERA if their agency does not offer it

We have had a significant number of questions come in from Feds saying that they still want to leave federal service, but their agency is not offering a VERA.

You can still leave federal service any time that you want, but not without potential consequences. Let’s dive into the various types of retirements under FERS.

Immediate Retirement Eligibility Under FERS

Federal employees covered by the Federal Employees Retirement System (FERS) are eligible for immediate retirement if they meet one of the following age and service requirements:

- Minimum Retirement Age (MRA) with 30 years of service

- Age 60 with 20 years of service

- Age 62 with 5 years of service

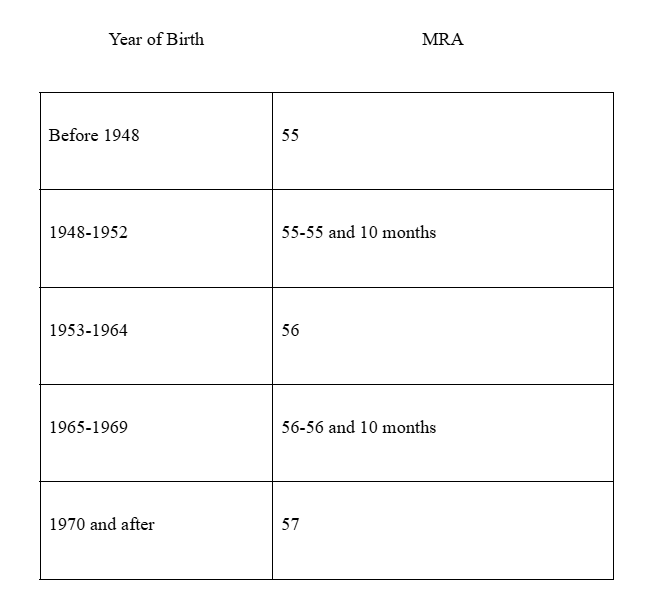

The Minimum Retirement Age (MRA) varies based on an employee’s year of birth:

It’s important to note that retiring before age 62 with less than 30 years of service may result in a reduction of your pension. The reduction is 5% for each year you are under age 62.

There is also an option for immediate retirement at MRA with 10-29 years of service, but this comes with a permanent reduction in benefits of 5% for each year you are under age 62. If you’re just simply done with federal service, this may be worth considering but talk to your financial advisor – assuming that they specialize in federal benefits – and ask if this is the best option for you or if you should consider waiting.

Key considerations should include age, years of service, and the potential impact on your pension (OPM calls this an annuity; we call it your pension to eliminate confusion between this and an issuance product called an annuity).

Postponed Retirement

Postponed retirement is an option for FERS employees who are eligible for immediate retirement but choose to delay receiving their pension5. Important aspects include:

- Available to those who meet age and service requirements for immediate retirement

- Allows employees to retire but postpone starting their pension

- Can help avoid reductions in benefits

- May allow retirees to reinstate health insurance (FEHB) when pension payments begin

Deferred Retirement

Deferred retirement is for employees who leave federal service before reaching retirement eligibility but have at least 5 years of creditable service. Key points:

- Allows employees to claim their FERS pension at a later date

- Does not provide an immediate pension upon leaving federal service

- Does NOT include the FERS pension supplement or FEHB eligibility

- Pensin can be claimed at age 62 or at minimum retirement age (MRA) with at least 10 years of service

Why the Distinctions Matter

Understanding these options is crucial because they have different implications for:

- Timing of benefits: When you can start receiving your pension

- Amount of benefits: Whether your pension will be reduced

- Health insurance: Whether you can maintain or reinstate FEHB coverage – your best benefit as a federal employee!

- FERS Special supplement: Whether you’re eligible for the FERS pension supplement

Remember, the right choice depends on your circumstances.

What works for one person may not be the best option for another. Always seek professional advice to make the most informed decision about your federal retirement.

If you think that hiring an expert to help you navigate your benefits is expensive, imagine what it will cost you to hire an amateur.

ABOUT THE AUTHOR

Micah Shilanski, CFP®, is a distinguished financial planner known for his deep commitment to providing exceptional advisory services to his clients. As the founder of Plan Your Federal Retirement, Micah has dedicated his career to helping federal employees understand and optimize their benefits to ensure a secure and prosperous retirement. His expertise is widely recognized in the industry, making him a sought-after speaker and educator on financial planning and retirement strategies.

Micah’s approach is client-centered, focusing on creating personalized strategies that address each individual’s unique needs. His work emphasizes the importance of comprehensive planning, incorporating aspects of tax strategy, investment management, and risk assessment to guide clients toward achieving their financial goals.