“Planning on retiring at my MRA, is the FERS supplement subject to the social security earnings test? Thank you for your time!” – Craig.

Underestimating retirement income can be detrimental to your wealth. Imagine if you retired, carefully planning for your go-go years and beyond, only to realize six or seven months in that you grossly understated your retirement income!

What would happen if your retirement income was off by $500 a month? $1,000 a month? $1,500 a month? Would underestimating your retirement income by $2,000 a month impact how you plan your retirement years? Many federal employees we visit throughout the year have been planning their retirement carefully (and cautiously!). Most of our clientele have been planning what they want to do in retirement for years. They have put off reading certain novels, taking up hobbies, being with the grandchildren more, or even traveling until they retire and have more time and less stress.

Your first few years of retirement we in the financial planning space call your “go-go years.” These are the years that you want to celebrate a retirement and take up all the activities that before, you had restrictions around. Sometimes it is gardening in your backyard, and other times it is visiting Monet’s garden in Giverny, France – sometimes it is both! All of which takes money to fund.

While working for the federal government, you were paid systematically and knew what your paycheck would be (providing there wasn’t a furlough, of course). One of the big surprises that most Federal Employees are unaware of when they retire is that their retirement check comes once a month, not bi-monthly. If you’re estimating what your retirement income is going to be and planning life around that, then you had better be really, really close.

Craig is trying to calculate his retirement income and asks us a great question about how the FERS Special Supplement is calculated as well as whether or not it is subject to the Social Security earnings test.

The FERS Special Supplement is subject to the Social Security earnings test.

With that in mind, let’s draw out your retirement income timeline and understand the source of where your retirement income comes from as a federal employee.

Federal Employee Retirement Income Sources

Your retirement as a federal employee is what we call a three-legged stool. You have three retirement income sources that should work in concert with your greater financial plan.

- FERS Pension

- Thrift Savings Plan

- Social Security

FERS Pension

To calculate your FERS pension, you must know your creditable years of service and your “High-3” average salary. Your creditable years of service include the years, months, and days rounded down to the nearest month of how long you’ve been working as a federal employee. This time does not have to be consecutive and often has broken. However, your High-3 average salary is based on years of consecutive service. Your High-3 is the average basic pay salary of the highest three consecutive years of creditable service as a federal employee.

The formula for the FERS Basic pension is shown below:

Age Formula

Under Age 62 at Retirement, OR,

Age 62 or older with less than 20 years of creditable service

1% x High-3 x Years of Creditable Service

Age 62 or older with 20 or more years of creditable service 1.1% x High-3 x Years of Creditable Service

There’s a 10% increase in the FERS pension amount if you retire at age 62 or older with 20 or more years of creditable service.

[There are special formulas not shown in this article for Air Traffic Controllers, Firefighters, LEOs, Capital Police, Supreme Court Police, Nuclear Materials Couriers, Members of Congress, and Congressional Employees.]

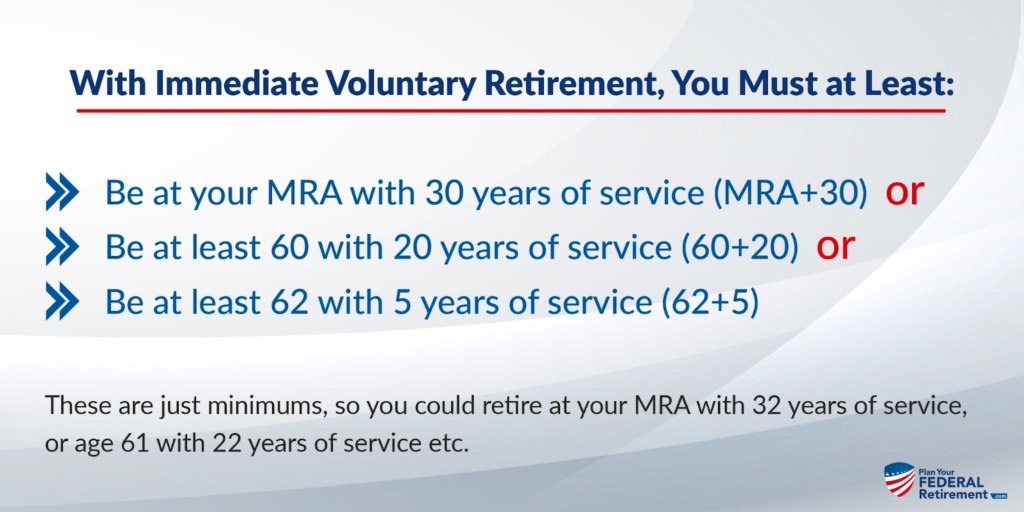

In order to receive your FERS Pension, you must meet the rules of eligibility:

FERS Special Supplement

Because many Federal Employees can retire from Federal Service before they are eligible to enroll and receive Social Security benefits, they receive the FERS Special Supplement.

The FERS Special Supplement was designed to bridge the gap between when you retire and when you are first eligible to draw social security benefits. Remember that you are eligible to draw social security at age 62 does not mean you should. Before making this decision, you want to read our articles on best practices to optimize your social security benefits.

How to enroll in FERS Special Supplement

Enrollment in the FERS Special Supplement is automatic. If you apply and are eligible for an immediate annuity before you reach age 62, the Office of Personnel Management will automatically enroll you in the FERS Special Supplement.

The FERS Special Supplement will automatically cease when you reach age 62. You do not need to notify OPM or fill out a form to stop your FERS Special Supplement. OPM is very, very good at remembering when to stop this benefit.

How to calculate your FERS Special Supplement

The formula for the FERS Special Supplement is:

(Years of Creditable Service / 40) x Your Age 62 Social Security Benefit

Example: assume that Sue just turned 58, and wants to retire on her 60th birthday. She’s worked as a federal employee for the last 20 years, and she just received her Social Security benefit estimate for age 62, and it will be $1600 per month. Knowing this info, we can plug it into the formula above, but add a couple of years since she plans on retiring 2 years from now.

(22 Years of Creditable Service / 40) x $1600 Age 62 SS benefit = $880 FERS Supplement

Social Security Earnings

If you were eligible to retire from the Federal Government as a FERS Employee and receive a FERS Supplement, then you are probably aware that the supplement will cease at age 62.

The FERS Special Supplement stops at age 62 because that is the first time you are eligible to begin drawing on your social security benefit. Social security is a retirement system that you have paid into throughout your working years, and your employer has.

The benefit is designed for you to be able to draw a monthly income contingent on the contributions that you have made over your working history.

Every year you worked and paid into social security, you received up to 4 credits. Each quarter of a calendar year represents one credit. For example,

- 1 Quarter Earnings = 1 Credit

- 1 Year Earnings = 4 Credits

- 10 Years Earnings = 40 Credits

Regarding drawing social security, there are three critical age-defined turning points.

Here is what they are:

- Age 62: eligible to draw a permanently reduced benefit.

- Full Retirement Age (FRA): the age you can draw your full, unreduced benefit.

- Age 70: the age at which you can draw the maximum increased benefit.

If you retired from Federal Service under FERS before you reached age 62, you should receive the FERS Special Supplement.

At age 62, the FERS Special Supplement will stop automatically.

At age 62, most federal employees we meet with feel compelled to start drawing their social security benefits early. This is not always the best financial move and is something you want to visit with your financial planner about. Physically draw out a retirement income timeline together and make sure that when you pull the retirement income levers, you are doing so in a manner that does not jeopardize your income or increase your tax liabilities.

Social Security Earnings Limitations

Many retirees take on full or part-time employment after they retire from federal service. Sometimes it is because they enjoy working and the sense of purpose they get from doing so. Other times it is because they want to earn more money to either support their retirement needs or for incidental expenses or “fun things.”

If you choose to work after you retire from Federal Service and are receiving the FERS Special Supplement, your earnings from that employment are subject to the social security administration earning limitations.

Each year, the earnings limitations are published (See 42 U.S.C. 403.) The limit is around $19,560 and can adjust annually.

OPM will reduce $1 from your benefits for each $2 you earn above $19,560.

A reduction in the retiree pension supplement in a given year is based on excess earnings in the previous year.

If the following year you are not eligible any longer to receive the supplement because you turn age 63+, the rules are:

“The (FERS Special) supplement is payable in the year following a year in which the retiree’s earnings exceeded the exempt amount (that is, the annuity the supplement was terminated during the previous year due to the attainment of age 62), there is no reduction for excess earnings since the reduction can only be applied to the retiree annuity supplement.” (opm.gov)

Your FERS Special Supplement is reduced to $0.00 under the earnings limitations of social security.