“My husband wants to retire and he has been at the USPS and was always told he gets 60% of his basepay and the more we look into its like we will only get 1400 a month? This is with FERS.He is 70 and has been there 24 yrs.” – Tonia

What if you retired from the Federal Employee Retirement System (FERS) and your retirement check was HALF of what you were expecting it to be? Miscalculating your anticipated retirement income under FERS is one of the most common misunderstandings that we help Federal Employees navigate through. When we sit down with our Federal Employee clients who hire us to help them develop a financial plan, that incorporate their benefits, we run into two common misunderstandings about how your pension is calculated (note, OPM and your Agency call your pension an “annuity” but we like to call it what it is – a pension). The two most common mistakes Federal Employee’s make when calculating their pension are:

- Creditable Service and

- Estimating your Hi-Three Number

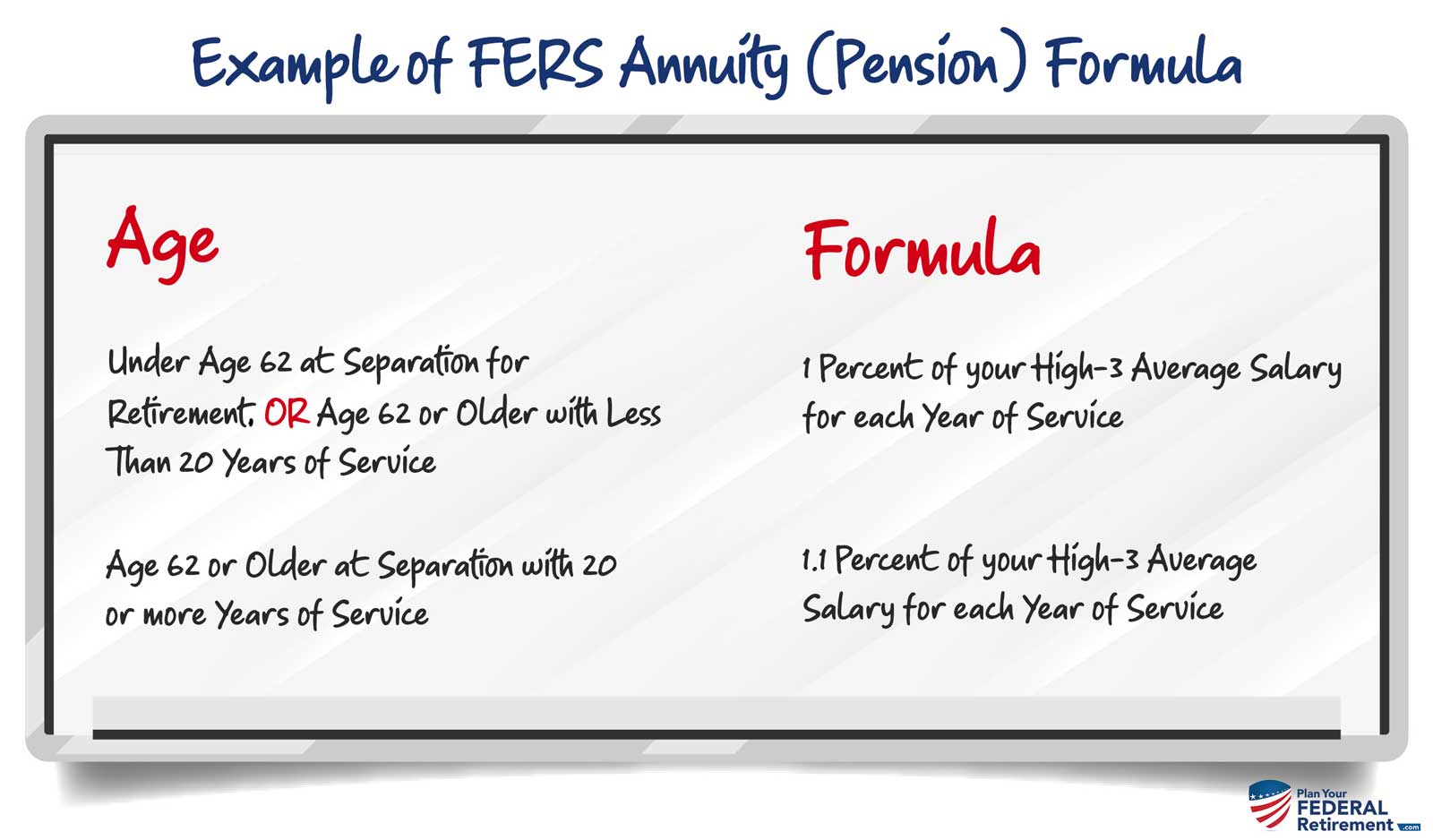

FERS Annuity (Pension) Formula

The basic pension is computed based on two variables:

- your length of service and

- your “high-3” average salary

Length of Service: Your length of service, known as creditable service, is counted by taking your length of service for computation, add all your periods of creditable service. Once you have this number, eliminate any fractional months. High-3 Average Salary: Your “high-3” average pay is the highest average basic pay you earn during any 3 consecutive years of service. These three years are usually your final three years of service, but can be an earlier period, if your basic pay was higher during that period. Your basic pay is the basic salary you earn for your position. It includes increases to your salary for which retirement deductions are withheld, such as shift rates. It does not include payments for overtime, bonuses, etc. (If your total service was less than 3 years, your average salary was figured by averaging your basic pay during all of your periods of creditable Federal service). (opm.gov) These two numbers, your creditable years of service and your high-3, are going to get multiplied by a percentage. Most Federal Employees receive 1% however, there are some special circumstances that a Federal Employee may receive more like in Tonia’s case. Tonia’s husband is older than age 62 and has more than 20 year of service. Therefore, he is entitled to a 10% ‘raise’ in the computation of his pension.

FERS Annuity Calculated

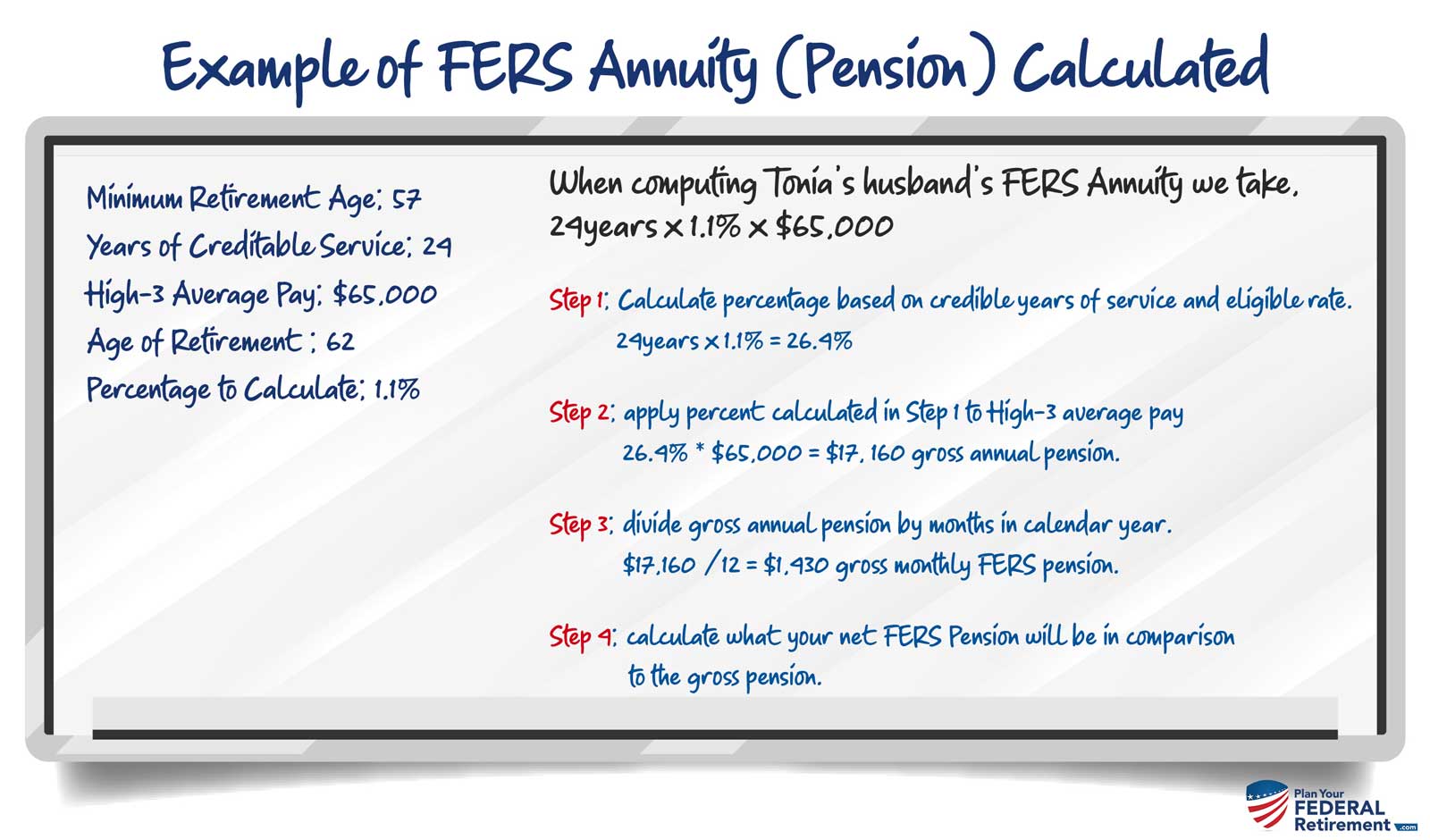

Using the information that we have from Tonia, let’s look at an example of how to calculate what her husbands pension may look like when he retires from Federal Service. Since we do not have all of the information we are going to use what we do have and make a couple of other assumptions. Here are the details we will use:

- Minimum Retirement Age: 57

- Years of Creditable Service: 24

- High-3 Average Pay: $65,000

- Age of Retirement: 62

- Percentage to Calculate: 1.1%

When computing Tonia’s husbands FERS Annuity we take,

24years * 1.1% * $65,000

Step 1: Calculate percentage based on credible years of service and eligible rate.

24years * 1.1% = 26.4%

Step 2: apply percent calculated in Step 1 to High-3 average pay

26.4% * $65,000 = $17, 160 gross annual pension.

Step 3: divide gross annual pension by months in calendar year.

$17,160 / 12 = $1,430 gross monthly FERS pension

Step 4: calculate what your net FERS Pension will be in comparison to the gross pension.

FERS Net Pension vs Gross Pension

In the above example, we use the word “gross” pension because the number that your agency will calculate to help you plan for retirement will be your gross FERS Pension amount.

When determining your FERS Pension amount keep in mind that the gross benefit is the calculation often seen; but your retirement spending is based on your net calculation.

Deductions from your FERS Pension can include:

- Survivor Benefits,

- Federal Employee Health Benefits,

- Tax Withholdings,

- Federal Employee Group Life Insurance (FEGLI)

- Dental Insurance.

Particularly in Tonia’s case as her husband is a postal worker; so be mindful of the cost of health insurance when you retire from Federal Service.

For our clients who are employed with the United States Postal Service, they often forget that their health insurance payments are significantly subsidized through their union. When you retire from service, this will no longer be the case. Make sure you have incorporated all deductions from your gross pension when you plan for retirement.

Watercooler Talk

When we take financial advice from colleagues because they seem knowledgable in the area, we call this listening to “water cooler talk”.

That person administering the advice may have the right information for their situation but that does not mean they have the right information for YOUR situation.

In Tonia’s case, her husband could have been talking to someone who was employed under the Civil Service Retirement System (CSRS) which is where the 60% of their pay in retirement number could have come from.

As a FERS employee, your calculation is different. Unlike CSRS employees, under FERS you are also eligible for social security benefits.

We talk a lot about how social security benefits work in conjunction with your Federal Employee benefits on our podcast for Federal Employees.

In our pod, we talk about whether or not you should draw for social security early and what portion of your benefits is taxable.

Planning for retirement under FERS

If you are a Federal Employee planning to retire, you may consider reaching out to our firm for a one on one consultation where we can answer your questions and discuss your benefits.

If you want to find out if meeting with one of our Federal Employee advisors is something you should consider, you can read more about doing so here.

Oh, and you can always call our firm too. We promise you will be speaking with a real, live human being right here in the United States. Well, that is if you call during business hours of course. 🙂

We seen the mistakes that people (and even some professionals!) can make, and we want to help you avoid them. Click the button below to learn more.

7 CRITICAL MISTAKES

Federal Employees make

✗ Forgetting to check your beneficiary designations

✗ Expecting pension check to arrive in 30 days after retiring

✗ Not knowing the difference between SCD vs. RSCD

✗ Completing retirement paperwork incorrectly

✗ Failing to prepare financially for retirement

✗ Failing to understand tax consequences

✗ Getting bad advice

Click the button below and learn how to avoid these mistakes while planning YOUR retirement