Listen to the Full Episode:

Social Security is one of the most misunderstood parts of retirement planning. For federal employees and their families, it’s not about whether to take it early or late; it’s about how to coordinate Social Security with your pension, TSP, survivor benefits, and taxes.

In this episode, Micah and advisor John share real-life client experiences and dive into:

- The Pros and Cons of Claiming at 62 vs. Waiting Until 70

- Survivor benefits and why early decisions matter.

- How Social Security interacts with your overall retirement cash flow.

- What pending legislation could mean for your FERS supplement.

- Practical strategies to avoid common mistakes.

Listen now and get the clarity you need to make Social Security a strong part of your retirement plan.

What We Cover:

- Understanding Social Security Decisions

- Full Retirement Age and Penalties for Early Claims

- Delaying Social Security Benefits

- Survivor Benefits Are Tied To When You Claim—Early Claiming May Reduce What Your Spouse Receives

- Life Expectancy and Social Security Strategy

- Pending Legislative Changes and Their Impact

Action Items

- Review your Social Security statement and identify your Full Retirement Age.

- Run the math for claiming at 62, FRA, and 70 and compare long-term outcomes.

- Build Social Security into a comprehensive plan with your pension and TSP.

- Revisit your retirement plan regularly to adjust for changes in the law, health, or family needs.

Ideas Worth Sharing:

Don’t take Social Security at 62 for an emotional reason. Run the math, run the numbers, make the decision logically. – Micah Shilanski Share on X

Every Social Security decision you make affects survivor benefits, cash flow, and taxes. They’re all connected. – John Raleigh Share on X

Delaying Social Security is like getting a guaranteed 8% return, without investment risk. That’s hard to beat. – Micah Shilanski Share on X

Enjoy the show? Use the Links Below to Subscribe:

Micah Shilanski 00:48

Welcome to the Plan Your Federal Retirement podcast. I’m your co host, Micah Shilanski, and today we’re going to dive a little bit deeper, and we might even get in some technical weeds about a question that’s one of the biggest questions outside of federal benefits that we get from retirees, and is a big question on the internet, and I got to say, if you ask chat, if you ask AI, if you ask Google, you get a variety of different answers. And so we want to share with you some experiences we have from real clients working with us, day in and day out. We brought on John Raleigh, who’s an advisor on our team, who has a lot of experience answering these great questions about Social Security and really, what’s that insider track and then stay tuned, because we’re also gonna talk about some pending changes and legislation that you need to make sure you know about as we get into planning. So John, thanks for joining us on the pod.

John Raleigh 01:38

Thanks for having me here.

Micah Shilanski 01:40

Well, this is something that we were talking about it beforehand, right? But this is one of the really big questions that we get all over the time. Of course, with a normal federal employee preparing for retirement, the first questions are all federal benefits related, which understandably, huge portion of your your retirement is based on that. But if it’s a non federal employer, we’re working with, maybe a spouse of a federal employer, or somebody else, or just by the time we get to it, we get to these social security questions. And there’s a lot of questions and concerns that come up about this.

John Raleigh 02:06

Yeah, it’s it’s amazing and and there’s so many different answers. And how you answer every question changes the direction of where you’re going to decide to go or which what’s best for you and family.

Micah Shilanski 02:16

Yeah. And this is the one that there’s not always a wrong answer. There’s sometimes a better answer than another one, right, which also makes it hard, because it’s a really clear right and wrong answer. It’s really easy to make a decision, but it’s it’s more complicated because it’s not a great wrong answer. There’s some potential better answers, but all of the answers, decisions that you have to make are connected. They’re connected to survivor benefits. So we gotta go side with that. They gotta be connected to the growth rate of how much your social security is going to grow or not grow by how much you’re going to get an income. It’s going to have a tax effect, which is going to be there, and it’s just going to have an overall cash flow effect. So these are just really important things that we need to be thinking about.

John Raleigh 02:59

And then you have the other piece of everything that’s out of our control, which is how long you’re going to live. Because taking it at 62 and dying at 65 was a good thing. Taking it 60 through it and living per 100 may not have been the best choice.

Micah Shilanski 03:07

All right. Well, John, let’s we jumped into that one. So let’s dispel that myth. Okay, facts number one, we don’t know how long you’re gonna live, so I agree with that, right? So that’s that’s the big question. But I’m gonna say, and feel free to push back on me a little bit. Most people, clients that we work with, most people underestimate their life expectancy. What do you think about that?

John Raleigh 03:27

Well, there’s no doubt we’re dealing with a generation too that came up and if you think about it, and it’s the generation that’s in their mid 70s to even late 80s or so, they were raised with parents that had experience with the depression, had experience of pensions, had experience with all those pieces that were there and they were there to support and protect them. Then all of a sudden, being a federal employee, you’re blessed because of the pension that you receive. But there’s a lot of individuals that hit retirement without that sort of security, and now all of a sudden it becomes one of their major sources of income, and that’s when it can get really scary.

Micah Shilanski 04:06

Yeah, and you got to be careful, right? You go back to the original Social Security Code, one thing is talks about is to augment a retirement benefits, right? It is not to be your retirement benefit, and it’s super easy for some people just to rely on this and saying, Okay, well, that’s going to be my income. But that’s never how it was designed. That’s not how the math works and how it’s set up. And I know a lot of our listeners, that’s not what you’re thinking about. This being your primary source. It could be a good source for you, but we have that wide range of ages, right? John, when you get your your Social Security statement, it comes in, they show this nice little chart on there, now on the first page, which kind of shows a sliding scale, one to turn on, and the first thing we always look at is your FRA, your full retirement age goes between 65 and 67 depending on when you’re born. But John, why is that important for us to always kind of start the conversation off by?

John Raleigh 04:53

Because the full retirement age gives us a baseline for the amount of income that we need to be thinking about or what this benefit is, and what this benefit is to us, and that’s where you can make the concessions, because there’s a cost to wait. I mean, there’s a cost to take it too early, and then there’s a benefit to wait. So juggling those two in the distance between those two is key, but the fixed retirement age, I mean, nice thing about it, we’re getting to the point where there’s less and less and less that are receiving Social Security that are not on the sliding scale, because I remember having to go back and not only find the months, but calculate then how, where they fit into the schedule where the majority of people were seeing now are 67 is there? Is their fra it makes it a little bit easier for us, we just can’t assume anything. So…

Micah Shilanski 05:39

It is. It does mak e it a little bit easier, which is super nice. So let’s dive into what John was talking about right there. Right? If we turn our Social Security on early, well, let’s just say 62 right? Let’s say your full retirement age is 67 because that’s a lot of our listeners. That’s where it’s going to you’re going to be, you’re going to take a penalty. The penalty is roughly 30% right? So if you turn it on early that’s the penalty, John, you were just talking about, right? Is that 30% early penalty that never goes away. That is a permanent penalty, and it affects your spouse for survivor benefits. When you turn on your social security, it locks that amount in. Now it can go up when there’s a cost of living adjustment. You know, sometimes there’ll be no cost of living adjustment. Sometimes there’ll be a negative cost of living adjustment, let’s talk about that. And then sometimes you’ll get a 2% cost of living adjustment, which will happen, but when you turn that on, it’s gonna lock it in. And so God forbid, if you pass away, your spouse is entitled to 100% of their benefit or 100% of your benefit, whichever is greater. So especially if there’s a disparity in Social Security benefits, and yours is the higher, and you lock it in at a lower dollar amount, we just lost a bit of a survivor benefit that’s going to be there.

John Raleigh 06:50

And that can be devastating to the survivor. And of course, it all depends on whether you care, the survivor is okay. Majority of clients we have do, but some of them don’t. The other thing too is it also limits your ability to be able to work if you wanted to work, because you also have a penalty if you make too much money, when you take it too early. So that makes it, I mean, even, even a double sting, if you’re not paying attention.

Micah Shilanski 07:11

Yeah, the income comes in and is taxed, and then all sudden, Social Security says, Oops, you made too much money, which, by the way, too much money is not that much money, and you, all of a sudden, you start making over that. And now you have to your social security goes away. There’s that penalty that’s going to be imposed so and that goes away at your full retirement age, and after, which is kind of nice. So lot of moving pieces in there to take it early. And then let’s talk about kind of that after your full retirement age is 70. And then I want to talk about a different way to frame this. Let’s talk about the life expectancy, because it’s kind of the traditional way people frame this question. Then I got a different way to frame it that I like to talk so John, if we don’t take it at our full retirement age, what happens? How long can we delay our Social Security for?

John Raleigh 07:53

Wait till age 70, which is, which is, doesn’t seem that long, from 67 to 70, but the benefits are pretty incredible, because you get a return that is substantial in growth every single year. And it’s, it’s something, I mean, I don’t know any advisor out there that wants to guarantee a rate of return, but you’re basically being guaranteed a rate of return on that money for putting it off. And that benefit can make a substantial difference the other way, it’s almost the exact opposite of taking it early, there’s a big benefit to it.

Micah Shilanski 08:23

One of the things I hear time and time again from federal employees that we work with is how dedicated they are to the mission, to helping their service, to helping grow into being a true civil servant, which is absolutely amazing. But inside of that civil service, you have a great set of benefits that you really need to understand how it works for your retirement, because there’s going to come a time, whether it’s sooner than you would like, or maybe it’s on your schedule, which would be amazing, that it’s time for the next exciting chapter of your life – retirement, doing the things you want to do, when you want to do them, where you want to do them, but to get the most out of that, you need to understand how the process of Retirement works, and that’s why we’re putting together a one day event, a one day class, really going through soup to nuts your retirement benefits, but more importantly, the key things that you need to know to get the most out of your retirement. You already know, the challenges with OPM and him processing retirement and how long it’s going to take to get a retirement check, but that’s just one of many obstacles you need to avoid in your retirement. So the class fills up fast, so make sure you register. Join us for this event. It’ll be taught by myself and several great instructors that really understand your federal benefits. Our goal is to help another 1 million federal employees with retirement, and we want your retirement to be successful. So join us in the workshop until next time. Happy. Planning.

Micah Shilanski 09:44

As financial advisors, we cannot guarantee a rate of return. So by the way, that’s a good warning sign for you. If you get hit up in WhatsApp or whatever and you get this message about this guaranteed investment, odds are that’s a scam. Anytime that G word is being thrown around, it is prohibited for us to use right? From an investment standpoint. Now there’s certain circumstances, like a bank is could have a certificate of deposit that has a guaranteed return because it’s FDIC to church, but that’s not a financial advisor saying this investment is going to make it. That’s a bank that’s offering those things, and that’s the same case here in Social Security, right? We’re not saying that this is an investment. We’re saying social security guarantees, so the federal government guarantees, every year you defer Social Security from 67 onward. It grows by guaranteed 8% a year. And you can’t find 8% money right now without taking risk. Let me rephrase that. You can find it, but you’re going to take risk this. You don’t have risk of investment loss with right you’re just going to be growing your benefit. So this is a really good thing. Another thing I think people forget about John is they look at these three milestones, 62 their full retirement age, let’s say at 67 and 70. But okay, those are my three choices. But it’s even more complicated than that, because you can turn it on at any point in time, in that eight years and at any month. So one of the things I always talk with my clients about, we’ve decided to defer to 67, their borderline. Should I take it? Should I not? And I like to look at it in two ways. Number one is the the investment perspective, saying, hey, if I had a CD and that, you know, it was with a with a bank, was FDIC deterred, and was paying 8% a year. And would you want to put $100,000 in there? And the vast majority of my majority of my clients are like, 8%? Absolutely. I would buy that all day long, right? Of course, that makes tons of sense, because current money is way less than that. Well, that’s kind of what we’re getting with social securities. You’re getting that guaranteed increase. But the cool part is, we can break that. We can access that whenever we like. So if we turn it on to 67, John, if I wait six months and I’m like, I really don’t wanna wait till I’m 68 Can I turn that Social Security on and still get proportionate credit for that 8% interest?

John Raleigh 11:51

Yes, you can. It’s credited monthly. So I mean, in other words, the timeframe, so it works to your advantage that way, also you’re not penalized, and have to do it within a certain time frame.

Micah Shilanski 12:01

Yeah, so this becomes a cash flow question right? Now, if we hit 67 we’re strapped for cash. We don’t have enough money coming in. We, it is be unsafe to pull more money out of our investments. This could be a good reason to turn your Social Security down. Hey, we just need the money, and that’s not a bad thing to do. But if you’re not in that place, then maybe we should look at it from an interest rate perspective. Now, that’s one perspective. John, the other one we hear a lot, though, is the life expectancy aspect of it. So walk us through a little bit kind of what the internet talks about with turning it on early, because how much money you’re going to get versus delaying, et cetera.

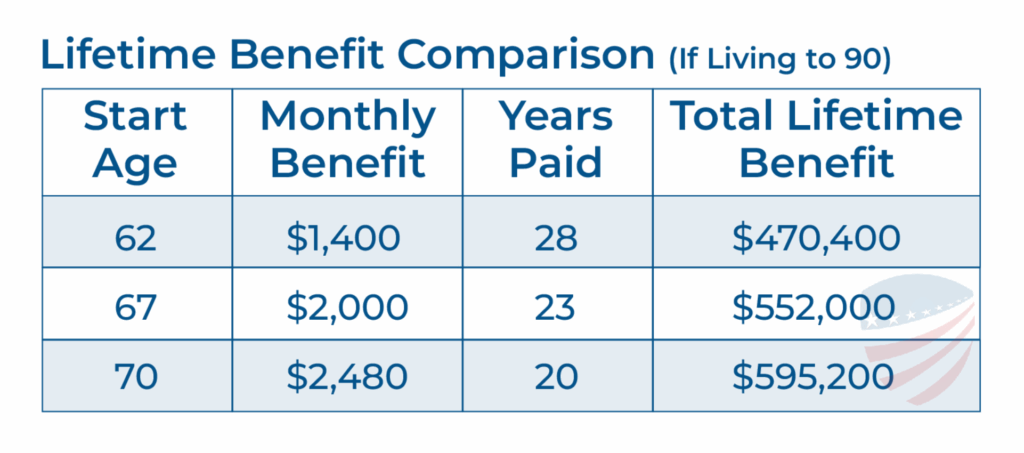

John Raleigh 12:36

Yeah, you can make it a math problem, and you can say, what is the difference on a monthly basis, and then sit there and say, okay, when’s the break even point? That makes it a math problem. But the problem is, unfortunately, we don’t know the day. I mean, unless you’ve expired all your appeals there on your on death row, you don’t know the day you’re going to go. And what happens if you made the wrong choice? What happens if you listen to the prior generation where they thought they were going to retire at 65 and be dead by 75 and how much money did you have to have in place to survive during that time frame? Here we have to make sure that that decision and the purchasing power, and yes, there’s inflation added protection, added that are in place, but in general, is that money that you’re agreeing now in current dollars going to make you happy 10 years, 15 years, 20 years from now? And you have to understand that you’re making a decision. That’s the consequence of the decision, and you need is it going to benefit you the way you want to do it?

Micah Shilanski 13:35

You know? The other thing that we need to think about, too, and I talked about this before, about like, negative inflation, negative cost of living, adjustment, Social Security. And so what I mean by that gross versus net, right? All that you see on your Social Security statement, I’m not knocking the statement at all. They’ve done a lot of good jobs improving this over the age, over the years, but that is your gross amount. And just like we talked about on your pension, we don’t care about the gross amount, so the IRS cares about, we care about that net amount, after deductions, after taxes, what do you get deposit in your bank account? And one of the things we often forget about is Medicare, at 65 automatically gets deducted from your Social Security benefit. So this is something we got to watch out for if all of a sudden there’s a zero inflation year cost of living adjustment and Medicare goes up. By the way, this happens with your health insurance. We talk about this all the time. What happens if you don’t get a cost of living adjustment with your pension, your FERS pension, but your health insurance goes up? Your net pay went down. What happens if there’s actual inflation at that time, but you didn’t get an inflation increase? Your spendable purchasing power went down? Right? This is another reason I love to delay that Social Security if we can, because you’re getting that compound growth of that social security benefit to stave off inflation, because, generally speaking, 8% increase a year, or even before that, the 6% that you on average get between 62 and your full retirement age, John, 6% a year pretty much beats inflation on an average basis. Is that a fair statement?

John Raleigh 15:03

That’s pretty fair. There’s only a few times in the past that it didn’t, but that is definitely fair.

Micah Shilanski 15:09

Yeah, and especially with that 8% right? So now we have this inflation hedge, because Social Security will not keep up with inflation. Even with its cost of living adjustments, it will not keep up with inflation. So this is the life expectancy thing that I kind of run into is, John, as you saying it’s like, what a 10 Year break even if you wait till age 70. Ish, right? Just round numbers, but if you wait till 70 to turn it on, but we’re forgetting about the purchasing power. We’re forgetting about the value of spending the money. And that’s what I care about, because my clients that turn Social Security on at 62 money’s pretty tight, by the time they’re 68 and 72. It’s not as much as it used to be. They need a more income coming in. Is that what you see as well?

John Raleigh 15:50

Absolutely. And part of it. Micah, too. And I mean, I just thought about this. I’m sorry about throwing in to bring it up, but I can only think of maybe one or two times in my career, and I’ve been there a long time where people were happy with the increase in inflation that they gave up on their social security. It’s just the way it’s calculated and how they what number they use for the calculation. So that also comes into play. I mean, if it really costs you 4% or so to live on this given year because of the way inflation was, but you only get a two and a half percent, you’re losing ground, even though you’re you feel like they’re given a little bit of money.

Micah Shilanski 16:25

You have great and you’re not trying to rag on Social Security, right? This, it’s a good piece to your retirement, your pension, your FERS pension, is a good piece to your retirement. The question is, how do you string these good things together for a great plan? And you must have a strategy to put this together. And if we let our emotions take over and say, Hey, this is the other objection I get. Micah, I better turn it on, because they’re gonna take it away. Okay, that’s that’s fair. I do understand that that could be a real life concern. Social Security is also kind of a third rail, right? If, when politicians are talking about taking away, they are unelected post haste, right? It happens really, really quickly. So this is my pontification, I guess, right here. So I could absolutely be wrong. So John, let me know what your thought is. But I don’t think for the vast majority of people getting ready to receive Social Security, getting ready to retire, I don’t think their social security is going to greatly change. I think, as we have it today, is what I’m planning for now those just entering the workforce. I don’t feel as confident about that one.

John Raleigh 17:13

Yeah. Well, and Micah, I know when I started the business, one of the questions we asked is, do you want to include Social Security and plan? And that the majority of the people said no. And yet, here we’re talking now, and we’re talking 30 plus years later. Now we’re feeling pretty confident, except depending on the age now of the person receiving going to be receiving Social Security. So Right? It’s definitely a different mindset, and I believe it’s going to be there. I agree, totally. I mean, if you bring it down, the most common denominator that a politician wants to be reelected, and if they don’t want to get reelected, go ahead and try to cut Social Security up, you’re going to lose on that one.

Micah Shilanski 18:01

Do you know the difference between a postponed versus a deferred retirement? Do you know that simply by putting the wrong date on the form, you could lose your health insurance for a life? This is a massive impact on your retirement and potentially your cash flow in the future? Many federal employees are unsure which path to take how to properly fill out the forms and what these effects are. That’s why we created a free online guide that’s going to answer seven top things that you need to know, to answer whether a postponed or deferred retirement is right for you, and which path you should walk down and how to fill out those forms. Now you’re probably asking, Micah, why are you creating this free series and guide? And that’s a great question, and because our goal is to help another 1 million federal employees with a successful retirement. And I got to say, I love sitting down with federal employees and helping them plan their retirement. But one of the things that pains me, and pains all of my team members as they’re doing this as well, is when we sit down with a federal employee and we see a mistake that they have made, that had we had known about this before, we could have avoided it. Had we had a conversation, we could have avoided this cascading problem. And we want to make sure you’re off to the best retirement you can so we created this free video series to make sure you understand the difference and defer versus postpone retirement. And there’s a lot of differences between those. To get this free video series make sure you visit our website, plan-your-federal-retirement.com. Or click that link below so you can get the details and the information. Don’t leave your retirement to chance. Make sure you understand your benefits and you get the most out of your retirement. Until then, happy planning.

Micah Shilanski 19:37

It’s, yeah, it’s going to be an issue. So these are things. That’s how we kind of evaluate this, right? And there’s a little bit of a swag. I mean, Congress can do anything with a stroke of a pen, fair enough. And this is my only political joke, so I really hope our listeners laugh. The biggest problem that I find with this administration is actually the same problem with the previous administration. They don’t return our phone calls. Like we have great ideas. I’m just science. That’s my only joke that I got. So we’ll move on from politics. So I think that coming up with a strategy for Social Security is really, really important. If you choose to take it as social at 62 don’t do it for an emotional reason. Do it for a logical reason. Run the math, run the numbers, see how it’s actually going to work. God forbid, unless you have a life threatening illness, and my heart goes out to you, if you do short of that, you’re probably going to live a little bit longer than you think. And that’s just our experience working with clients, and clients living longer. And we’re seeing life expectancy increase, modern medicine, technology, etc, all these wonderful things, right? We’re seeing that life expectancy increase. So John and I aren’t sitting down with somebody planning saying, All right, well, let’s maximize this by the time you’re 80, because you know 86 you’re going to pass away. That’s not That’s not how we’re planning. We’re planning for a longer time period.

John Raleigh 20:46

It’s tough when you’ve got that sort of piece in front of it. I mean, in other words, people have met and that’s a long can be a long time. If you retire 55 or 65 that’s a long time your money has to last.

Micah Shilanski 20:55

Now a big piece of this making a little bit of a transition, a big piece of your Social Security benefit, I’m sorry, a big piece of your retirement, depending on when you’re retired from the federal government is Your FERS supplement, right? And your first supplement is kind of linked to Social Security. It’s that ability for you to get that Social Security early if you go out under a full, unreduced pension, let’s say retire at 57 you get access to a portion of your Social Security until you’re 62. That is on the chopping block in the current legislation, the current updates I was looking at as of today, by the time this airs, it could very well be different, but that would go into effect in 2028 for those retired after 2028 is who it would affect. Again, this is pending legislation. Biggest thing I say with this is it’s good to keep your ear to the ground to kind of see what’s happening and kind of think about it. I don’t change planning decisions on pending legislation because we’ve seen a lot of pending legislation. I really wait till it’s inked, until it’s signed off. Once we have the law, we read it, then we make an educated decision. John, you’ve seen a lot of these changes over the years, as well. Any other additional thoughts on that?

John Raleigh 21:56

If you’re making decisions on pending legislation, you’re going to be wrong no matter what. I mean, you may get lucky every once in a while, but I can go back and think of the tax codes being in the 60s to 90% when I first started. I mean, now you could write off a whole other things. So it was, it was a different world altogether, but it still was. I mean, if I had to done my planning based on that number, those numbers, the plans, will be very different than what they are now, because of what we are, we’re given. And this FERS supplement is important because it’s a gap between 57 as long as you qualify, and 62 and so it’s a big piece, and it’s really important to know, especially if you’re thinking about retiring early, or retiring traditionally early.

Micah Shilanski 22:43

It is. And I would go back to the aspect of saying, Okay, if I was planning for this, and say I was 20 years away from retirement, I’m a younger listener to the podcast. Okay, great. Then do the budgeting without the supplement, and treat it as a cherry on top, if you get it, you know. And then that way you’re not worried about what Congress may or may not do with the law. Be more self funded, self independent with that. And you may get it may not. It doesn’t affect your retirement date.

John Raleigh 23:06

It goes back to if you’re planning for it. It’s sort of like when they started taxing Social Security if you planned on that disappearing. We’ve made a mistake. Who knows if it will but in other words, you have to deal with the rules that are in place and be flexible enough to adjust to them. If they do change.

Micah Shilanski 23:28

It’s you know, your estate planning, your risk management, your financial plan, your tax planning, right? All of these things are living documents. They’re not set it and forget it stuff. And we’re not just saying it because we’re biased. Okay? We are biased, fair enough on that one. But in addition to being biased, life changes, and these are things that you have to revisit and relook at consistently. You know? It’s one reason we have a two year cycle with all of our clients. We want to be able to touch every single aspect of their financial plan every two years. And it’s because life changes, right? Sometimes it’s a law change. Sometimes it’s something happens in your life that changes, that affects us. Sometimes it’s something in a kid’s life that affects you and you’re gonna have to make a change, etc. So these are always things that you need to be able to revisit on a scheduled basis. So this podcast is about changing lives, about having another 1 million federal employees with retirement. So do us a favor, send us out, make sure that a lot of federal employees are getting great information. John again, thank you so much for being on the podcast. Really appreciate your insight until next time. Happy planning.

John Raleigh 24:25

Happy planning!